The cryptocurrency market is at present navigating a wave of macro-economic uncertainty. On Monday, January 19, 2026, the $Ethereum value slipped towards the $3,200 assist stage, mirroring a broader “risk-off” sentiment throughout world markets. Whereas Bitcoin has struggled to take care of its footing above $92,000 on account of renewed commerce tensions between the US and the EU, Ethereum’s on-chain metrics inform a way more bullish story.

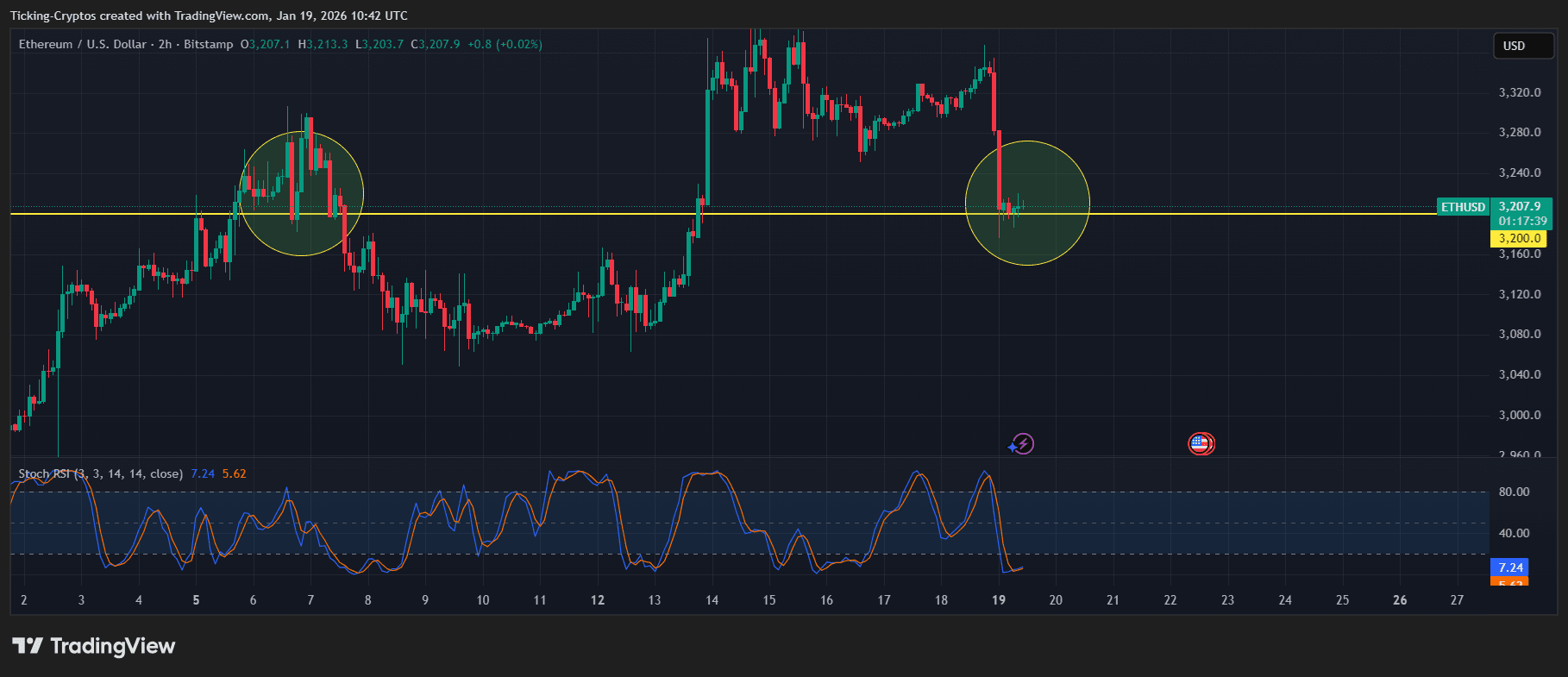

Ethereum Worth Evaluation: Holding the $3,200 Help

In keeping with current market knowledge, Ethereum ($ETH) has pulled again to the decrease boundary of its rising value channel. Regardless of the 24-hour dip of roughly 3%, technical analysts observe that the uptrend stays structurally intact so long as the value stays above the $3,100 – $3,200 zone.

ETH/USD 2H – TradingView

The fast resistance sits on the $3,350 mark. A day by day candle shut above this stage may ignite a momentum shift towards $3,500 and past. Nonetheless, if the psychological ground at $3,000 fails to carry, we would see a deeper correction towards the $2,700 liquidity pockets. Buyers usually use an trade comparability to search out platforms with one of the best liquidity for buying and selling these unstable swings.

Whales Accumulate ETH from Binance

Whereas retail sentiment stays cautious, institutional “whales” are viewing this dip as a first-rate shopping for alternative. On-chain monitoring reveals that a number of giant entities have been withdrawing 1000’s of ETH from Binance.

Notably, an entity labeled as an “Insider Whale” just lately added 20,000 ETH to its holdings, bringing its whole place to over $730 million. This stage of aggressive accumulation sometimes means that large-scale traders are positioning themselves for a mid-term restoration, possible fueled by the continued “CLARITY Act” momentum and constant spot ETF inflows.

Macro Headwinds: US-EU Commerce Tensions

The first catalyst for at this time’s market-wide cooling is the escalation of tariff threats between Washington and Brussels. As reported by Reuters, these tensions have pressured conventional equities and digital property alike. Ethereum, usually delicate to world liquidity shifts, has felt the pinch, but its decentralized ecosystem continues to evolve.

Vitalik Buterin just lately highlighted the necessity for “higher DAOs” that transfer past easy token-holder voting, using AI and ZK-technology to enhance governance effectivity. For these holding long-term, securing property in {hardware} wallets stays a prime precedence in periods of excessive macro volatility.

Ethereum Worth Prediction: What’s Subsequent for ETH?

The technical “coiling” section Ethereum is at present in normally precedes a major transfer. With trade reserves at multi-year lows and whale demand remaining sturdy, the supply-demand imbalance may set off a quick reversal if commerce tensions de-escalate.

You possibly can keep up to date with the newest actions by checking our crypto information part for real-time updates.