Ethereum value trades round $3,000, however the chart and on-chain knowledge each point out a strain zone that merchants can’t ignore. Momentum appears unstable, as one key holder group continues to promote.

The Ethereum value is caught at a degree the place even slight shifts can alter the complete construction.

Momentum Weakens as Lengthy-Time period Sellers Step In

The ETH value has tried to get well over the previous week, rising roughly 10%, however the broader development stays down 23% over the past 30 days. The bounce appears wholesome on the floor, but the habits beneath the chart tells a distinct story.

The RSI, or Relative Power Index, measures momentum. A hidden bearish divergence has fashioned between November 18 and November 28.

The Ethereum value made the next low, however momentum made the next excessive. When this occurs throughout a downtrend, it usually indicators a weak rebound and that sellers nonetheless management the development.

Ethereum Worth Motion: TradingView

Need extra token insights like this? Join Editor Harsh Notariya’s Day by day Crypto Publication right here.

Who’re these sellers? On-chain knowledge provides the reply.

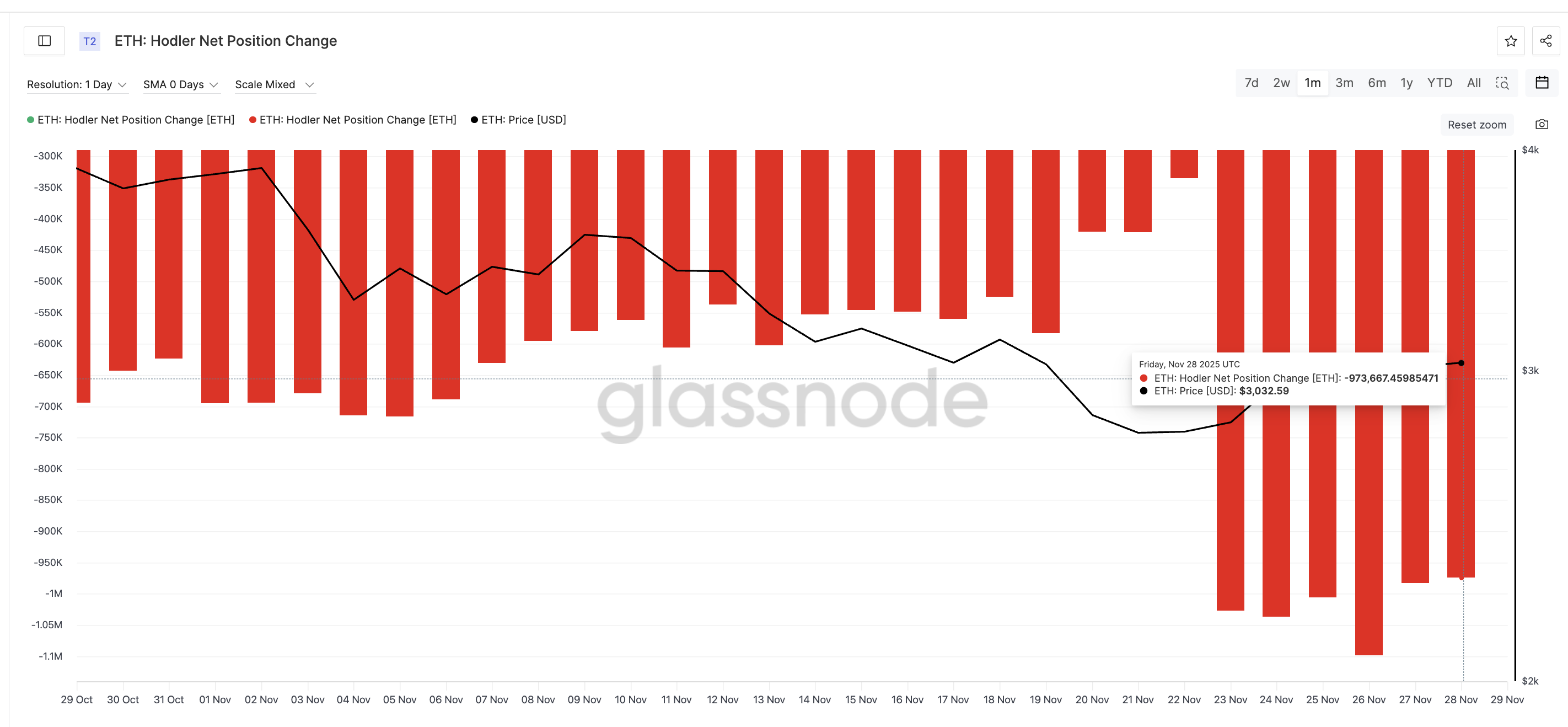

Hodler Internet Place Change — which exhibits whether or not long-term holders are including or eradicating ETH — has stayed deep in pink for the complete month. Pink readings imply long-term wallets are sending ETH again towards exchanges.

Over the past week, that strain has elevated sharply. On November 22, long-term holders offloaded about 334,600 ETH, however by November 28 the determine had grown to roughly 973,000 ETH — an increase of about 191% in six days.

There was additionally a neighborhood spike close to 1.1 million ETH on November 26. This regular enhance in weekly outflows signifies that the cohort that sometimes stabilizes the market is now leaning extra closely in the direction of the promote facet.

Lengthy-Time period Cohort Promoting: Glassnode

Momentum softening and long-term promoting taking place collectively give ETH a transparent draw back danger.

Ethereum Worth Sits at a Tight Break Level

The Ethereum value can be closing in on the sting of a pennant construction. This may break both approach.

ETH now trades proper above the $3,016 assist zone, which traces up with the 0.382 Fibonacci degree. If this ground breaks, the following ranges sit at $2,864, a 5% dip. A deeper slide may open $2,619, particularly if long-term promoting continues.

Ethereum Worth Evaluation: TradingView

To cancel the bearish setup, ETH should push above $3,138. That degree breaks the higher pennant trendline and flips the short-term bias. With out that break, the chart stays weak.

Pennants can technically break both approach, however the RSI setup and long-term promoting tilt the Ethereum value danger towards a draw back break except patrons step in quickly.

The submit Ethereum Worth Chart Flashes a Bearish Warning — Might This Be a ‘Lengthy-Time period’ Danger? appeared first on BeInCrypto.