Ethereum got here dangerously near breaching the $3,000 mark, briefly dipping to $3,053 earlier than bouncing again. The autumn rattled the market, triggering liquidations and panic promoting. However after weeks of regular decline, early indicators of a rebound are lastly beginning to seem.

Regardless of being down 27% prior to now month and eight.4% within the final 24 hours, each technical and on-chain information now trace that Ethereum might have shaped a neighborhood backside.

Early Rebound Setup Seems on the Charts

Ethereum’s value motion over the previous few weeks exhibits that bearish momentum is slowing.

On the 12-hour chart, Ethereum’s Relative Energy Index (RSI), which measures value momentum to point whether or not an asset is overbought or oversold, has begun forming increased lows, whilst the worth made decrease lows between September 25 and November 4.

Ethereum Flashes Bullish Divergence: TradingView

Need extra token insights like this? Join Editor Harsh Notariya’s Every day Crypto E-newsletter right here.

This sample is named a bullish divergence, which usually indicators that promoting strain is fading and a possible pattern reversal or rebound might comply with.

Since hitting a low of $3,053, the Ethereum value has already moved up 9%, at press time. That may imply the beginning of the rebound. Nonetheless, it’s nonetheless too early to say.

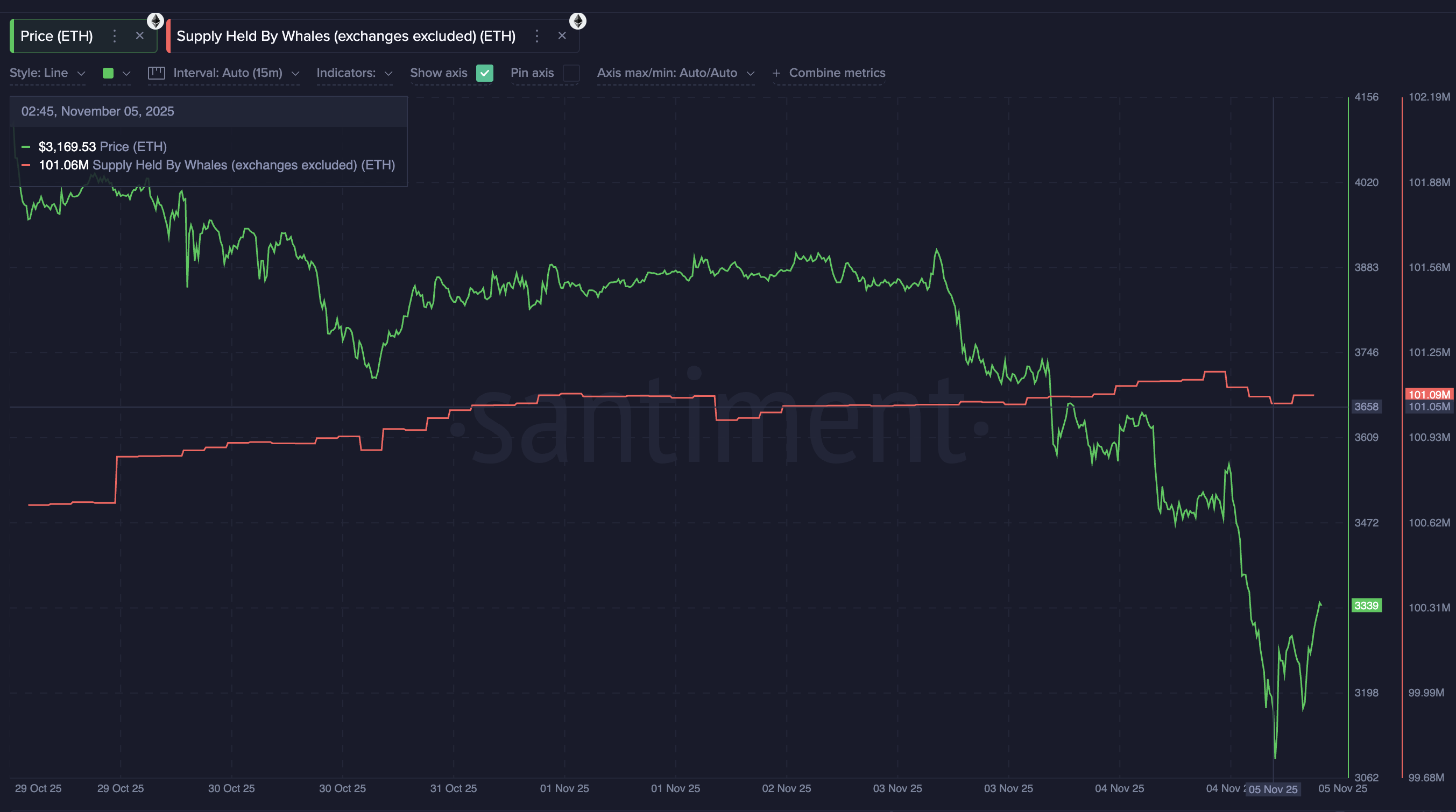

Supporting this setup, giant pockets holders have begun to return quietly. Ethereum whales have elevated their mixed holdings from 101.05 million to 101.09 million ETH in just some hours, including round 0.04 million ETH, or $134 million at present costs.

It’s not an aggressive accumulation, but it surely’s an indication of renewed confidence after a pointy sell-off.

Ethereum Whales Are Displaying Up: Santiment

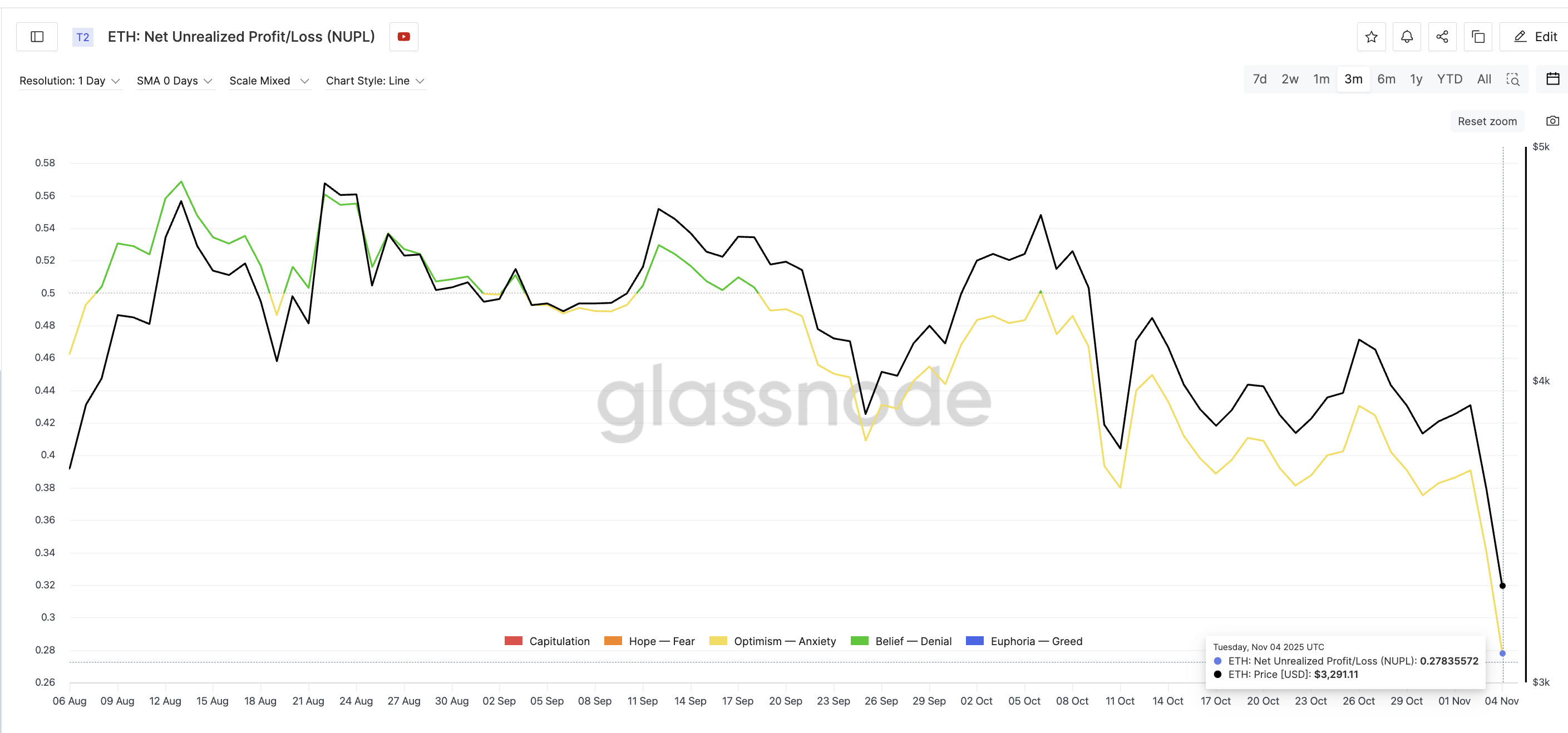

In the meantime, the Internet Unrealized Revenue/Loss (NUPL) ratio, which measures how a lot revenue or loss traders are nonetheless holding, has dropped to 0.27, its lowest degree since July 7. When NUPL falls this low, it usually implies that most weak fingers have exited at a loss, forsaking decided holders.

Weak Arms Are Principally Out: Glassnode

The final time this indicator dropped and shaped a neighborhood backside in mid-October, Ethereum rallied by greater than 10% inside two classes, suggesting that the market could also be repeating this conduct.

Derivatives Information Exhibits Stress Constructing for a Quick Ethereum Value Squeeze

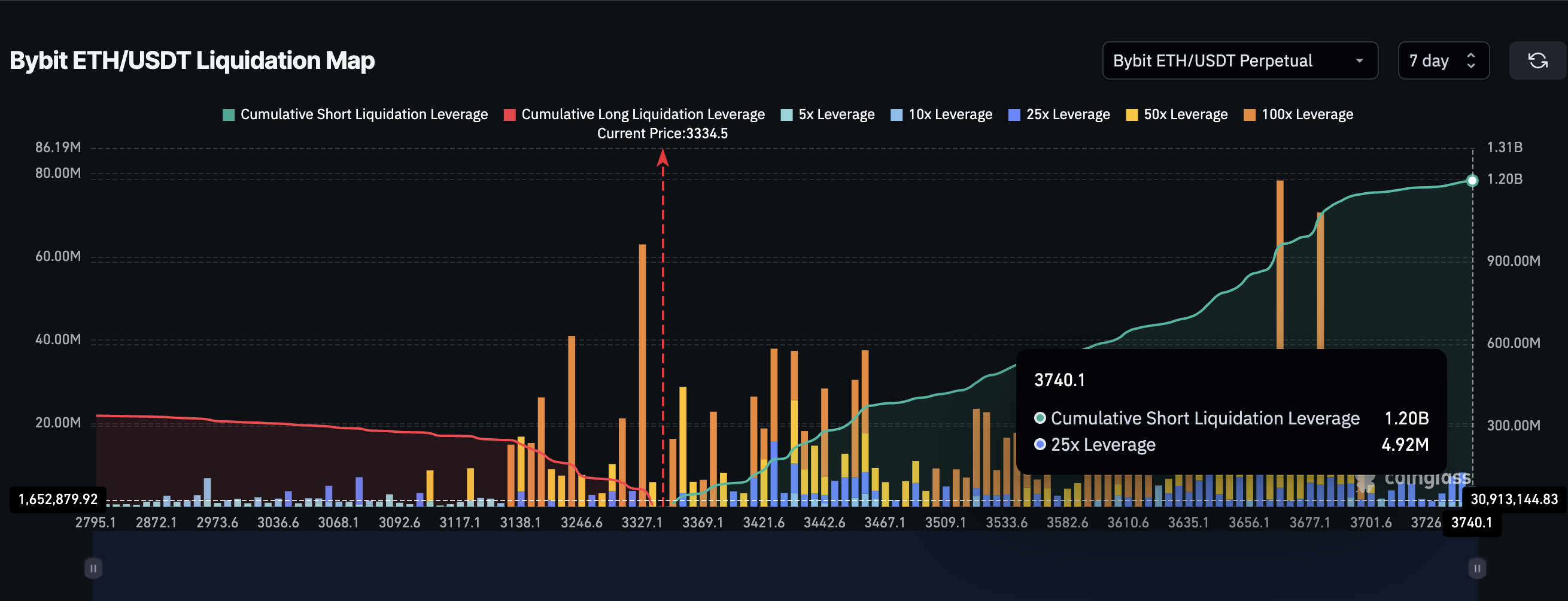

Ethereum’s by-product markets additionally assist the rebound case. Based on Bybit’s ETH/USDT liquidation map, practically $1.2 billion briefly positions at the moment are in danger between $3,320 and $3,740.

That is huge compared to simply $330 million in lengthy leverage. That imbalance — nearly 3.5× extra shorts than longs — means that any upward transfer may set off a brief squeeze, forcing brief merchants to purchase again and speed up value good points.

Liquidation Map Hints At A Quick Squeeze Setup: Coinglass

Nonetheless, just a few sizable lengthy positions close to $3,100 may nonetheless disappear if Ethereum dips once more. That’s one danger factor merchants should carefully monitor.

Technically, Ethereum continues to maneuver inside a falling channel, confirming that the broader pattern remains to be bearish. However the crucial assist zone at $3,053 has held thus far.

If Ethereum can shut above $3,338, it could affirm a rebound setup. From there, the subsequent main resistance is round $3,799.

Ethereum Value Evaluation: TradingView

Clearing it with a 14% upmove may ignite a stronger transfer towards $4,000 and even $$4,260. Nonetheless, if the 12-hour candle closes under $3,053, the Ethereum value would invalidate the rebound speculation.

The publish Ethereum Might Have Printed Its Backside — Rebound Setup Factors to $4,000 Goal appeared first on BeInCrypto.