Ethereum’s (ETH) worth prediction is exhibiting indicators of a doable breakout as a number of components point out rising bullish momentum. Technical patterns and rising institutional investments recommend that Ethereum might be getting into a brand new section of development.

Ethereum (ETH) Value Chart Exhibits Bullish Sample Formation

Ethereum’s present worth motion shows a descending wedge sample, in line with latest technical evaluation. A descending wedge is usually a bullish sample that emerges after a downtrend, indicating weakening promoting stress and a possible reversal.

Supply| X

The chart reveals Ethereum consolidating between two downward-sloping trendlines, forming a narrowing vary. Analysts be aware that worth consolidation inside such a wedge typically precedes a pointy breakout. A inexperienced arrow on the chart factors upward, suggesting {that a} breakout is anticipated quickly.

Market watchers are paying shut consideration to Ethereum’s (ETH) motion close to the higher trendline. A confirmed breakout above this line, particularly with greater buying and selling quantity, would validate the bullish setup. Nevertheless, analysts warning that merchants should look ahead to doable false breakouts, the place the value quickly breaks above resistance however fails to carry.

ETF Inflows Recommend Rising Investor Confidence

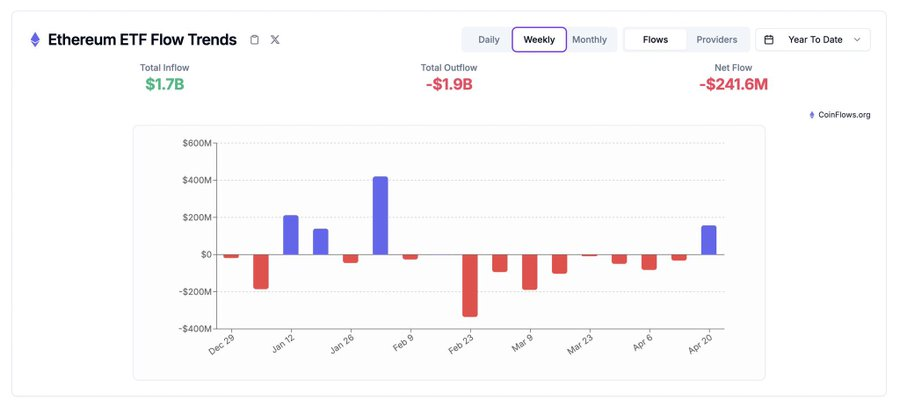

Views into investor preferences will be recognized by means of evaluation of the Weekly Ethereum ETF Circulation Tendencies chart revealed in latest occasions. Ethereum ETFs recorded a complete inflow of $1.7 billion throughout April 2025 but there was $1.9 billion in outflows which created a internet lack of $241.6 million.

Supply| X

The weekly influx throughout probably the most present interval marks the biggest since February 2025 regardless of unfavourable year-to-date internet circulation statistics. An infinite blue bar within the chart signifies the contemporary influx for Ethereum ETFs through the week ending April 20, 2025.

Ethereum ETFs suffered a steady interval of fund outflows till buyers initiated large-scale asset deposits ranging from April 2025. The substantial monetary motion appears to indicate institutional buyers switching their stance towards Ethereum in line with analysts. The crew plans to maintain monitoring upcoming weekly circulation knowledge to find out whether or not this present development sample maintains its power, thus justifying a chronic market restoration.

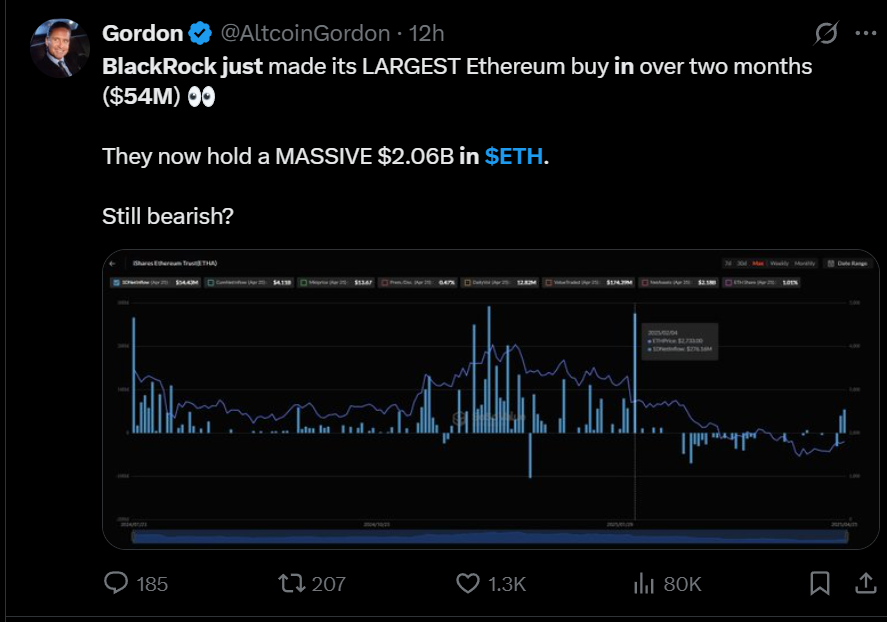

BlackRock Will increase Holdings to Over $2 Billion

BlackRock elevated its Ethereum (ETH) holdings by means of an over-the-counter (OTC) transaction value $54 million as a result of its place as one of many greatest asset administration corporations. By this latest motion, BlackRock has made its largest Ethereum buy because the earlier two months.

Supply| X

The acquisition led to BlackRock proudly owning Ethereum (ETH) value $2.06 billion. The spokesperson for BlackRock said that the corporate stays energetic in investigating potential digital asset alternatives to broaden its crypto portfolio.

Massive establishments comparable to BlackRock, together with President Trump’s sizable Ethereum portfolio, are investing by means of substantial purchases, serving to to construct stronger confidence in associated belongings. Traders typically view these actions positively after they happen throughout robust technical market setups and alongside rising ETF inflows.

Elliott Wave Analyst Suggests Ethereum (ETH) Will Transfer Towards $10,000 Value Degree

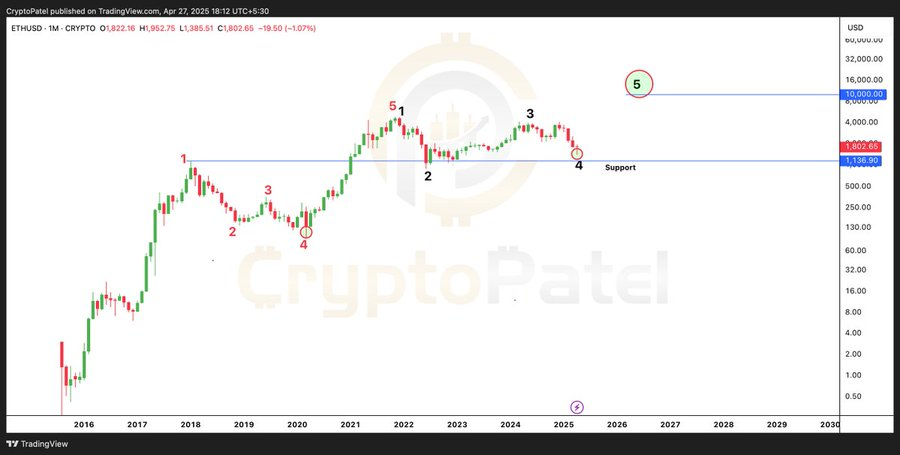

Technical crypto analyst CryptoPatel’s Ethereum worth prediction and evaluation revealed that ETH alerts the event of a 1-2-3-4-5 Elliott Wave sample throughout its worth actions. Market costs exhibit repeating wave actions beneath Elliott Wave Idea as a result of they replicate the emotional habits of buyers.

Supply| X

The diagram identifies the 5 potential waves, exhibiting waves one, two, and three and the anticipated wave 5 in an upward route. Waves 2 and 4 characterize corrective downward strikes. The mannequin from CryptoPatel signifies Ethereum might generate costs as much as $10,000 ought to Wave 5 develop efficiently.

To validate a sample throughout the Elliott Wave Idea particular retracement limits should exist between the waves and specific guidelines must be fulfilled. Analysts clarify that the goal can solely be reached if the Ethereum (ETH) worth motion follows the required wave construction.