Ethereum demonstrated proof of latest momentum this week as community exercise and value motion each reversed after a sluggish stretch. The second-largest cryptocurrency lastly broke via a essential value barrier that had constrained its advance for over every week.

Energetic Addresses Up By Virtually 10%

As per statistics from CryptoQuant analyst Carmelo Alemán, Ethereum’s community skilled a notable improve in consumer exercise between April 20 and April 22.

Energetic addresses elevated from roughly 306,000 to greater than 336,000 inside this three-day interval, an increase of almost 10 p.c. The community is simply “heating up”, in keeping with Alemán.

Ethereum is Heating Up!

“Ethereum’s energetic addresses jumped from 306,211 to 336,366, representing a 9.85% improve in simply 48 hours” – By @oro_crypto

Learn the total evaluation ⤵️https://t.co/g55MiVnmOo pic.twitter.com/brIHtXx3Sx

— CryptoQuant.com (@cryptoquant_com) April 23, 2025

This frenzy in exercise at addresses is often indicative of adjustments out there temper and rising investor curiosity. Market analysts usually contemplate such rises as potential early indicators of value actions, largely once they coincide with value rise.

Value Throttles Down To Main Resistance

Preserving on with the battle of breaking above $1,640 completed since April, the worth of Ethereum lastly surpassed this resistance space. Putting above $1,780, the coin has defeated the confinement left by an assertive inexperienced day by day candle.

For the primary time in latest historical past, consumers look like taking heart stage out there. The worth now reads as above each the 10-day and 20-day shifting averages, indicating power within the shorter-term.

The relative power index is simply above its 50 line, exhibiting some bullish momentum with out being near the overbought zone.

Technical Indicators Current Blended Indicators

Some indicators present nice momentum, though every little thing will not be completely aligned. The shifting common convergence/divergence begins synthetizing foreboding development reversal early with barely optimistic numbers.

On the identical time, the stochastic RSI approaches the higher limits of its vary, which doubtless signifies short-term exhaustion except extra consumers come again quickly.

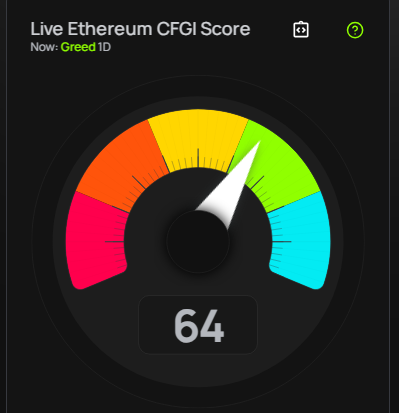

In line with value forecasts, Ethereum will fall by 6.50% and hit $1,652 on Could 24, 2025. Technical evaluation signifies a bearish development, whereas the Worry & Greed Index is at 64, which places market sentiment within the “Greed” zone.

Within the final month, Ethereum had inexperienced days 40% of the time (12 out of 30 days) with value volatility at 9.26%, knowledge from CoinCodex reveals.

Community Utilization Stays Low Regardless of Value Motion

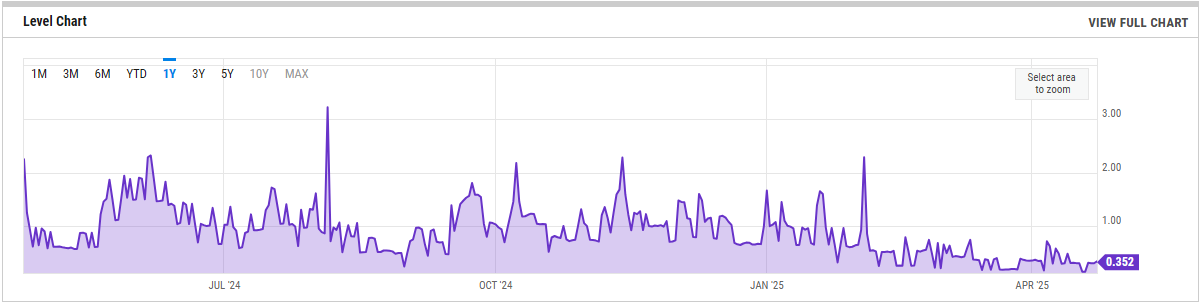

One of many confounding issues about Ethereum’s present state is the divergence between value motion and real-world community utilization. Transaction charges are nonetheless abnormally low at about $0.31 on common, primarily based on YCharts knowledge. Low charges point out that on-chain demand remains to be missing regardless of the community being cheap to make use of.

Regardless of this conflicting signal, the mix of accelerating energetic addresses and ETH holding place above prior resistance ranges has enhanced the short-term image.

Ought to current momentum proceed, market strategists might be conserving a detailed eye to find out whether or not Ethereum could make a cost within the course of the psychologically vital $2,000 value degree.

Featured picture from Fandom, chart from TradingView