Ethereum worth every day chart reveals tentative indicators of restoration simply because the Federal Reserve faces considered one of its most intricate conferences of the 12 months. With policymakers debating whether or not to delay and even cancel December’s assembly attributable to lacking job knowledge, markets are reacting with uncertainty. For Ethereum worth, this sort of macro hesitation has usually fueled volatility—particularly when rate of interest expectations shift quickly.

Ethereum Worth Prediction: The Fed’s Indecision and Investor Nerves

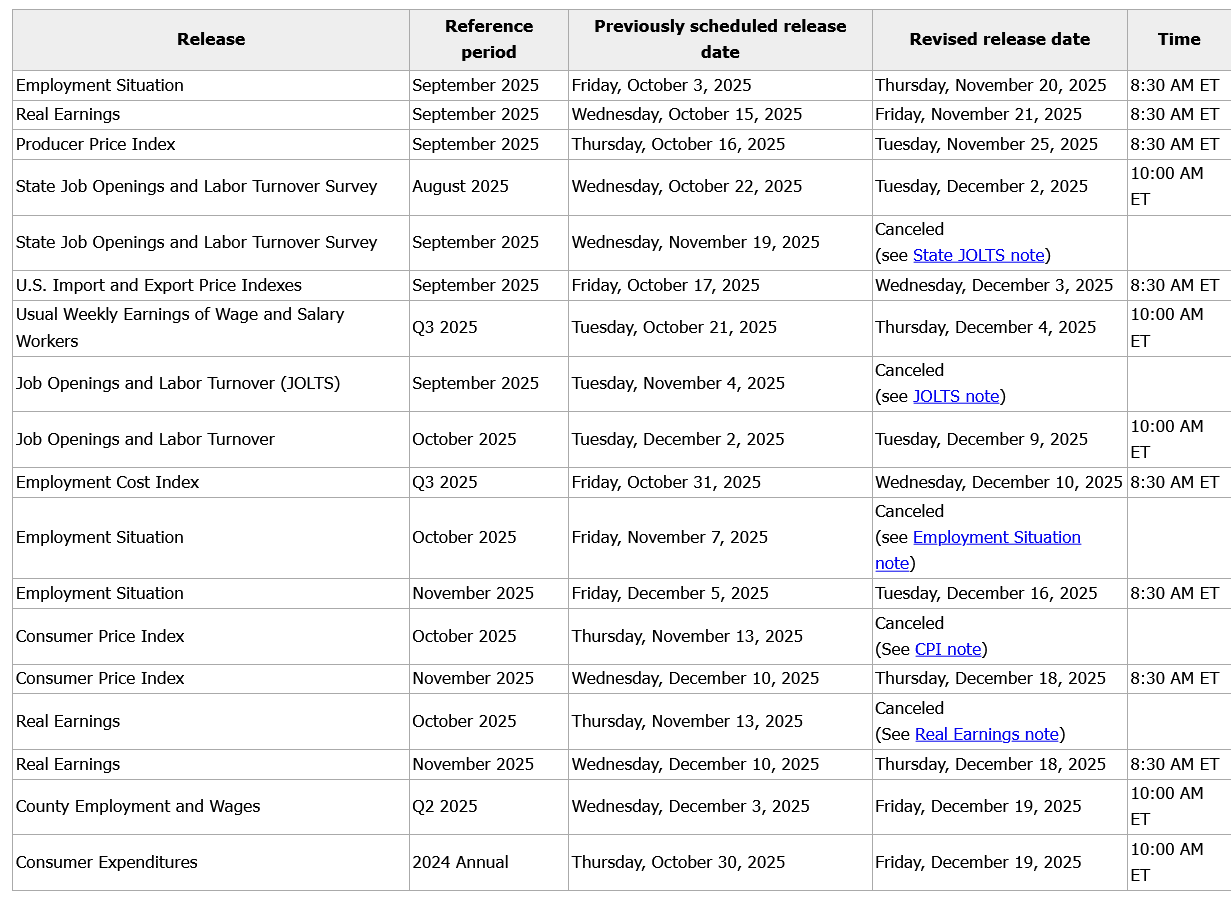

The Fed’s dilemma is easy however important. With out November labor knowledge, they’re pressured to resolve between reducing charges for the third time or holding regular to struggle inflation. Traditionally, price cuts have spurred threat property like Ethereum, however the timing issues.

If the Fed delays the assembly, that uncertainty may quickly stall bullish momentum throughout crypto. As of now, futures markets are pricing in an 83% chance of a price minimize, however any trace of hesitation may result in one other wave of volatility earlier than the choice.

ETH Worth Battles the Mid-Band Resistance

ETH/USD Every day Chart- TradingView

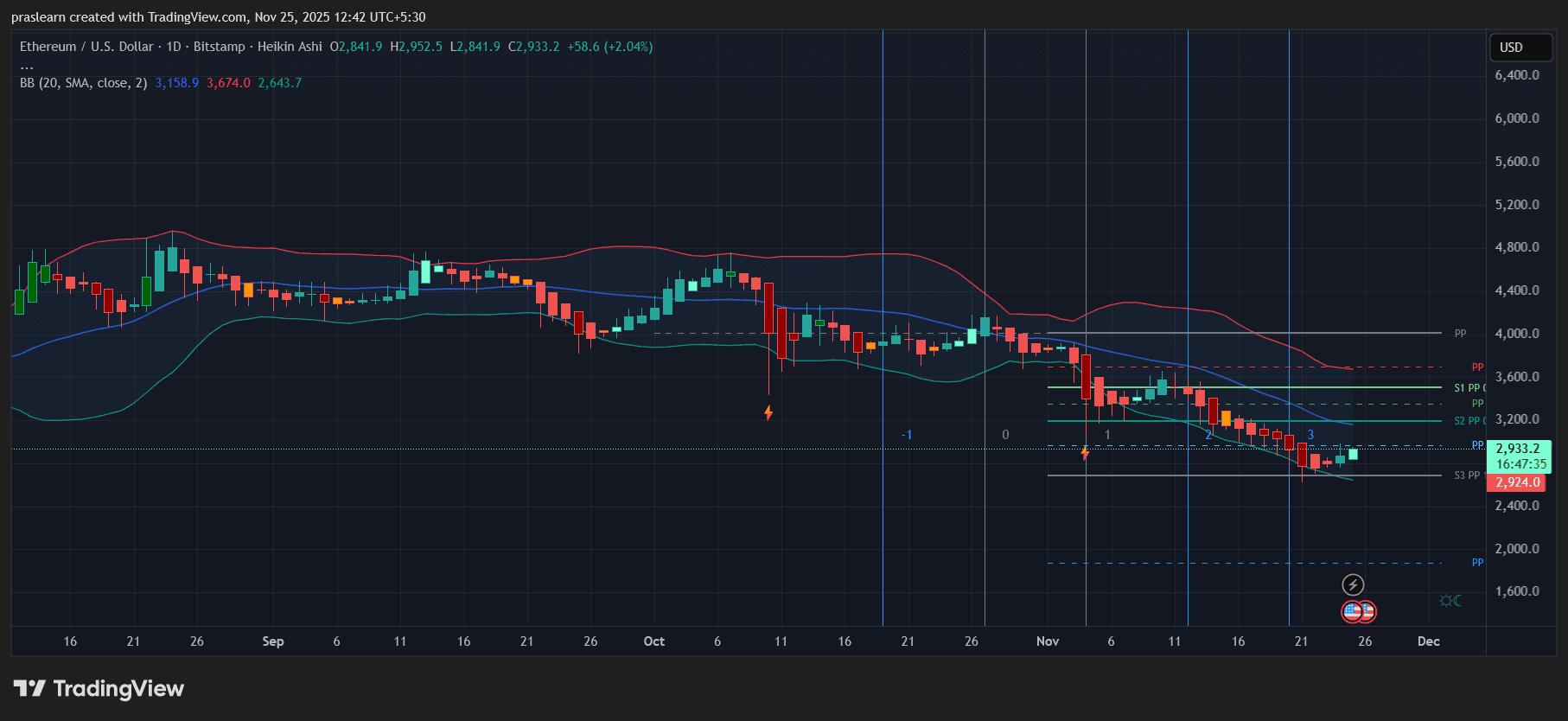

On the every day chart, Ethereum worth is buying and selling round $2,933, testing the mid-line of its Bollinger Bands after a multi-week downtrend. The latest candles are Heikin Ashi bullish, suggesting short-term reversal energy, however the 20-day SMA close to $3,158 stays a key resistance barrier.

- Assist Zone: $2,640–$2,700

- Resistance Zone: $3,150–$3,200

- Subsequent Pivot Goal: $3,400 if the breakout sustains above the 20-day SMA

ETH’s present motion hints at consolidation earlier than a doable bullish growth. The Bollinger Bands have began to slim, which regularly precedes a volatility breakout. A decisive every day shut above $3,200 would probably verify the beginning of that part.

Fed Coverage Meets Technical Strain

Ethereum’s chart conduct over the previous two months mirrors investor sentiment towards Fed coverage. Every time expectations for a price minimize strengthen, ETH bounces from its decrease band—simply because it did this week from close to $2,640. If the Fed delays the assembly or indicators coverage uncertainty, merchants may take income early, sending ETH again towards assist.

Nevertheless, if the Fed strikes ahead and confirms a minimize, liquidity inflows may elevate ETH worth towards the higher Bollinger Band close to $3,674. This aligns with the Fibonacci retracement from the final main swing, marking a robust confluence for mid-term resistance.

Brief-Time period Ethereum Worth Prediction: “Vibes Over Information” Market

UBS analysts referred to as the present Fed state of affairs “working in a fog,” and that sentiment captures Ethereum worth setup completely. Technicals present ETH worth making an attempt to reverse, however conviction stays weak. Loads is determined by whether or not macro readability returns earlier than December 10.

If ETH maintains assist above $2,850 for 3 consecutive days, the chances of retesting $3,200–$3,400 develop sharply. However a drop under $2,800 would invalidate this rebound and reopen the trail to $2,600 and even $2,400 assist.

Ethereum Worth Prediction: ETH’s Response to the December Determination

If the Fed cuts charges or delays its determination however indicators dovish intent, Ethereum worth may rally towards $3,600 in December. A no-cut stance mixed with continued inflation warnings may drag it again into the $2,600–$2,700 zone.

The following transfer will probably be much less about charts and extra about macro confidence. Ethereum’s worth is now shifting on the intersection of coverage uncertainty and dealer psychology—and whichever means that breaks, volatility is assured. Ethereum’s rebound from $2,640 reveals early energy, nevertheless it wants affirmation above $3,150 to show this isn’t simply one other aid rally. The Fed’s December assembly will resolve whether or not $ETH reclaims its bullish development—or slips again into winter.