Following an explosive multi-week rally, Ethereum value is displaying indicators of fatigue because the market reacts to resistance close to the $3,820 provide zone. Ethereum value at present is round $3,690, down 1.9% intraday, after slipping under each native VWAP and trendline help. Merchants are intently watching the $3,650 to $3,680 area, which might outline the subsequent directional transfer.

What’s Occurring With Ethereum’s Value?

ETH value dynamics (Supply: TradingView)

ETH is present process a technical rejection after a powerful vertical run from $2,800 to just about $3,820. The 30-minute chart reveals a clear break under a rising wedge construction, adopted by a bearish retest of the damaged trendline. This shift occurred proper after ETH didn’t maintain above $3,800, which aligns with key Fibonacci and provide zone resistances.

ETH value dynamics (Supply: TradingView)

The 1-day chart exhibits ETH nonetheless holding above all main EMAs. Nevertheless, the each day candle has now reduce under the higher Bollinger Band close to $3,940, which had expanded considerably through the current surge. This implies that Ethereum value volatility could start contracting, significantly if the $3,650 to $3,600 area doesn’t maintain as help.

Why Is The Ethereum Value Going Down At the moment?

ETH value dynamics (Supply: TradingView)

Why Ethereum value happening at present stems from two key pressures. The primary is a confluence of historic resistance ranges. The second is seen profit-taking from leveraged merchants. On the weekly chart, ETH touched the 0.786 Fibonacci retracement at $3,624, measured from the November 2024 to April 2025 decline, earlier than reversing decrease. This space had beforehand triggered a number of rejections, and present value motion seems to be repeating that sample.

ETH value dynamics (Supply: TradingView)

Good Cash Idea indicators verify a short-term change of character under the $3,750 area. ETH additionally failed to interrupt via the $3,820 to $3,940 provide block, which is clearly highlighted on each each day and LuxAlgo charts. This now locations draw back strain focusing on demand clusters between $3,600 and $3,500.

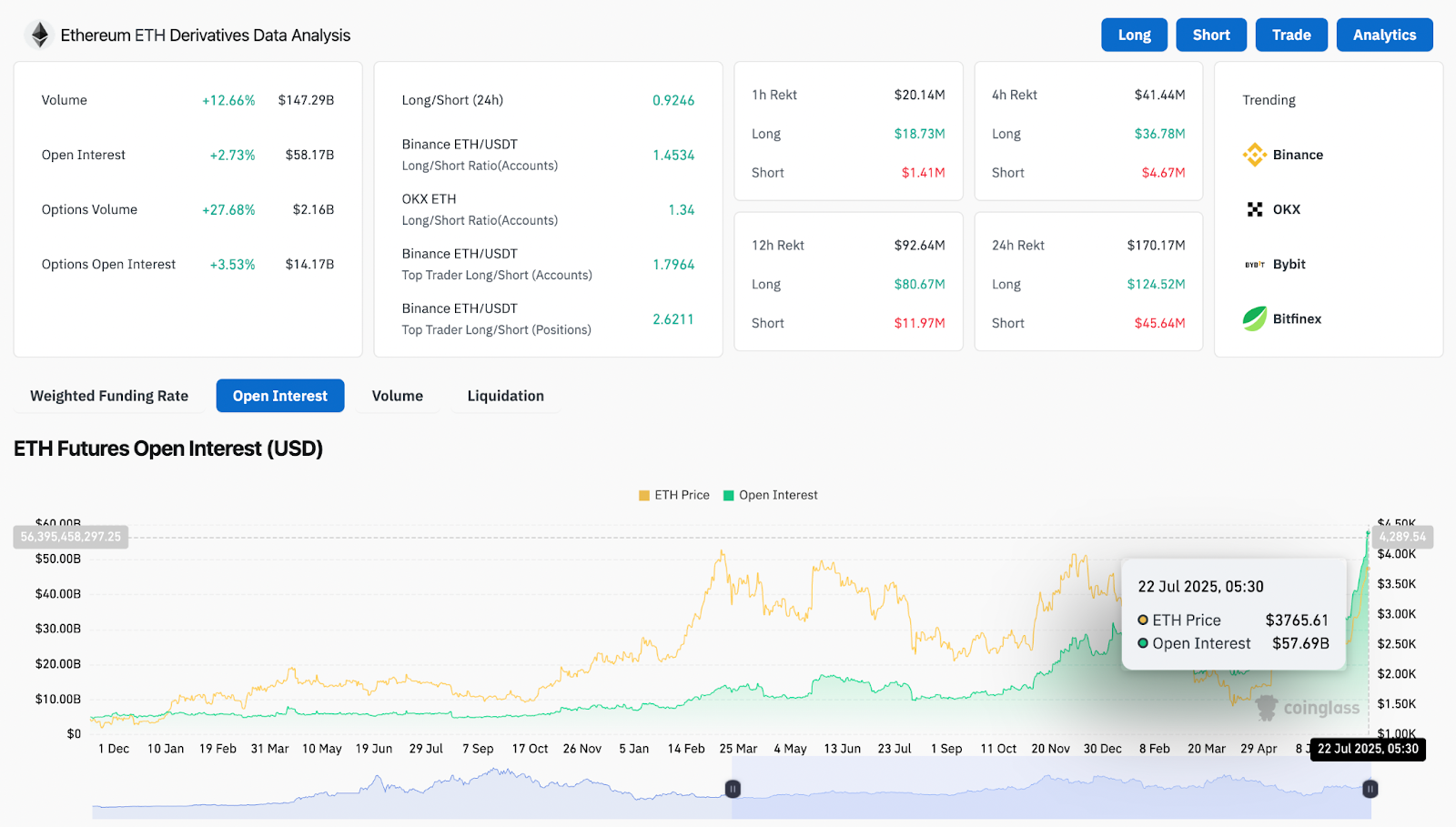

ETH Spinoff Evaluation (Supply: Coinglass)

On-chain positioning and futures information help this outlook. In line with Coinglass, Ethereum’s 24-hour quantity is up by 12.6 % to $147.29 billion, whereas open curiosity climbed solely 2.73 %. This exhibits that quantity is pushed by liquidations or revenue exits relatively than recent conviction. The Binance prime dealer lengthy to quick ratio is 2.62, indicating that longs are closely uncovered and extra weak if $3,650 fails.

EMA Construction, SAR, and VWAP Ranges Verify Breakdown Potential

On the 1-day chart, ETH has prolonged nicely above the 200 EMA at $2,582 and 100 EMA at $2,625. Nevertheless, value is now reverting towards the mid-Bollinger line round $3,065. This might act as a medium-term pullback zone if help ranges don’t maintain.

ETH value dynamics (Supply: TradingView)

Quick-term charts together with the 30-minute and 4-hour reveal a extra cautious image. The Supertrend on the 4-hour chart has not but flipped bearish, however the Parabolic SAR has already turned destructive. VWAP is being rejected on a number of candles, and value is urgent towards the decrease Bollinger Band, growing the chance of acceleration towards $3,600 or decrease.

The quick help construction lies round $3,590 adopted by $3,520. These ranges correspond to earlier breakout zones. If sellers push under them, the subsequent potential goal turns into the $3,380 to $3,400 liquidity area from mid-July.

ETH Value Prediction: Quick-Time period Outlook (24H)

At current, Ethereum value at present is correcting inside a bigger bullish development. If ETH confirms an hourly shut under $3,650, it could drop additional into the $3,590 to $3,520 zone. Deeper targets embrace $3,380 and $3,200, the place value final consolidated earlier than the current breakout.

A bounce above VWAP at $3,719 and restoration into the $3,750 to $3,780 vary could be wanted for bulls to reattempt $3,820. Nevertheless, this could require recent quantity and improved sentiment within the derivatives market.

With Parabolic SAR flipping, VWAP resistance, and lengthy publicity climbing, ETH stays weak to extra draw back except consumers strongly defend present help.

Ethereum Value Forecast Desk: July 23, 2025

Disclaimer: The knowledge offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any form. Coin Version will not be answerable for any losses incurred on account of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.