- With an intraday bounce, the Ethereum worth reveals sustainability above the neckline help of long-coming head and shoulders sample.

- On-chain information reveals Ethereum information a gentle development in its lively addresses, making a median of 163K new addresses per day.

- Financial institution of Japan lifted its coverage price to 0.75%, the best degree seen since 1995, as a part of financial normalization.

ETH, the native cryptocurrency of the Ethereum ecosystem jumps 5.3% throughout Friday’s U.S. market session to achieve $2,977. The shopping for stress adopted market optimism that normalized Japanese charges for international threat urge for food with out speedy liquidity squeezes. Together with broader market help, Ethereum worth gained further because the community recorded a surge in new pockets creation.

BoJ Hikes Charges to 0.75% as ETH Jumps 5% on Macro Reduction

On Monday, December nineteenth, the Financial institution of Japan raised the rate of interest to 0.75%, marking its highest degree since 1995. This step was the additional step in ongoing efforts to normalize situations amid inflation in extra of the two% goal. Japanese authorities bond yields reacted with bond yields rising, such because the 10-year observe exceeding 2%.

Digital asset markets registered features within the speedy aftermath. Ethereum superior over 5% within the buying and selling classes, coming near $2,975-$2,976. Broader cryptocurrencies additionally marked upward actions, alongside excessive volumes.

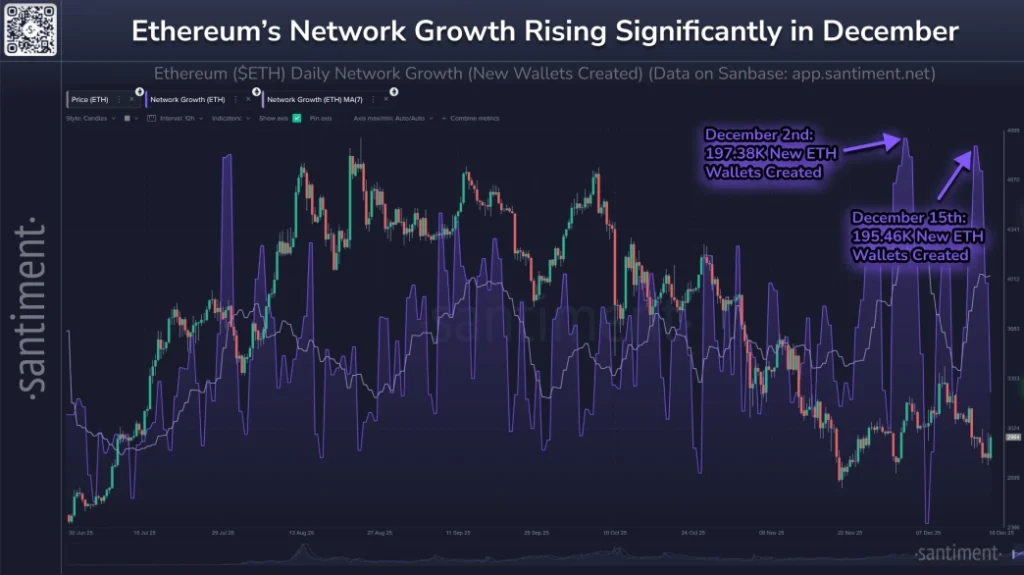

On-chain indicators confirmed elevated exercise on the Ethereum blockchain through the month of December. Analytics from Santiment reported important every day growths within the variety of new handle formations, with that quantity reaching 197,380 on December 2 after which 195,460 on December 15. Common every day creations amounted to about 163,000, a lot larger than the 124,000 creations famous within the month of July.

Discussions between market observers confirmed various views. Some commentaries targeted on patterns of weakening peaks in worth charts and prospects of corrections in conventional equities affecting higher-risk holdings.

The coverage adjustment was carried out because the stress from externalities abated to a sure extent, with diminished tensions in worldwide commerce relations. The yen got here underneath stress after the announcement; fairness indices in Japan had superior.

Key Assist For Ethereum Worth in Present Correction

Over the previous 4 months, the Ethereum worth witnessed a steep correction from $4,955 to present buying and selling worth of $2,967. This downswing displayed with recent decrease excessive formation and growing quantity accentuates sturdy conviction from sellers.

The falling ETH worth has began to stabilize above $2,700 as proven within the chart beneath. A deep evaluation of the technical chart reveals this falling worth developed into head and shoulders patterns. This chart setup is displayed by three peaks i.e., left shoulder, lengthy head and proper shoulder.

If the sample holds true, the Ethereum worth may revert 6% down and problem the underside neckline help for a bearish breakdown. The momentum indicator RSI all the way down to 45% accentuated a common bearish sentiment in worth to help extended downtrend. The post-breakdown may push the opposite 25% all the way down to hit $2,000 psychological help.

Quite the opposite, if coin worth managed to reveals sustainability above the neckline help, the consumers may regain management over this asset.

Additionally Learn: Tron Integrates with Base to Increase Cross-chain Entry of TRX