Ethereum is trying to reclaim the $3,000 stage because the broader crypto market stays trapped in a section of uncertainty and uneven conviction. Value motion suggests consumers are keen to defend key help zones, but momentum stays fragile, with rallies struggling to increase meaningfully. This hesitation is going on in opposition to a backdrop of elevated leverage and unstable derivatives conduct, which continues to form short-term market dynamics.

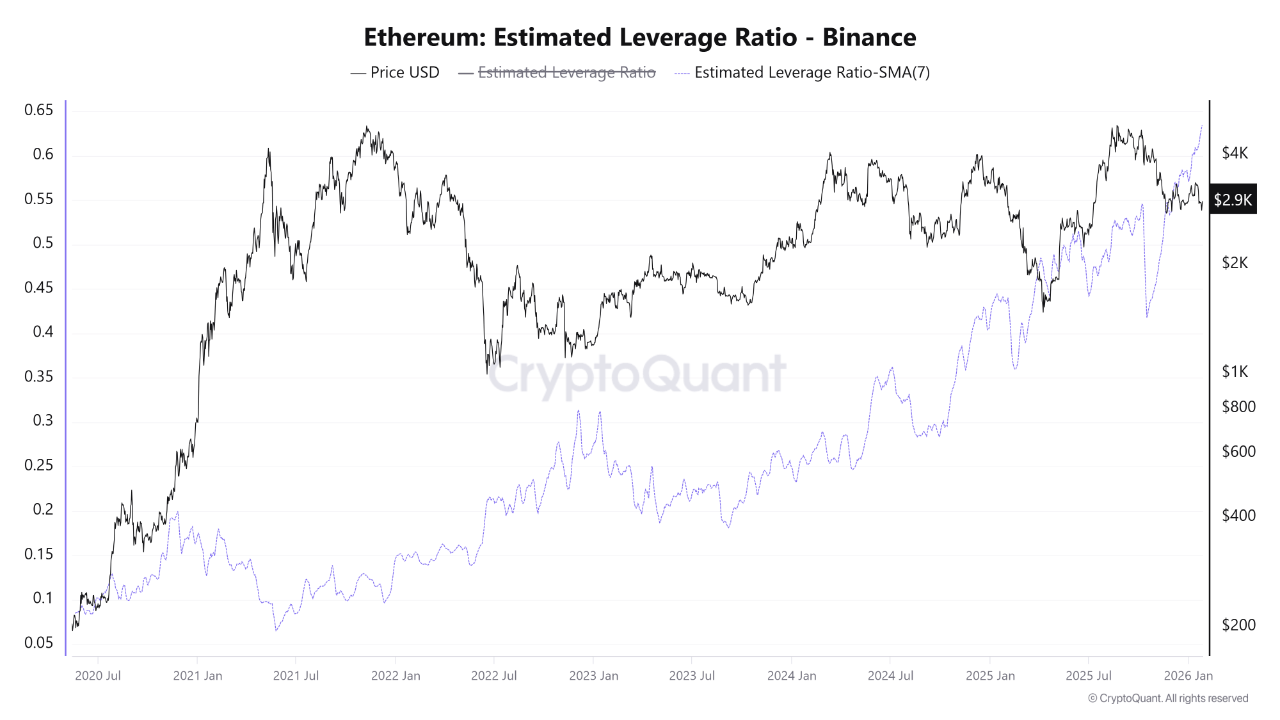

A current report from CryptoQuant highlights a rising supply of danger beneath the floor. Ethereum’s Estimated Leverage Ratio on Binance stays at a report excessive, with the 7-day easy shifting common holding round 0.632.

This means a heavy focus of leveraged positions, leaving the market more and more delicate to sudden value swings and liquidation occasions. In parallel, order-flow knowledge factors to erratic dealer conduct, reinforcing the view that the present construction lacks stability.

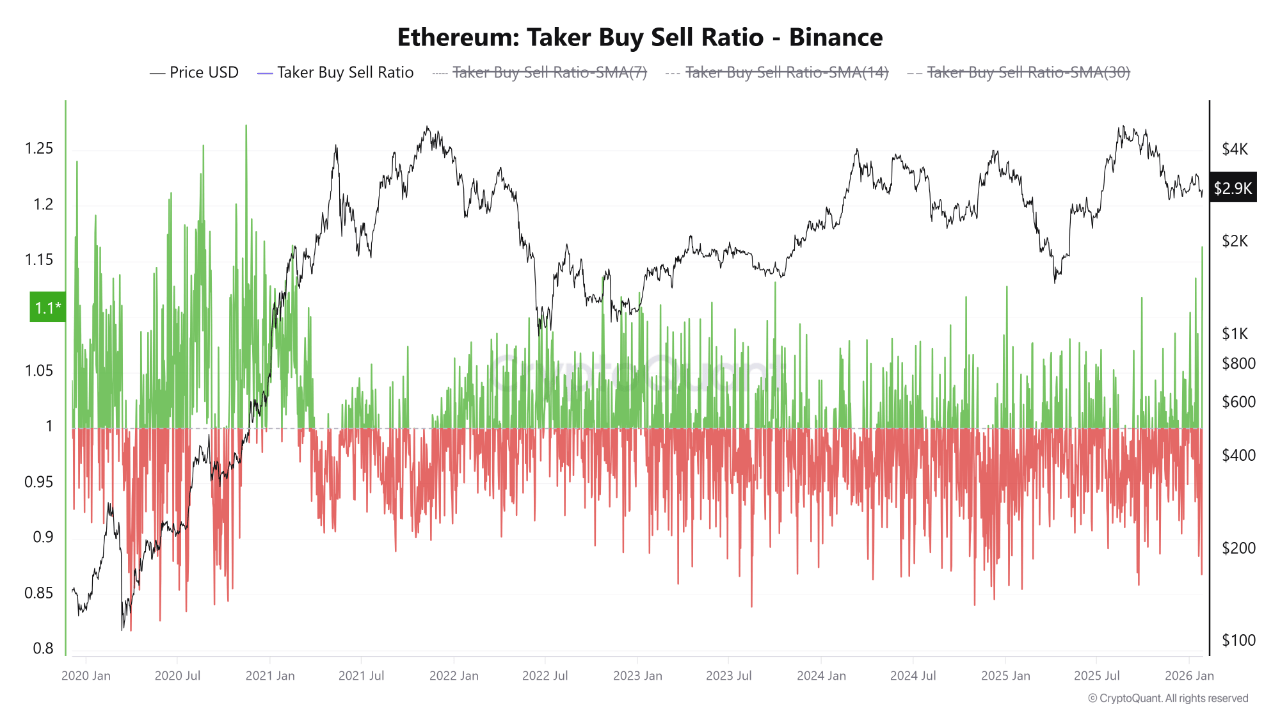

The Taker Purchase Promote Ratio illustrates this instability clearly. On January 25, the metric fell to 0.86, its lowest studying since September, signaling robust taker promote dominance. Shortly after, it rebounded sharply to 1.16, the best each day stage since February 2021, reflecting aggressive market shopping for. Such abrupt reversals underscore a market pushed extra by short-term positioning than by sustained directional confidence.

Ethereum Consolidates as Excessive Leverage Amplifies Volatility Threat

The report explains that this abrupt shift in taker conduct is unfolding whereas Ethereum value motion stays structurally weak. After failing to interrupt above the $4,800 all-time excessive, $ETH entered a chronic corrective section and is now consolidating close to the $2,800 help zone.

This stage has grow to be a short-term pivot, repeatedly absorbing promoting strain however failing to generate sustained upside momentum. The dearth of follow-through highlights a market caught between defensive consumers and aggressive short-term merchants.

What makes this section notably delicate is the interplay between value compression and elevated leverage. With Ethereum’s Estimated Leverage Ratio nonetheless close to report highs, even modest value strikes can set off outsized reactions within the derivatives market.

Speedy reversals within the Taker Purchase Promote Ratio reinforce this fragility, signaling that positioning is flipping shortly quite than constructing in a steady, directional method. Such situations typically precede sharp expansions in volatility quite than orderly tendencies.

Underneath this setup, Ethereum seems extremely depending on a transparent exterior or inside catalyst. With out a decisive shift in macro situations, spot demand, or network-specific developments, value motion is prone to stay reactive. Till conviction emerges on both aspect, the mix of excessive leverage and unstable order circulation retains the chance of sudden liquidations elevated, growing the likelihood of abrupt and disorderly value actions round key technical ranges.

Value Motion Particulars: Testing Important Resistance

Ethereum’s value motion displays a market caught between stabilization and unresolved draw back danger. On the each day chart, $ETH is buying and selling close to $3,000 after a number of failed makes an attempt to reclaim larger ranges, highlighting this zone as a key psychological and technical pivot.

Value stays beneath the 50-day and 100-day shifting averages, each of that are sloping downward, reinforcing the concept that short- to medium-term momentum remains to be fragile. The 200-day shifting common sits larger, close to the mid-$3,500 space, appearing as a transparent marker of the broader pattern deterioration since $ETH failed to carry above $4,000.

$ETH has transitioned from a robust impulsive uptrend into a large consolidation vary, bounded roughly between $2,800 and $3,400. The current bounce from the decrease finish of this vary means that consumers are nonetheless defending the $2,800 help zone, however quantity stays muted in comparison with prior selloffs, indicating a scarcity of robust conviction on both aspect. Every rally try has to date produced decrease highs, according to a corrective or distributional section quite than a renewed pattern.

So long as $ETH holds above $2,800, the market can argue for consolidation and base-building. Nonetheless, a sustained break beneath that stage would expose the draw back towards the $2,500–$2,600 area. Conversely, reclaiming the $3,300–$3,400 space could be required to meaningfully enhance the technical outlook.

Featured picture from ChatGPT, chart from TradingView.com