Ethereum is nearing key resistance at $1,675, and a bullish breakout might push costs towards $1,750 amid ongoing whale accumulation.

As Bitcoin crosses the $87,000 mark, Ethereum is steadily gaining momentum. Over the previous 24 hours, Ethereum’s market worth has surged by practically 3.5%, reaching $1,647.

With this restoration rally, Ethereum is approaching the $1,675 provide zone. Will this drive ETH costs past $1,750?

Ethereum Targets $1,650 Breakout

Within the 4-hour worth chart, the Ethereum worth pattern showcases a bullish breakout of a long-standing resistance trendline. Moreover, the current restoration run marks a constructive cycle inside a consolidation vary.

The sideways vary exchanges between the 23.60% and 38.20% Fibonacci ranges. The decrease boundary is at $1,577, with the higher ceiling at $1,675.

Presently, Ethereum’s restoration run has created 5 consecutive bullish candles that surpass the 50-EMA line. Nevertheless, the uptrend faces opposition from the overhead provide zone and the 100-EMA line.

Nonetheless, the short-term restoration, fueled by the trendline breakout rally, marks a constructive crossover within the MACD and sign traces. This tasks an elevated chance of a breakout run.

Based mostly on the Fibonacci ranges, the 100-EMA breakout, adopted by the consolidation vary breakout, will doubtless problem the 50% stage close to the 200-EMA line. This tasks a excessive potential for Ethereum to surpass $1,750. Conversely, a possible bearish reversal will doubtless retest the 23.60% stage.

Ethereum Merchants Anticipate Sturdy Restoration Forward

Amid the rising chance of a brand new bullish cycle in Ethereum, the curiosity of merchants in Ethereum derivatives is rising considerably. Open curiosity has surged by 4.83%, reaching $19.19 billion and the funding fee is flipping constructive.

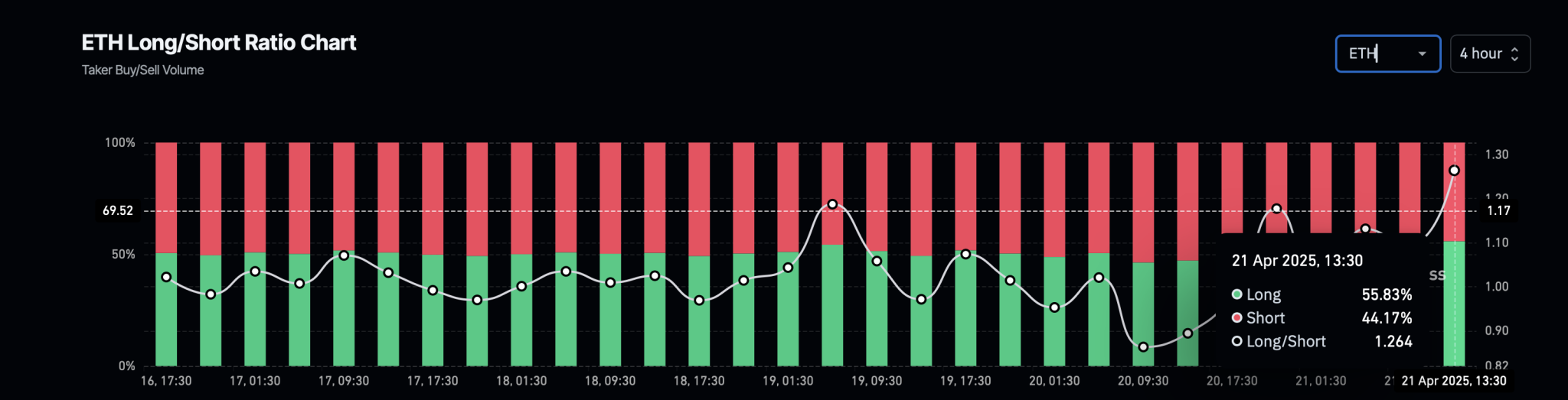

Moreover, up to now 4 hours, lengthy positions within the Ethereum derivatives have surged to 55.83%, driving the long-to-short ratio to 1.264. This indicators the elevated bullish sentiments for Ethereum within the derivatives market.

Ethereum LongShort Ratio Chart

Analyst Indicators A Potential Bullish Momentum

Including to the opportunity of a bullish run forward, Ali Martinez, a crypto analyst, suggests a large restoration for Ethereum this week. Based mostly on the TD Sequential Indicator, Ali Martinez highlights a possible bullish reversal upcoming for Ethereum.

The analyst hints at a possible shift in bullish momentum because the Technical Indicator triggers a purchase sign.

Massive week forward for #Ethereum $ETH! The TD Sequential has simply flashed a purchase sign, hinting at a possible shift in momentum. pic.twitter.com/xnhVkzBxJc

— Ali (@ali_charts) April 21, 2025

Whales Accumulating ETH

Amid Ethereum’s rising chance of a bullish turnaround, whales are beginning to accumulate ETH quickly. As per a current tweet by LookOnChain, a whale has acquired 1,897 Ethereum price $3 million. Earlier this month, the identical whale withdrew 3,844 Ethereum price $6.5 million from the Bitget alternate.

Moreover, a unique whale acquired 6,528 Ethereum price $10.69 million, bringing the whale’s holding to six,624 Ethereum price $10.83 million. As whales proceed to accumulate ETH, the opportunity of a bull run grows considerably.

Whales proceed to build up $ETH!

A whale withdrew one other 1,897 $ETH($3M) from #Bitget 10 hours in the past.

This whale has withdrawn 3,844 $ETH($6.51M) from #Bitget since April 3.https://t.co/HZN9KLPt6M pic.twitter.com/0HCPswZx8w

— Lookonchain (@lookonchain) April 21, 2025