- The ETH worth continues to slip beneath $2,300 assist which signifies it may transfer to $1,850 and probably attain $1,300 when the promoting stress fails to ease.

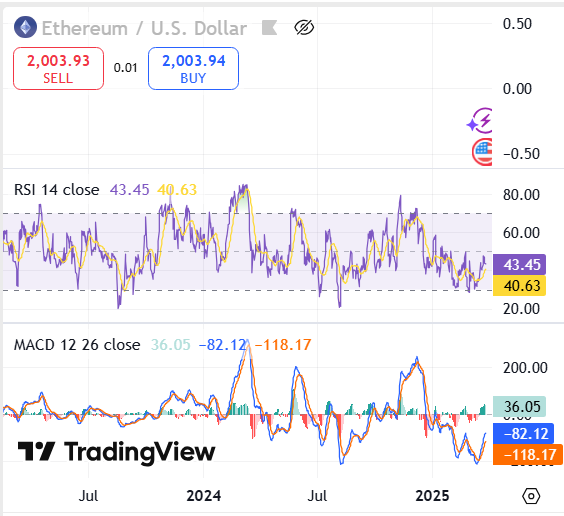

- RSI exhibits 43.45 whereas MACD alerts market sell-offs might proceed with no bullish pattern improvement.

- ETH requires a worth rise above $2,300 to $2,700 resistance to determine bullish circumstances however failing to take action will lengthen bearish worth actions.

The Ethereum coin (ETH) stays underneath downward stress as a result of latest market actions point out an prolonged bearish interval. The present chart evaluation exhibits ETH crossing beneath a key assist zone which reinforces investor and dealer fear about future worth decreases.

No change within the outlook for #Ethereum $ETH. The goal stays intact. Only a matter of time! pic.twitter.com/kGGHR0sQZv

— Ali (@ali_charts) March 27, 2025

Technical Overview and Key Ranges

The Ethereum worth chart signifies a longtime decline whereas it handed the $2,300 assist threshold earlier than its latest fall. When market members maintained the $2,300 assist stage with energy till their promoting capability declined it led to elevated market liquidations. At current the trade charge stands at $2,007.37 indicating a 0.5% discount from earlier day figures.

Ethereum did not exceed $3,700 resistance in its prior bullish momentum so this worth serves as a powerful resistance barrier. The present market exercise establishes $2000 as the value flooring however assist ranges relaxation close to $1300. Ethereum Worth might rise again to its earlier low earlier than bearish momentum continues to have an effect on future worth actions by way of upcoming weeks.

Market Indicators and Developments

The general market sentiment stays cautious, as Ethereum struggles to get well from its latest declines. ETH plummeted after experiencing a big market instability interval that pushed its worth to achieve $1,985.69 as its lowest level for the day however began exhibiting indicators of restoration. Market restoration throughout this era will face sturdy resistance on the $2,300 to $2,400 worth zone.

The indications counsel Ethereum continues to fall again after it surpassed its earlier assist ranges. Market analysts comply with ETH costs to grasp whether or not the asset stage will maintain at $2,000 or potential future worth losses will lengthen right down to $1,850 or additional.

Ethereum’s Technical Indicators Trace at Bearish Stress

The (RSI) indicator stands at 43.45 beneath the impartial 50 level which signifies a gentle bearish outlook with no indication of utmost sell-offs. ETH worth has displayed historic correction patterns when the Optimistic RSI sign reached the overbought zone of 70 marks throughout 2024’s mid-year and early 2025.

Supply:TradingView

The bull market sign emerges when the MACD line maintains a place above the sign line. Worth drops grew to become vital when the MACD reached 200 stage throughout earlier spikes and detrimental crossover occasions led to long-lasting market sell-offs.

Market Implications and Future Outlook

The first assist stage of Ethereum disappeared to create a pivotal juncture for market construction. The ETH worth incapacity to surpass $2,300 will set off a sustained worth decline in direction of potential $1,300 assist ranges.

The value may get well briefly if ETH absorbs buy funds however established obstacles at $2,300 and $2,700 would renegotiate their stand. Future weeks will reveal if Ethereum forex succeeds in constructing upward momentum or will encounter extra worth declines in market circumstances.