Ethereum (ETH) worth has jumped 43.88% within the final 30 days, displaying sturdy momentum. The declining provide of ETH on exchanges means that holders have gotten extra assured, transferring their tokens to long-term storage.

On the identical time, whales are stepping in and accumulating extra ETH, including to the bullish sentiment. With EMA patterns additionally leaning optimistic, the market appears to be gearing up for an attention-grabbing section.

ETH Provide on Exchanges Is Reducing

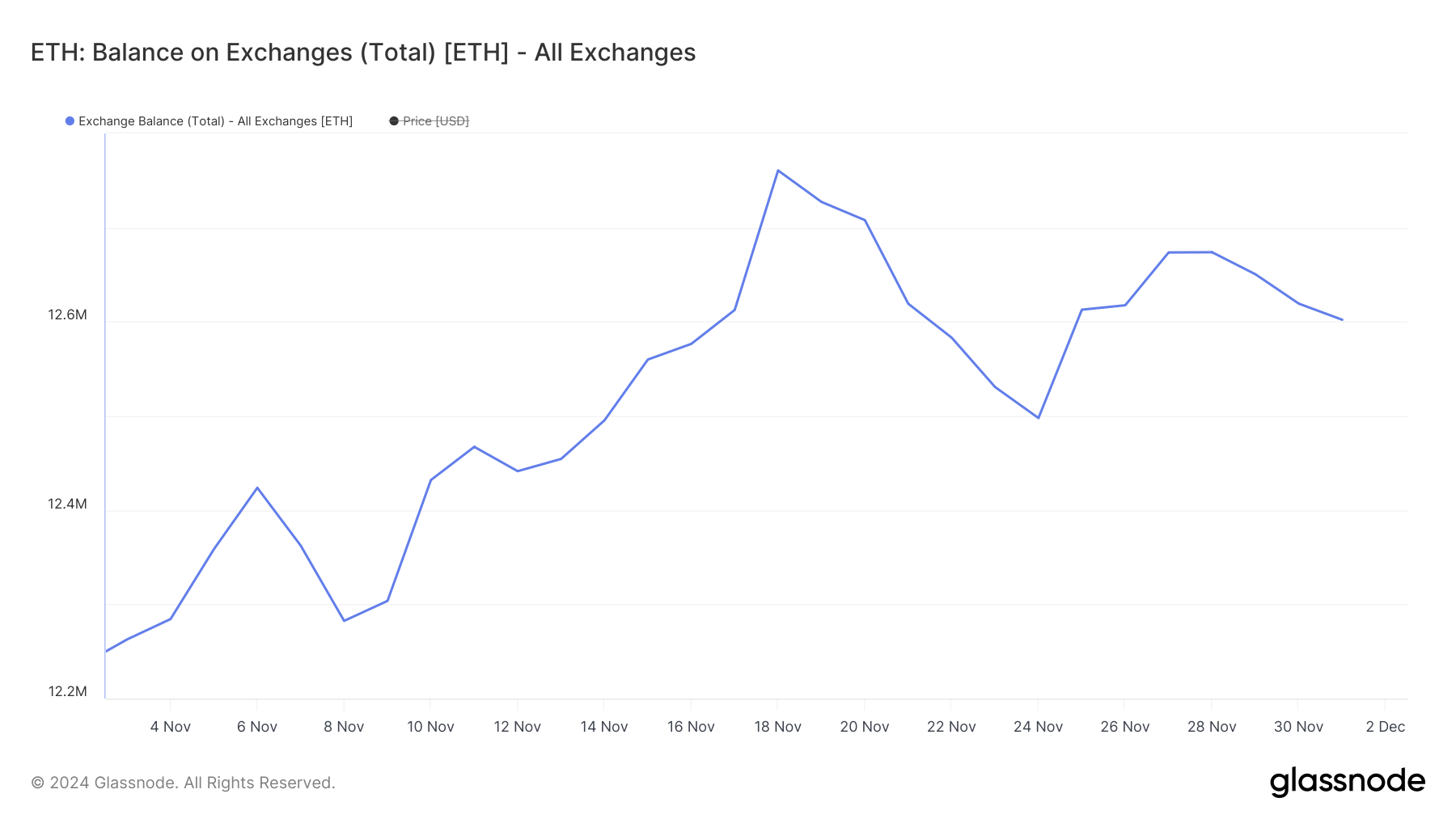

Between November 3 and November 18, the Ethereum provide on exchanges elevated considerably, rising from 12.2 million to 12.7 million.

This upward pattern indicated a rising accumulation of ETH on platforms the place it may be simply offered or traded. Such conduct typically displays a bearish sentiment, as customers could also be making ready to liquidate their holdings in response to market uncertainty or worth expectations.

ETH Stability on Exchanges. Supply: Glassnode

The decline in ETH provide on exchanges, which dropped to 12.6 million by December 1, alerts a possible shift in sentiment. When customers withdraw ETH from exchanges, it suggests a lowered probability of promoting.

This transfer is commonly thought-about bullish, because it implies holders are choosing long-term storage. This might be an early signal of rising confidence in ETH worth.

Whales Are Accumulating ETH Once more

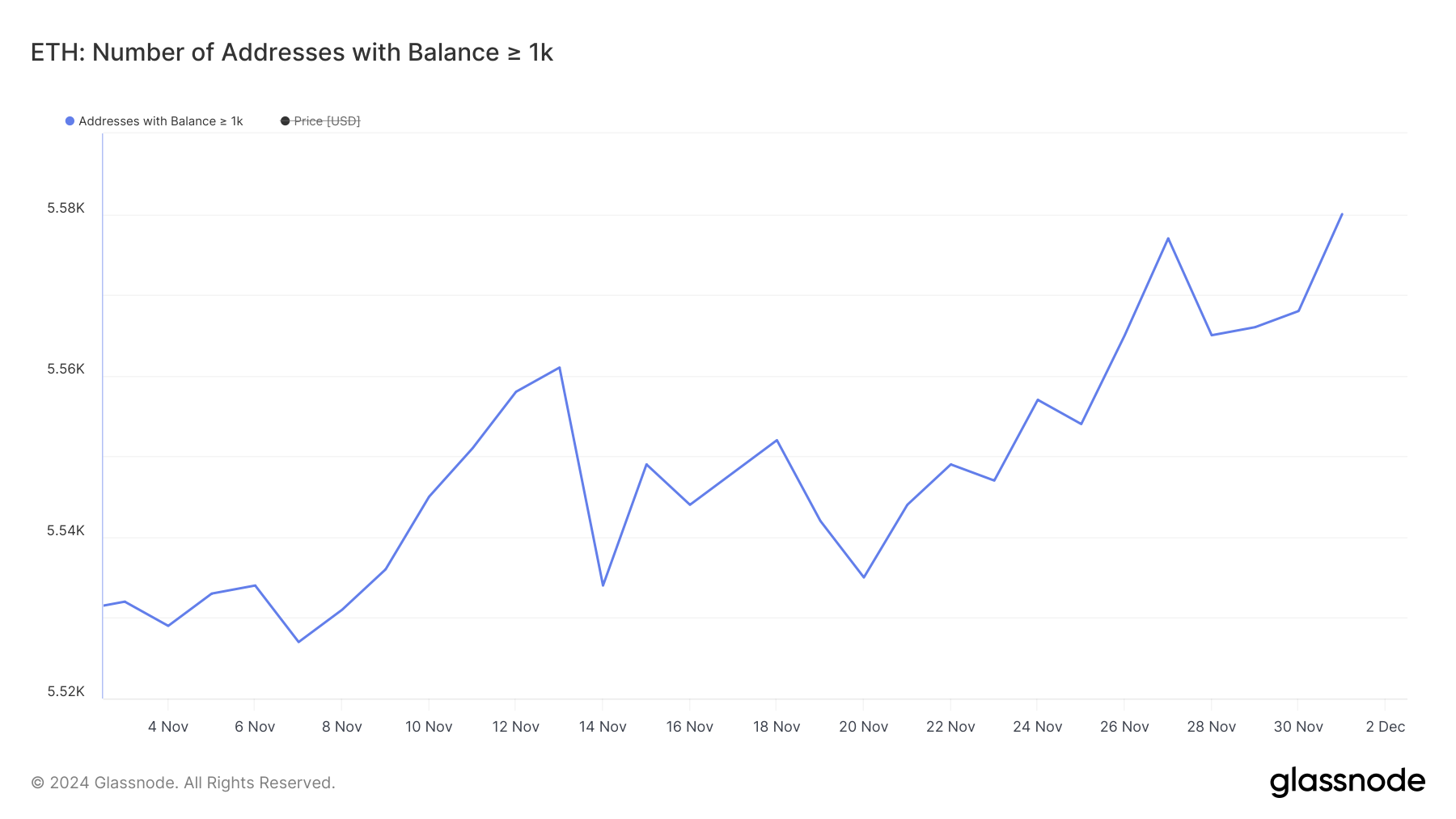

Ethereum whales started accumulating once more in the direction of the tip of November, with noticeable exercise beginning on November 20. This accumulation pattern is important, because it displays renewed curiosity from giant holders who’ve the potential to affect the market.

Such conduct typically attracts consideration from market individuals, as whale actions can point out strategic strikes based mostly on future worth expectations.

Addresses with Stability >= 1,000 ETH. Supply: Glassnode

Monitoring ETH whales is essential as a result of their holdings and buying and selling conduct can considerably influence the market. When the variety of whales will increase, as seen with an increase from 5,535 on November 20 to five,580—its highest stage since October 13—it suggests sturdy confidence amongst main gamers.

This accumulation might be bullish for Ethereum worth, as whales have a tendency to carry long-term positions, decreasing the circulating provide and creating upward strain on costs.

ETH Value Prediction: A Potential 10% Correction?

ETH’s EMA strains are at the moment bullish, with short-term averages positioned above long-term ones. Nevertheless, the value dipping beneath the shortest EMA suggests a lack of quick momentum.

This alerts warning, as it could point out a weakening of the uptrend if the value fails to recuperate shortly.

ETH Value Evaluation. Supply: TradingView

If ETH’s uptrend regains energy, it may take a look at key resistance ranges at $3,688 and $3,763. Breaking previous these factors may push ETH worth in the direction of $4,000, a worth not seen since December 2021, signaling a robust bullish reversal.

Then again, if short-term EMA strains decline additional and a downtrend varieties, ETH worth may face a correction to $3,255, representing a possible 10% pullback.