Ethereum worth falls close to $1,948 as whale wallets scale back total $ETH provide management share.

Santiment knowledge reveals giant $ETH holders dropped under 75% provide possession after months dominance.

Over 220,000 $ETH withdrawn from exchanges, lowering short-term promoting strain throughout crypto markets.

Ethereum worth immediately is buying and selling round $1,948, down 3.5% and practically 14% over the previous week, displaying robust promoting strain. On the similar time, main shifts are occurring behind the scenes.

In the meantime, massive whale wallets are shedding management over provide, and thousands and thousands of $ETH are leaving exchanges. These adjustments recommend that whereas the $ETH worth stays underneath strain.

Ethereum Huge Holders Cut back $ETH Provide Management

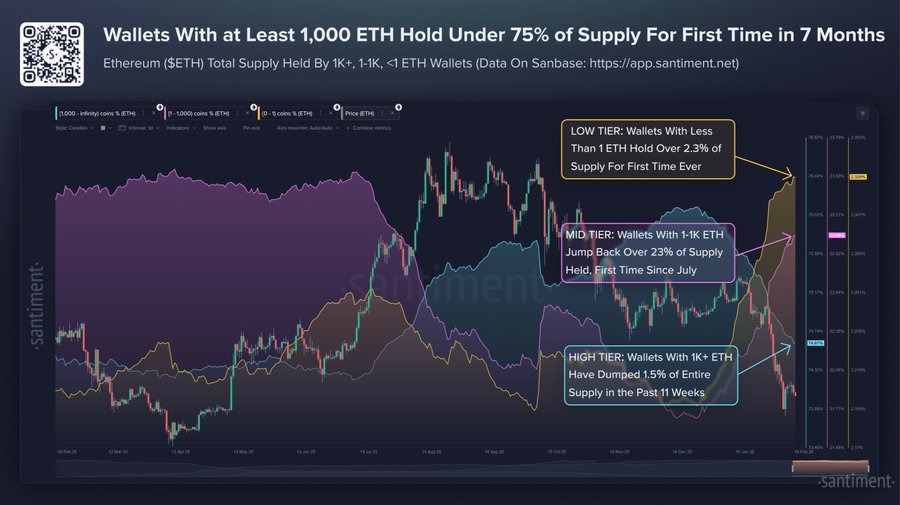

Based on Santiment, wallets holding at the least 1,000 $ETH now management lower than 75% of Ethereum’s whole provide, the primary time in seven months this stage has dropped so low.

Nevertheless, since December, these giant holders have offered or redistributed about 1.5% of the availability, suggesting profit-taking and diminished publicity throughout market uncertainty.

In the meantime, mid-sized wallets holding between 1 and 1,000 $ETH have elevated their share to over 23%, displaying quiet accumulation.

Smaller wallets are additionally rising, with addresses holding lower than 1 $ETH now proudly owning a report 2.3% of provide. Santiment believes this progress amongst small holders is probably going linked to staking exercise.

$ETH Is Now Under Whale Value Foundation

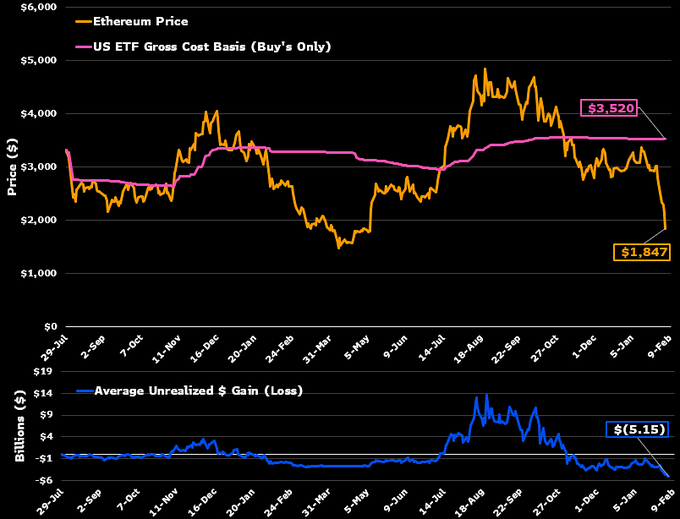

Ethereum is now buying and selling under the common worth at which giant holders purchased their $ETH, that means many whales are at the moment in a loss. This could possibly be simply seen amongst Ethereum ETF traders, who’re in a harder place than Bitcoin ETF holders.

With $ETH buying and selling close to $1945, it stays far under the estimated common ETF entry worth of round $3,500. For a lot of traders, it is a painful scenario.

Nevertheless, regardless of these losses, ETF holders proceed to build up extra $ETH.

In actual fact, Ethereum spot ETFs have additionally seen recent inflows, with $57 million on February 9 and $13.8 million on February 10, signaling continued institutional curiosity.

220K $ETH Leaves Exchanges

Whereas the Ethereum worth has been struggling not too long ago, on-chain knowledge reveals robust indicators of accumulation. CryptoQuant knowledge reveals that greater than 220,000 $ETH have been withdrawn from exchanges in current days, marking the biggest internet outflow since October.

On February 5, Binance alone noticed about 158,000 $ETH in withdrawals, the best since final August.

Massive trade withdrawals often scale back promoting strain, as cash moved to personal wallets are much less prone to be offered shortly.

Ethereum Worth Outlook

As of now, $ETH is buying and selling inside a well-defined descending channel, confirming steady promoting strain. Worth not too long ago broke under the important thing $2,000 help stage, which has now was resistance. $ETH is at the moment buying and selling close to $1,945, near a essential demand zone round $1,800.

For restoration, $ETH should first reclaim $2,440, adopted by $2,800. If worth fails to carry above the $1,750 help, additional draw back towards $1,600 is probably going.

Nevertheless, the RSI is close to 28, indicating oversold circumstances, which suggests a short-term bounce is feasible.