Ethereum (ETH) has fallen greater than 8% within the final 24 hours and over 22% previously 30 days, reflecting a bearish market sentiment. The value was already in decline earlier than the Bybit hack, which additional impacted market sentiment.

Though Bybit has since recovered 84% of its reserves, ETH’s value stays underneath strain. With key resistance at $2,850 and no break above $2,900 since February 2, Ethereum’s outlook stays unsure as bearish indicators proceed to dominate.

Bybit Is Recovering Its ETH Reserves After the Hack

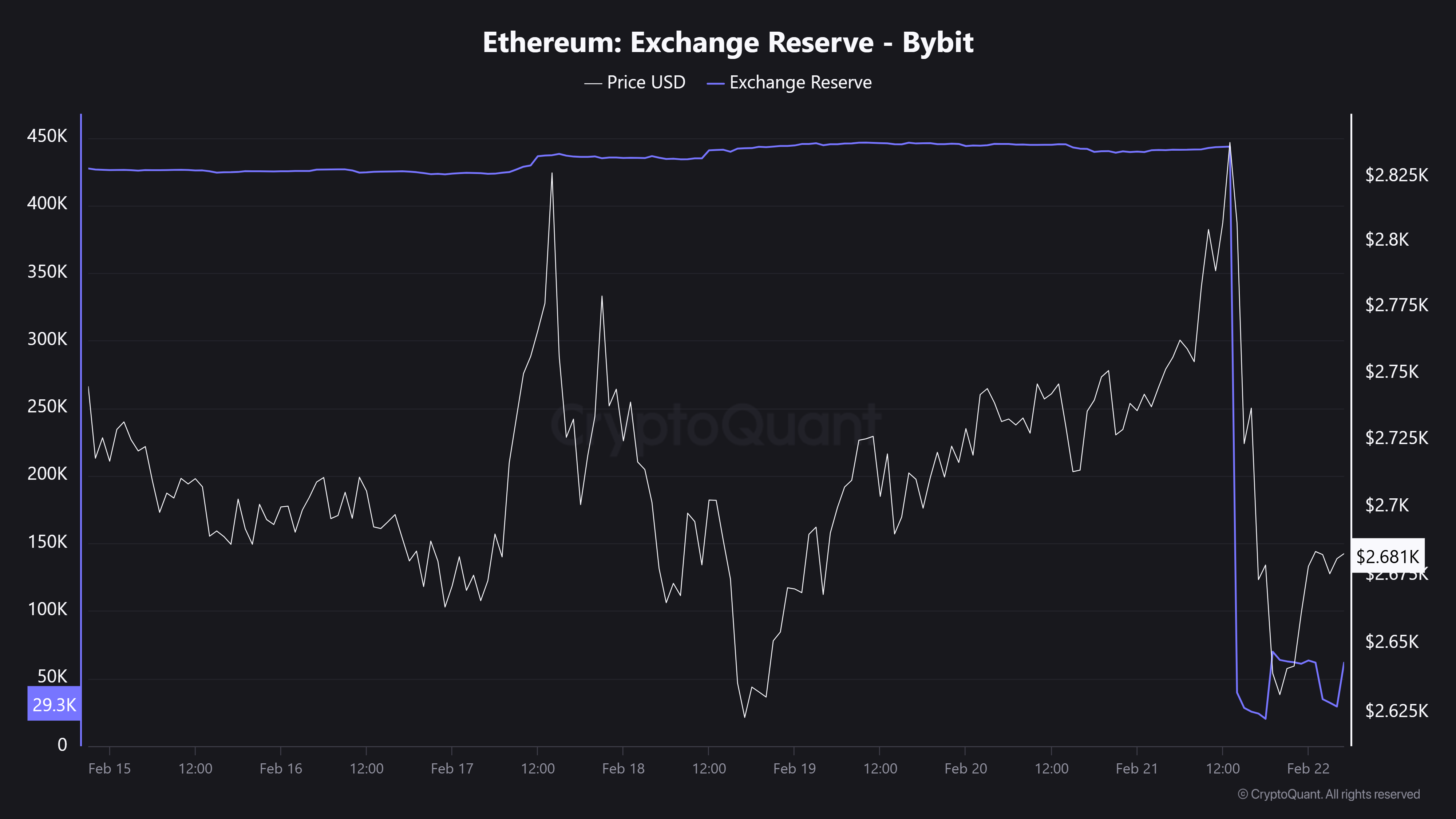

Ethereum’s provide on Bybit skilled a dramatic decline after the hack, plummeting from 443,000 ETH to simply 20,250 ETH in a single day.

This sudden drop triggered panic promoting strain on ETH and in addition on BTC and different cash, as market members feared a possible liquidity disaster.

Ethereum Reserves in Bybit. Supply: CryptoQuant.

The sharp lower in reserves heightened uncertainty, resulting in widespread hypothesis in regards to the aftermath. Some customers prompt that Bybit is perhaps pressured to purchase again ETH to revive its reserves, doubtlessly creating sturdy shopping for strain.

Since February 22, Bybit’s ETH reserves have proven important restoration, surging from 29,000 ETH to 372,000 ETH by February 24, which accounts for 84% of its pre-hack reserves.

The market’s preliminary panic promoting seems to have been non permanent, and the rebound in reserves may result in renewed shopping for curiosity in ETH. Nonetheless, Ethereum’s value has not recovered to ranges earlier than the hack but.

Indicators Present No Indicators of a Bullish Momentum

The Relative Power Index (RSI) for Ethereum was recovering after the Bybit hack, reaching 63.2 yesterday, indicating sturdy shopping for momentum.

Nonetheless, it has since dropped sharply and is now at 43, signaling a big shift in market sentiment. RSI is a momentum oscillator that measures the pace and alter of value actions, starting from 0 to 100.

Sometimes, an RSI above 70 means that an asset is overbought, indicating potential promoting strain, whereas an RSI beneath 30 signifies that an asset is oversold, doubtlessly signaling shopping for alternatives.

An RSI between 30 and 70 is usually thought of impartial, with actions inside this vary reflecting regular market fluctuations.

ETH RSI. Supply: TradingView.

Ethereum’s RSI dropping from 63.2 to 43 in simply sooner or later suggests a speedy shift from bullish to bearish sentiment. This important decline may point out elevated promoting strain or lowered shopping for curiosity, probably because of lingering considerations in regards to the aftermath of the Bybit hack.

A drop to 43 additionally brings RSI nearer to the oversold territory, which, if continued, may point out an additional bearish development. Nonetheless, if shopping for curiosity resumes, the RSI may stabilize and even rebound, suggesting a possible restoration.

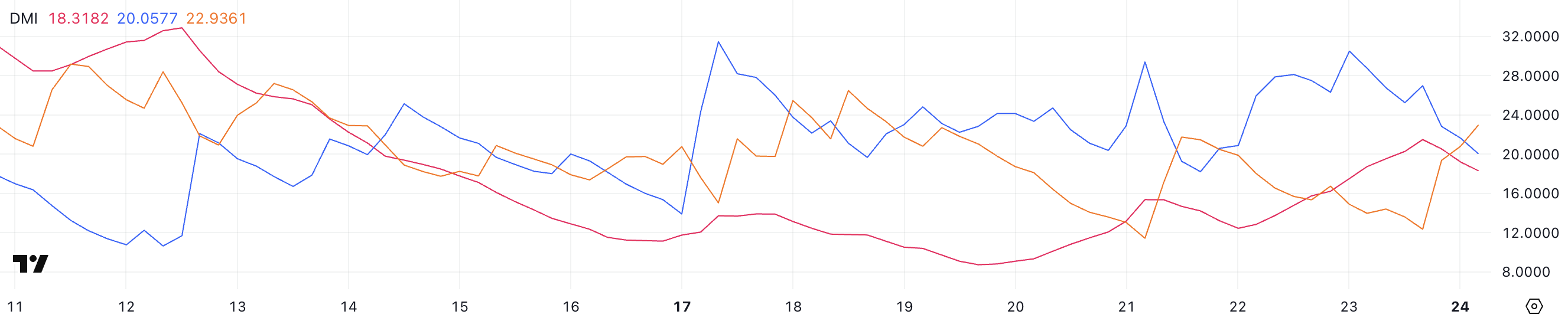

Ethereum’s DMI chart exhibits the ADX at 18.3, down from 21.4 yesterday, indicating weakening development energy. An ADX beneath 20 suggests an absence of clear momentum, aligning with Ethereum’s ongoing downtrend.

ETH DMI. Supply: TradingView.

In the meantime, the +DI dropped from 30.4 to twenty, displaying decreased shopping for curiosity, whereas the -DI rose from 12.3 to 22.9, signaling elevated promoting strain.

The crossover of -DI above +DI confirms bearish dominance, suggesting continued downward strain on Ethereum’s value.

The weakening ADX, mixed with rising -DI, factors to a declining development which will persist except shopping for momentum returns. This might lead to additional value drops or sideways motion within the quick time period

Ethereum Worth Has Been Under $2,900 For Three Weeks

Ethereum has struggled to interrupt above the $2,850 resistance, which has been repeatedly examined in current weeks. If the present downtrend continues, ETH may check the help at $2,551, and if that degree fails, it would drop additional to $2,159.

Notably, Ethereum hasn’t damaged above $2,900 since February 2, highlighting sturdy resistance on this vary.

ETH Worth Evaluation. Supply: TradingView.

Nonetheless, if Bybit efficiently restores its reserves to pre-hack ranges, this might enhance optimistic sentiment for ETH. On this state of affairs, an uptrend would possibly retest the $2,850 resistance, and if damaged, Ethereum value may rise to $3,020.

Ought to momentum proceed, the following goal can be $3,442. A break above $2,900 can be important, as ETH has struggled with this degree since early February, doubtlessly signaling a bullish reversal.