Ethereum hovered close to $2,977 as merchants tracked huge Binance staking pockets strikes, repeated assist retests, and liquidation strain constructing above spot. Collectively, the charts body a market watching whether or not ETH can maintain key ranges and problem close by resistance.

Arkham Information Exhibits Massive ETH Strikes Between Binance Staking Wallets

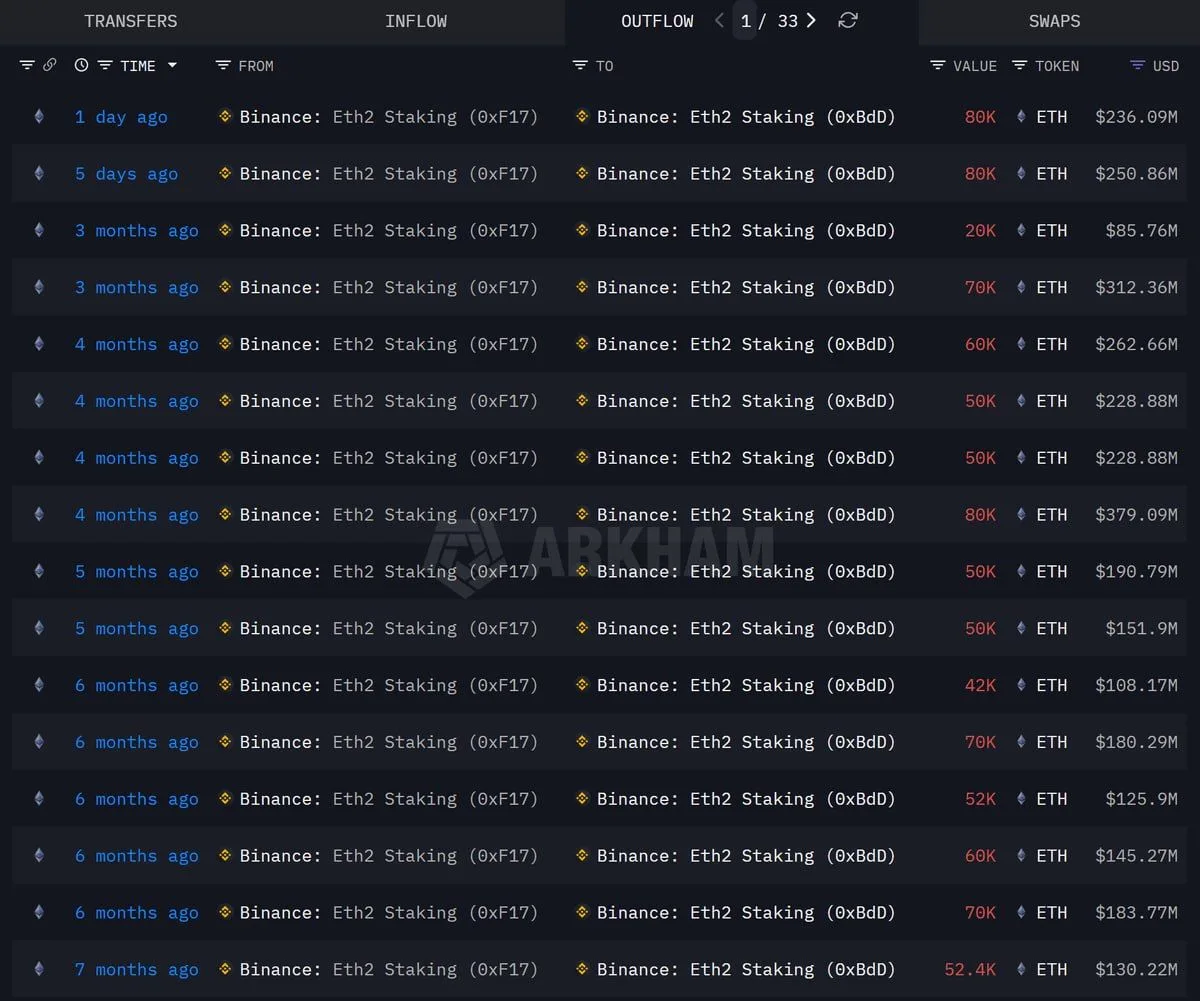

Arkham’s switch web page exhibits a number of massive Ethereum outflows between two Binance labeled wallets, “Binance: Eth2 Staking (0xF17)” and “Binance: Eth2 Staking (0xBdD).” The log consists of latest transfers of 80,000 ETH marked “1 day in the past” and one other 80,000 ETH marked “5 days in the past,” alongside older strikes reminiscent of 20,000 ETH and 70,000 ETH round three months in the past. The entries show USD estimates within the a whole lot of tens of millions for a number of of the transfers.

Binance ETH Staking Transfers. Supply: Arkham / X

A social media submit circulating with the screenshot claimed Binance “staked $500 million value of ETH this week” and referred to as the exercise “bullish for Ethereum.” Nonetheless, the screenshot itself exhibits pockets to pockets actions between Binance staking labeled addresses, so it doesn’t, by itself, show new staking demand from exterior customers or internet new ETH getting into Binance staking.

The identical submit additionally included a promotional line asking readers to not overlook to “drop your sol pockets deal with.” In the meantime, the on chain view proven within the picture focuses on Ethereum transfers and doesn’t reference Solana wallets or any giveaway mechanics.

Ethereum Trades Close to $2,977 as Analyst Tracks Help Maintain

In the meantime, Ethereum traded close to $2,977 on the ETH USDT 2 hour Binance chart after returning above a highlighted assist zone, based on a TradingView screenshot shared by DonnieBTC on X.

The chart exhibits ETH rebounding from a pointy mid week drop after which revisiting the identical worth band a number of occasions. Value motion additionally stays capped by a descending trendline that hyperlinks earlier highs, whereas a number of shaded bands above present ranges mark close by resistance areas on the chart.

Ethereum Help Zone Retest. Supply: TradingView/X

DonnieBTC wrote that Ethereum has moved again above the highlighted zone “for a number of occasions now.” He added that he’s watching whether or not ETH can reclaim the realm and maintain it, and he stated the outlook improves if worth sustains above that band.

Liquidation Heatmap Highlights Dense Ranges Above ETH Value

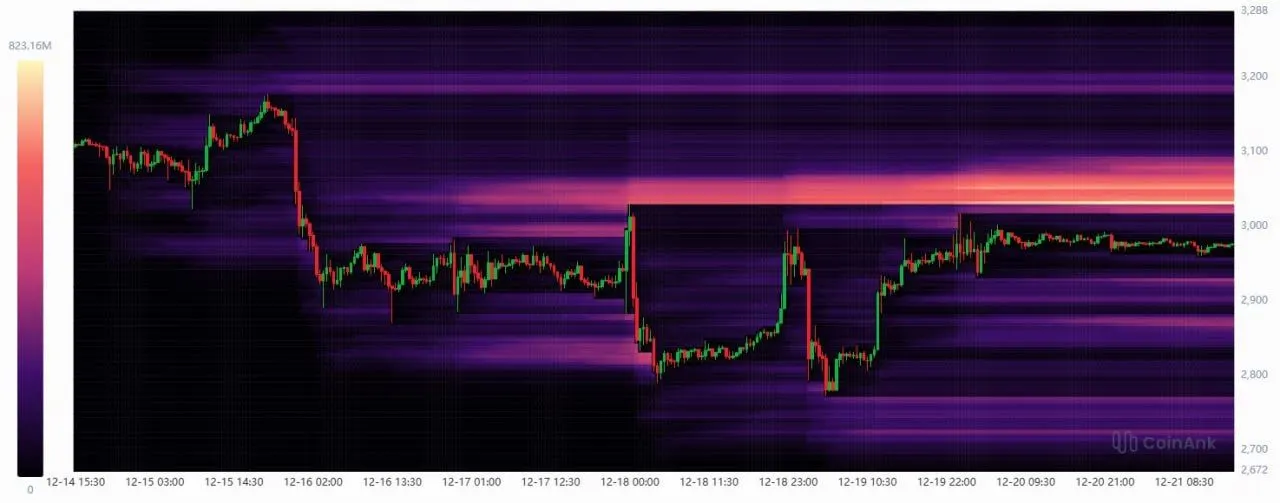

A CoinAnk liquidation heatmap shared by X person CW exhibits a big focus of potential liquidation ranges above Ethereum’s latest buying and selling vary, as ETH moved from the low $3,100s into the $2,700s after which stabilized close to the $2,900 to $3,000 space over the previous week.

Ethereum Liquidation Heatmap. Supply: CoinAnk

On the chart, the brightest horizontal band sits above present worth, clustered across the low $3,000s. In this kind of heatmap, brighter colours often mark bigger swimming pools of leveraged positions that may very well be compelled closed if worth trades into that zone, as a result of liquidations are inclined to set off round widespread leverage entry factors and cease ranges.

CW wrote that “excessive leverage brief positions on ETH will probably be liquidated quickly.” Liquidations solely happen if worth strikes into these ranges, so the heatmap exhibits the place strain could seem, not a assure that ETH will attain it.