Main altcoin Ethereum has seen its worth climb 5% over the previous week, using the wave of a broader market restoration. This worth progress has reignited demand for the altcoin, notably amongst US-based ETH retail merchants, as indicated by on-chain information.

Nevertheless, institutional traders seem to stay skeptical. They proceed to tug their capital from ETH-backed funds, signaling their insecurity in any near-term worth rebound.

Retail Curiosity in Ethereum Grows as Coinbase Premium Indicators Shopping for Surge

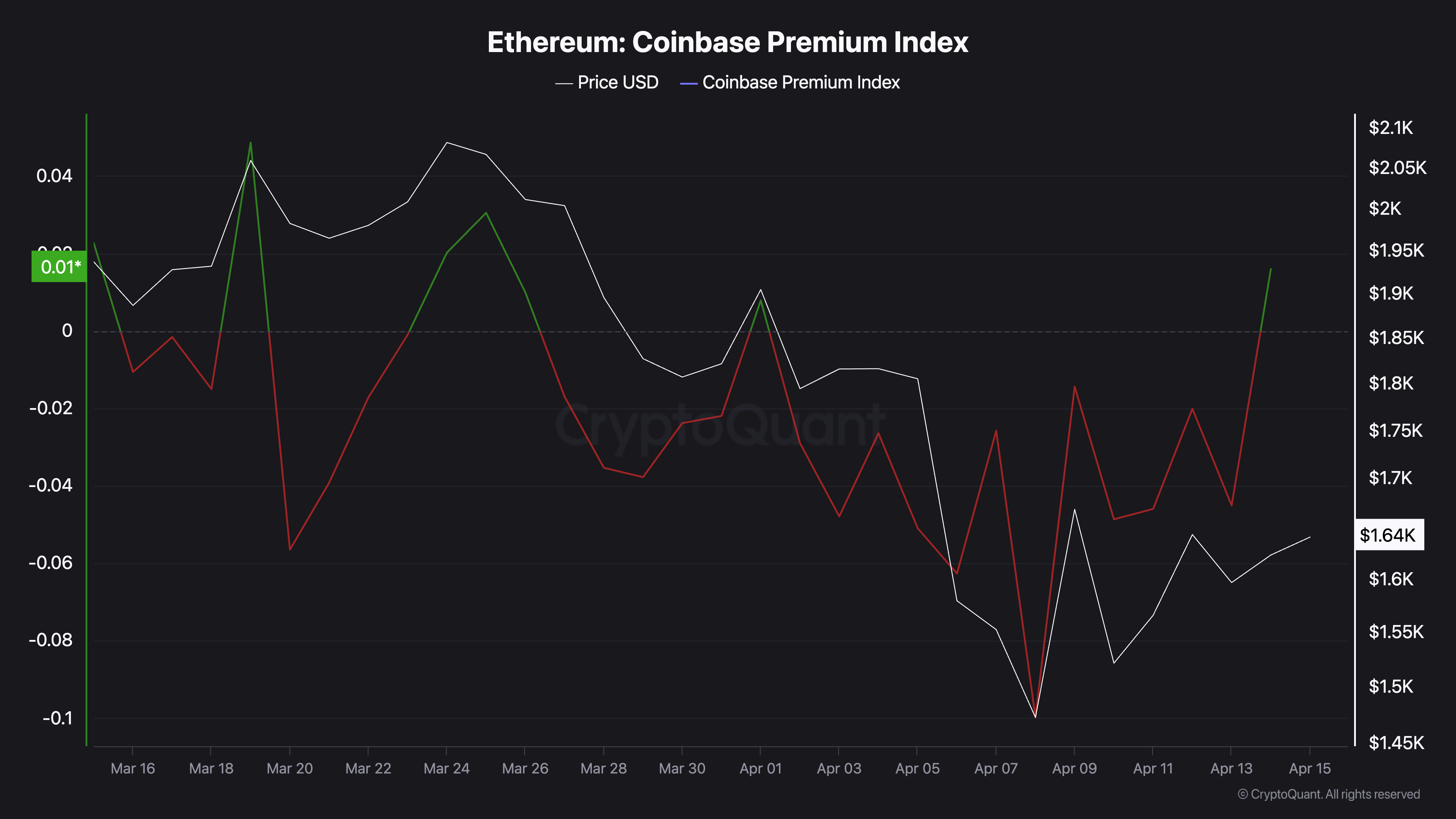

The rise in retail curiosity is clear in ETH’s Coinbase Premium. It has moved again above zero, signaling heightened shopping for exercise from US traders. At press time, that is at 0.016.

Ethereum Coinbase Premium Index. Supply: CryptoQuant

ETH’s Coinbase Premium Index measures the distinction between the coin’s costs on Coinbase and Binance. When its worth climbs above zero, it suggests important shopping for exercise by US-based traders on Coinbase.

Conversely, when it declines and dips into the adverse territory, it alerts much less buying and selling exercise on the US-based trade.

ETH’s Coinbase Premium Index displays bullish sentiment out there, as merchants are prepared to pay a premium to buy the coin on Coinbase. Within the quick time period, this will drive up the altcoin’s worth, because it alerts rising investor curiosity.

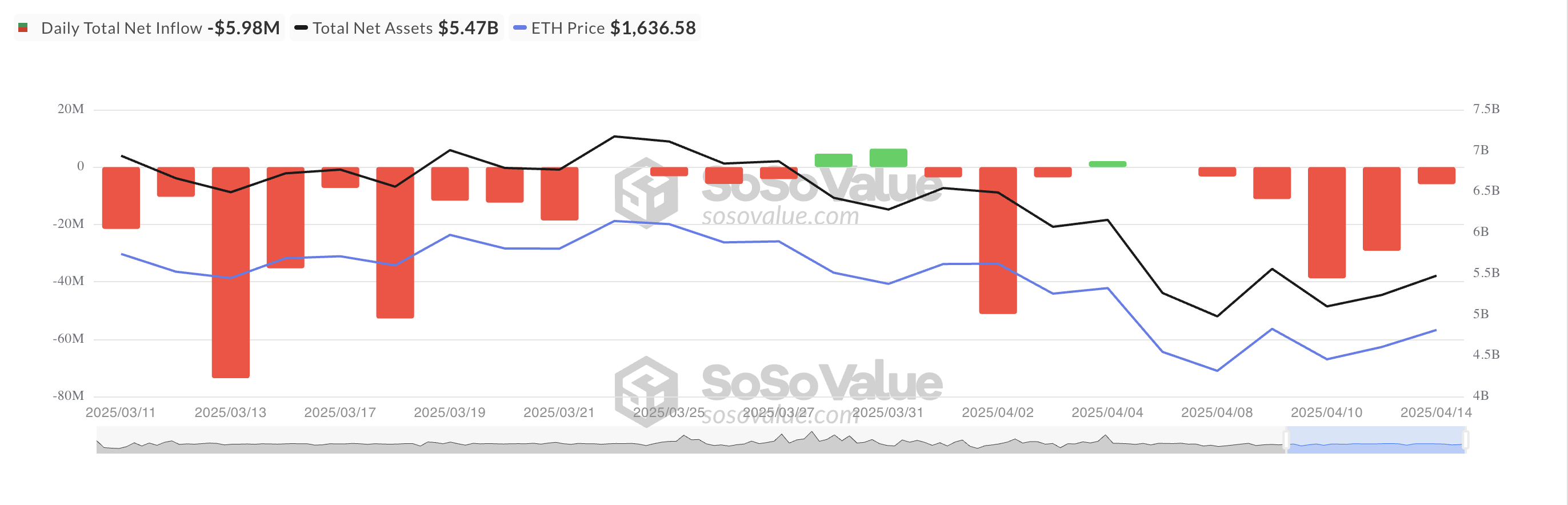

Nevertheless, institutional traders within the US stay cautious. That is evident within the ongoing outflows from US-based spot ETH exchange-traded funds (ETFs), marking the altcoin’s seventh consecutive day of withdrawals.

Whole Ethereum Spot ETF Web Influx. Supply: SosoValue

The continued exit of institutional capital stands in stark distinction to the rising enthusiasm amongst retail merchants. This divergence means that whereas US retail traders are more and more optimistic about ETH’s short-term prospects, institutional gamers are extra cautious, probably because of macroeconomic uncertainty.

ETH Exhibits Sturdy Capital Inflows, However Bearish Sentiment May See Value Drop

ETH’s Steadiness of Energy (BoP) is constructive at press time, reflecting at the moment’s market restoration. This indicator, which measures shopping for and promoting pressures, is in an upward development at 0.57.

A constructive BoP like this means extra capital influx into ETH than outflow, signaling an accumulation development. If this continues, it might push the altcoin’s worth to $2,114.

ETH Value Evaluation. Supply: TradingView

Nevertheless, if market sentiment turns bearish and ETH retail merchants cut back their demand for the altcoin, it might lose latest features and drop to $1,395.