As capital continues to move strongly into Ethereum in 2025—pushing its value above $3,600—the quantity of ETH queued for unstaking has additionally surged unexpectedly.

What may this imply for Ethereum’s value development? Listed below are some skilled insights.

Over 350,000 ETH Ready to Be Unstaked—What’s the Implication?

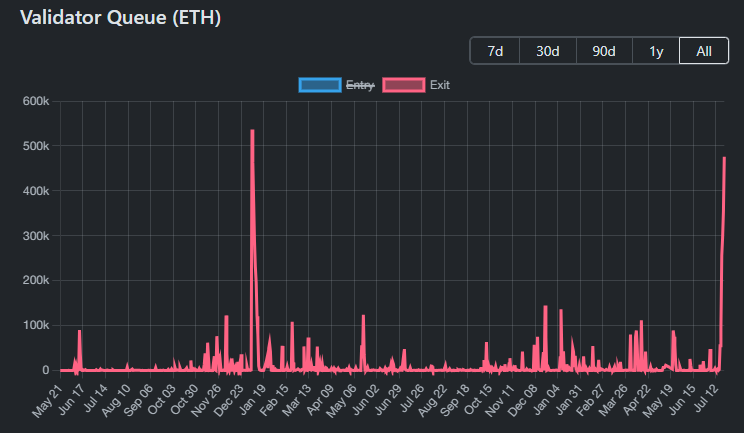

Udi Wertheimer, a outstanding investor within the crypto group, raised issues after discovering that greater than 350,000 ETH—value roughly $1.3 billion—are presently ready within the unstaking queue.

Ethereum Validator Queue. Supply: ValidatorQueue

“There’s 350,000 ETH queued as much as unstake. About $1.3 billion. The final time that a lot ETH was being unstaked was in January 2024, following a 25% rally in ETH/BTC in a single week. [price] went down solely from there,” Udi Wertheimer stated.

Unstaking permits customers to withdraw their ETH from staking good contracts, turning it again into freely usable belongings.

A big wave of unstaking may sign potential promoting stress. That is very true if traders need to take earnings after ETH’s 160% rally since its April lows.

Earlier in 2024, greater than 500,000 ETH had been unstaked earlier than ETH surged from $2,100 to over $4,000, and later dropped again to $2,100.

The place Would possibly This Unstaked ETH Go?

Viktor Bunin, OG Protocol Specialist at Coinbase, urged that this ETH is likely to be moved into inside treasury funds. These funds may serve monetary methods like long-term funding or portfolio diversification.

If that’s the case, this isn’t an indication of panic promoting—it’s extra possible a type of asset administration. This might truly assist stabilize the market in the long run.

In the meantime, a report from Lookonchain exhibits that on-chain knowledge signifies round 23 whales or establishments have collected 681,103 ETH (value $2.57 billion) since July 1.

And the buildup hasn’t stopped. Within the fourth week of July, extra establishments continued so as to add billions of {dollars} value of ETH.

“The brand new ETH treasury—The Ether Machine—introduced $1.5 billion in ETH this morning. That’d be the most important but. However then final week, Tom Lee from Fundstrat Capital stated he was going to purchase $20 billion in ETH, and Joseph Lubin stated he was in for not less than one other $5 billion. I don’t know who’ll find yourself as the most important. However I do know this—there’s not sufficient ETH to go round,” crypto investor Ryan Sean Adams stated.

What About ETH Being Staked?

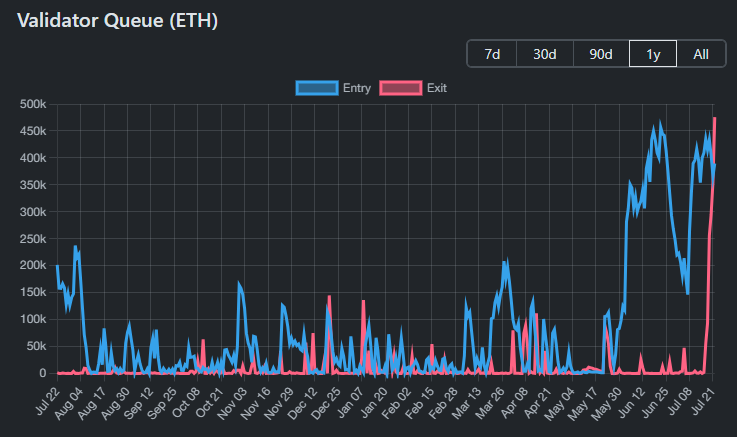

Udi Wertheimer’s concern could sound alarming, particularly when in comparison with historic patterns. Nevertheless, it lacks a key perspective: the quantity of ETH presently ready to be staked.

Ethereum Validator Queue. Supply: ValidatorQueue

Information from ValidatorQueue exhibits that the ETH queued for staking truly far exceeds the quantity queued for unstaking. Since June, this queue has surged, with over 450,000 ETH ready to be staked on sure days.

This displays continued investor curiosity in taking part within the Ethereum community by way of staking.

“Additionally, there’s a wholesome quantity of ETH queued up for staking at the moment,” Wertheimer added.

Information from beaconcha.in exhibits that over 35.7 million ETH is presently staked throughout numerous protocols. This accounts for 29.5% of the circulating provide.

In the end, the steadiness between ETH getting into and leaving staking protocols is a vital issue. It helps decide whether or not the market is dealing with actual promoting stress or just witnessing strategic reallocation by establishments and particular person traders.