- Ethereum worth faces renewed promoting stress at $2,150 resistance, signaling a danger of extended downtrend.

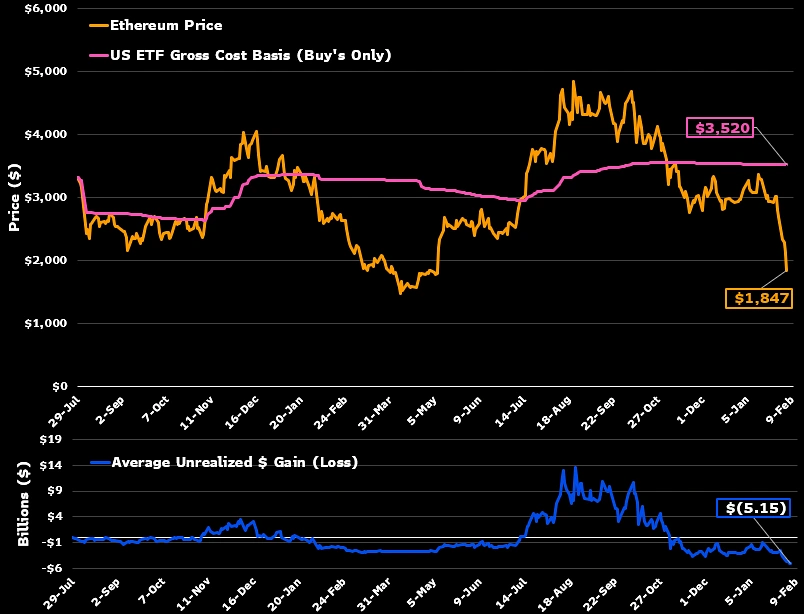

- U.S. spot Ethereum ETFs are below stress as $ETH trades nicely under buyers’ common entry worth

- The 20-day exponential shifting common acts as the primary line of protection for sellers to keep up their dominance on $ETH worth motion.

Ethereum’s latest rebound from final week’s sell-off has already hit a wall at $2,150. The coin worth is down 3.9% immediately showcasing renewed promoting stress and danger of a continued correction from right here. With broader market sentiment bearish and spot ETF deep under its common price foundation, the Ethereum worth is extra prone to lengthen all the way down to $1,600 earlier than discovering appropriate help.

Bearish Sentiment Dominates as $ETH ETFs Sit Deep Underwater

Social knowledge supplied by Santiment exhibits bearish dominance persevering with all through crypto discussions in early February 2026 with bearish posts significantly outnumbering bullish posts. Retail buyers present nice worry and hesitation to buy at low costs – near $2,000 for $ETH and $68,000-$70,000 for BTC – amidst ongoing volatility. In distinction, key stakeholders and establishments seem to accrue provide with little pushback.

In a historic context, intervals of excessive FUD and pessimism are sometimes the signal of capitulation and this offers a excessive chance of sturdy worth rebounds in subsequent market cycles.

Nonetheless, the U.S. spot Ethereum ETFs are below a lot stress, with the cryptocurrency buying and selling under $2,000— nicely under the estimated $3,500 common price foundation for inflows into the autos. Based on Bloomberg ETF analyst James Seyffart, this disparity places $ETH ETF buyers in a harder place than Bitcoin ETF buyers since holders joined these cash at close to or under present costs.

Charts from Seyffart’s evaluation present drawdowns of over 57% with heavy losses piling up by a lot of 2025 and persevering with on into early 2026. Internet inflows peaked at $15 billion in late 2025 however have since fallen to about $11.7-$12 billion, which amounted to solely $3 billion in internet outflows throughout the downturn. Property are nonetheless round $12 billion in complete, with latest buying and selling reflecting minor fluctuations on a day-to-day foundation, relatively than heavy liquidation.

Seyffart identified that regardless of deep unrealized losses – averaging a number of billion {dollars} unfavorable – most contributors have held agency. That is just like previous Ethereum cycles, for instance, a drawdown of greater than 60% in April 2025. The resilience is outstanding given the severity, although the scenario nonetheless presents a problem to conviction with the volatility persisting.

Ethereum Worth Poised For 17% Fall Earlier than Hitting Main Help

Since final month, the Ethereum worth confirmed a big correction from $3,400 to $1,700 low, registering a 48.8%. Final weekend, the coin worth rebounded with broader market reduction rally however failed rapid resistance at $2,150.

At this time’s worth drop exhibits a brand new decrease excessive formation in $ETH’s each day chart, indicating a sell-the-bounce intact from buyers. The momentum indicator ADX at 51% accentuates the sturdy bearish momentum in worth, suggesting a danger of extended downfall.

With sustained promoting, the Ethereum worth might plunge one other 17% earlier than resting at a long-coming help trendline at $1,630.

Since March 2020, the $ETH patrons have managed to recoup their bullish momentum at this ascending trendline, indicating an acceptable help to reverse the present downtrend.

$ETH/USDT – 1d Chart

In consequence, the coin worth is poised to enter a brief consolidation development close to $1,600 to test its sustainability for bullish rebound.

Additionally Learn: Pepe Coin Worth Close to Breakout as Whales Accumulate Throughout Downturn