Ethereum (ETH) has been on a powerful rally, with its value rising from $2,400 to $3,700 in current weeks. This surge has captured the eye of merchants and buyers, fueling optimism about ETH’s future. Nevertheless, in accordance with pseudonymous analyst VentureFounder, Ethereum is primed for a fair bigger rally, doubtlessly reaching $7,346.

Regardless of the bullish outlook, Ethereum’s basis stays barely unstable, with considerations over long-term holder (LTH) conduct and market volatility. Whereas a serious breakout is anticipated, warning stays as Ethereum navigates these important phases.

Ethereum Has a Strategic Rise Forward

Analyst venturefounder means that Ethereum is presently forming a “cup and deal with” triangle consolidation sample, which is commonly seen as an indication of future value good points. In keeping with this evaluation, if Ethereum efficiently breaks above the $3,800 resistance stage, it may goal $7,346—a rise of over 97% from its present value. This technical sample implies {that a} sustained rally is feasible, however provided that ETH confirms the breakout and continues to construct momentum.

Nevertheless, the sample just isn’t but totally confirmed, and Ethereum’s path ahead hinges on its means to push previous the $3,800 resistance. Till this happens, Ethereum stays in a consolidation part, and a breakout may very well be the catalyst for additional value appreciation. As such, merchants can be looking forward to any indicators of upward motion to validate the expected rally.

Ethereum Cup and Deal with Sample. Supply: vrenutrefounder

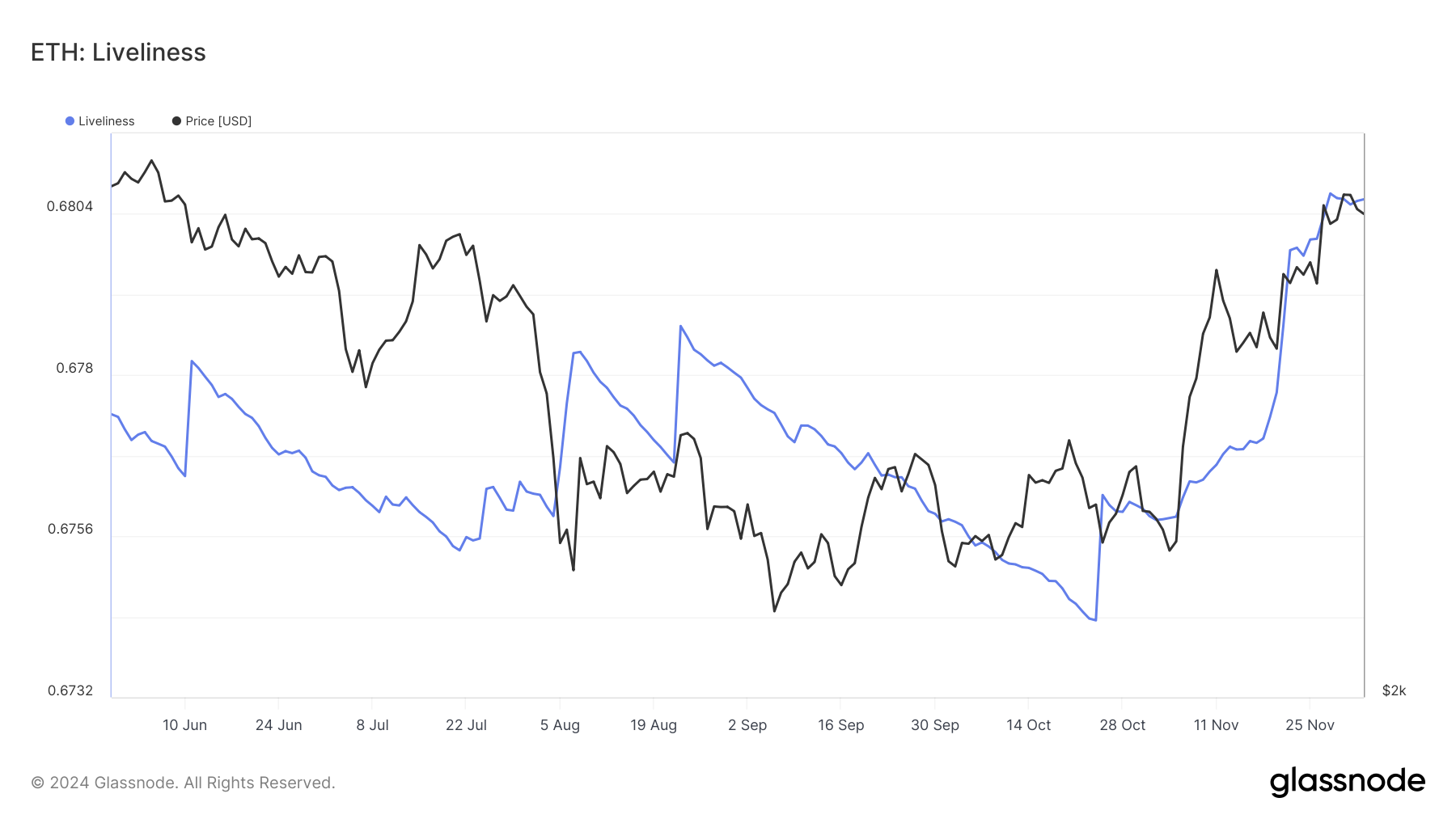

Ethereum’s macro momentum stays constructive, though there are considerations concerning the long-term holder (LTH) provide, which is measured by the Liveliness indicator. This metric tracks whether or not long-term holders are promoting or accumulating Ethereum.

An uptick in Liveliness signifies that LTHs are liquidating their positions, which may sign a bearish development or a shift in market sentiment. Conversely, a lower in Liveliness means that long-term holders are accumulating or holding their Ethereum, reinforcing a bullish outlook.

At current, LTH uncertainty is a priority. If Ethereum’s Liveliness continues to rise, it may point out that long-term holders are promoting off, which can put downward strain on the worth. Such promoting exercise may destabilize the rally and delay any potential value surge. Subsequently, the conduct of LTHs stays a vital issue to observe.

Ethereum Liveliness. Supply: Glassnode

ETH Worth Prediction: Aiming at All-Time Excessive

Ethereum presently sits at round $3,700, slightly below the essential $3,800 resistance stage. If ETH efficiently breaks above this threshold, it may provoke a rally towards $7,346, because the cup and deal with sample suggests. This could signify a 97% improve, signaling vital bullish potential.

Nevertheless, it’s important for Ethereum to ascertain agency assist above $3,800 earlier than any substantial value good points can materialize.

Bouncing off of $3,800 can also be the important thing to ETH crossing the $4,000 mark, which is the present year-to-date excessive. This could warrant conviction from retail holders and curiosity from institutional buyers.

Ethereum Worth Evaluation. Supply: TradingView

Nevertheless, if Ethereum’s Liveliness continues to climb and long-term holders maintain liquidating their positions, the bullish situation could also be in danger. A sustained interval of promoting may trigger a value correction, pushing Ethereum again towards the decrease $3,327 vary. This potential downturn would invalidate the present bullish thesis and will delay the anticipated rally.