- The Ethereum worth correction is heading for a bearish breakdown from the help trendline of a head and shoulders sample.

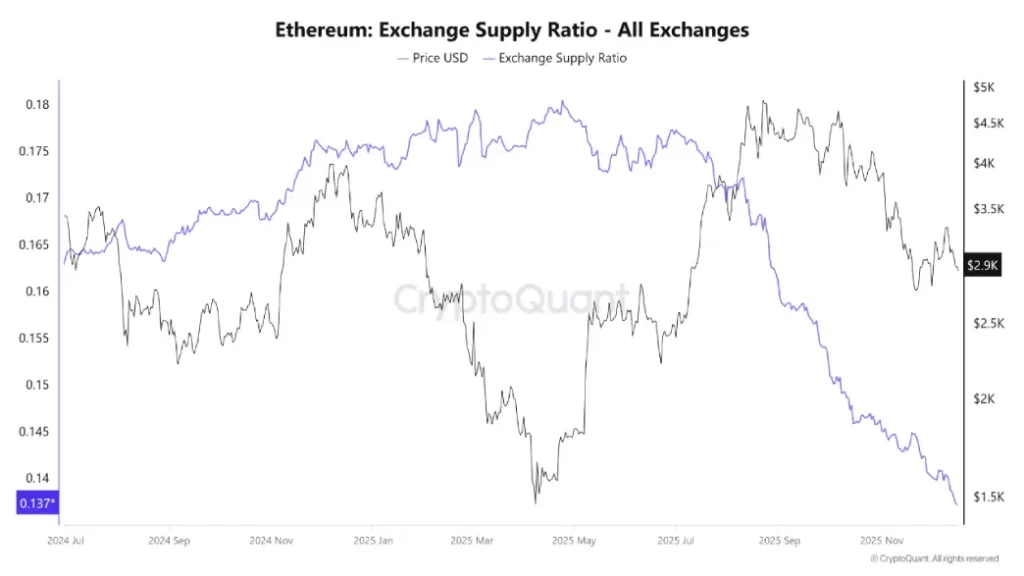

- Ethereum alternate balances have declined to roughly 0.137, matching ranges final seen throughout the community’s early part in 2016.

- A pointy downtick in Relative energy index(RSI) accentuates the aggressive promoting stress in present worth motion.

On Wednesday, December seventeenth, the Ethereum worth slipped 4.6% to at the moment alternate arms at $4.66. The promoting stress emerged amid rising uncertainty surrounding Financial institution of Japan’s upcoming rate of interest determination alongside important outflow from U.S-based spot ETH ETF. Whereas the market sentiment promotes additional correction in worth, on-chain indicators spotlight robust conviction from traders, which might bolster a base help for worth backside in close to future.

Ethereum Change Reserves Sink to 2016 Lows as Holders Transfer ETH Off Platforms

On-chain metrics reveal Ethereum holders transferring tokens off buying and selling platforms in large quantities. The quantity of complete ETH saved throughout centralized exchanges has fallen to about 0.137, which is similar stage it reached throughout the community’s early years in 2016. This discount signifies web transfers into non-public wallets in comparison with deposits for fast trades.

Knowledge from main venues exhibits fewer cash accessible on the spot markets. Merchants apparently choose to have belongings outdoors the exchanges, decreasing the variety of belongings which might be prepared for fast transactions.

On the main alternate by quantity, Binance, the share of ETH in its reserves is near 0.0325, decrease in contrast with values of latest durations. Withdrawals from this platform have exceeded inflows, decreasing the variety of tokens within the pool to be bought in spot gross sales.

Ethereum is at the moment buying and selling for round $2,960. This stage is within the latest buying and selling band, despite the fact that there have been persevering with shifts in alternate holdings, there aren’t any sharp drops. The decrease quantity on platforms is in line with regular pricing as accessible liquidity is sucked from different makes use of.

Ethereum Worth 2% Away For Key Help Breakdown

Over the previous month, the Ethereum worth has plunged from $3,450 to present buying and selling worth of $2,830, recording a 18% loss. This downswing displayed a recent lower-high formation within the each day chart, reflecting a sell-the-bounce sentiment intact amongst market individuals.

Nonetheless, a broader evaluation of Ethereum’s worth exhibits this pullback as a part of a standard reversal sample referred to as head-and-shoulder. The chart setup is characterised by three peaks, i.e., a left shoulder, a head, and a proper shoulder, whereas it’s generally noticed at main market tops, reflecting a bearish shift in market sentiment.

At the moment the coin worth is lower than 2% away from difficult the sample’s backside trendline, showcased as a long-coming ascending trendline within the chart beneath. A bearish breakdown beneath this help would full the sample and speed up the promoting stress on worth. The momentum indicator RSI at 37% additional helps the chance of bearish breakdown from sellers.

The post-breakdown fall might push the worth one other 23.5% all the way down to retest the psychological stage of $2000.

ETH/USDT- 1d Chart

Quite the opposite, if the coin worth exhibits sustainability above the ascending trendline, the patrons should breach $3450 to anticipate a significant rebound.