Ethereum (ETH) is underneath stress as soon as once more, dropping round 3% within the final 24 hours and falling under the $1,800 stage. This decline is placing a number of giant leveraged positions in danger, together with two huge whale vaults on Maker that collectively maintain over $235 million value of ETH.

With on-chain indicators flashing warning indicators and technical ranges being examined, the stakes are rising for each bulls and bears. As ETH hovers close to crucial assist, the approaching days might show pivotal for its short-term worth trajectory.

Ethereum Whales Might Get Liquidated

Ethereum has dropped round 3% up to now 24 hours, slipping under the $1,900 mark as soon as once more. This decline is placing stress on giant leveraged positions inside the DeFi ecosystem.

In line with on-chain information from Lookonchain, two main whale vaults on Maker—one of many main decentralized lending protocols—are actually approaching crucial ranges.

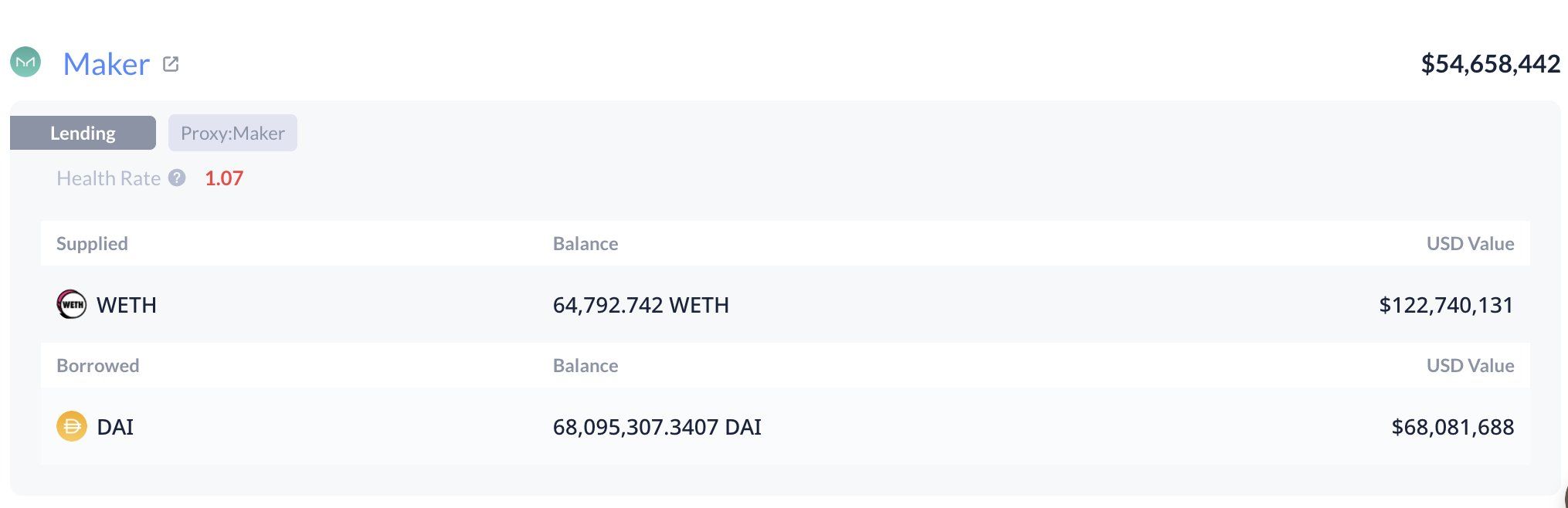

First Whale information on DeBank. Supply: Lookonchain on X.

Collectively, these vaults maintain 125,603 ETH, valued at roughly $235 million. With ETH’s worth nearing their liquidation thresholds, each vaults are liable to being forcibly closed if the downward pattern continues.

In Maker’s system, customers can deposit ETH into vaults as collateral to borrow the DAI stablecoin. To keep away from liquidation, the collateral should keep above a sure well being ratio—primarily a security buffer.

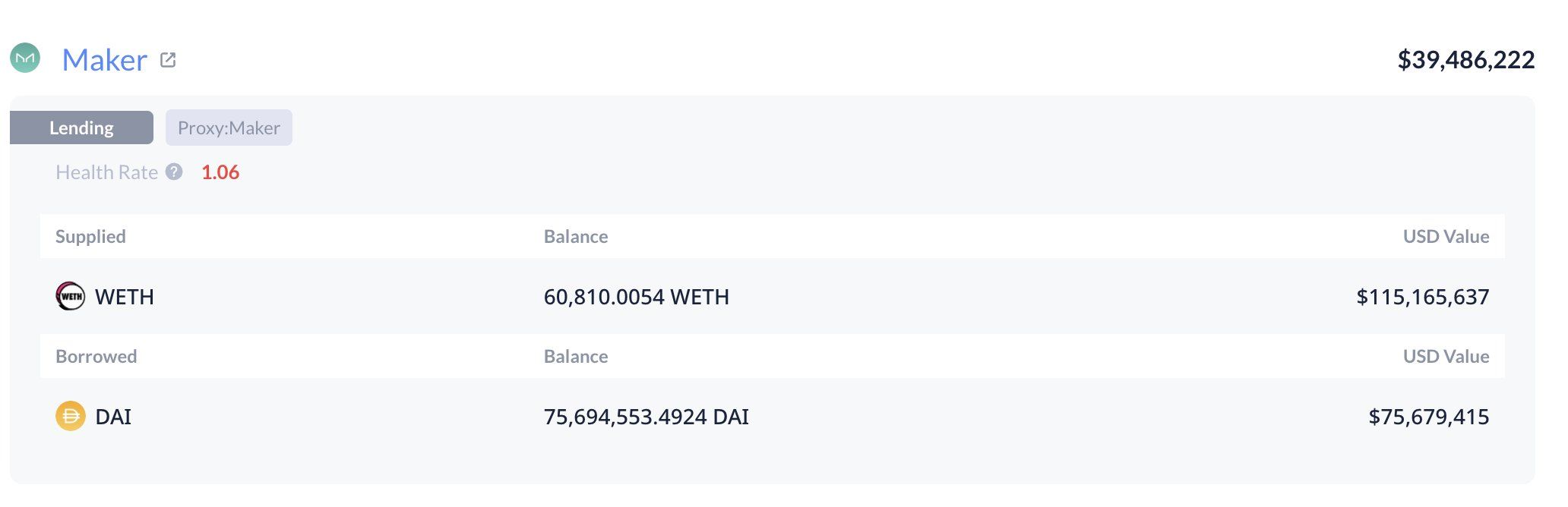

Second Whale information on DeBank. Supply: Lookonchain on X.

When that buffer will get too low, the protocol robotically sells off the collateral to cowl the debt. On this case, the well being ratio of the whale positions has fallen to simply 1.07, dangerously near the minimal threshold.

One vault faces liquidation at an ETH worth of $1,805, and the opposite at $1,787. If ETH continues to dip, these vaults might set off vital promote stress, doubtlessly accelerating the downward transfer.

Indicators Counsel The Downtrend Might Proceed

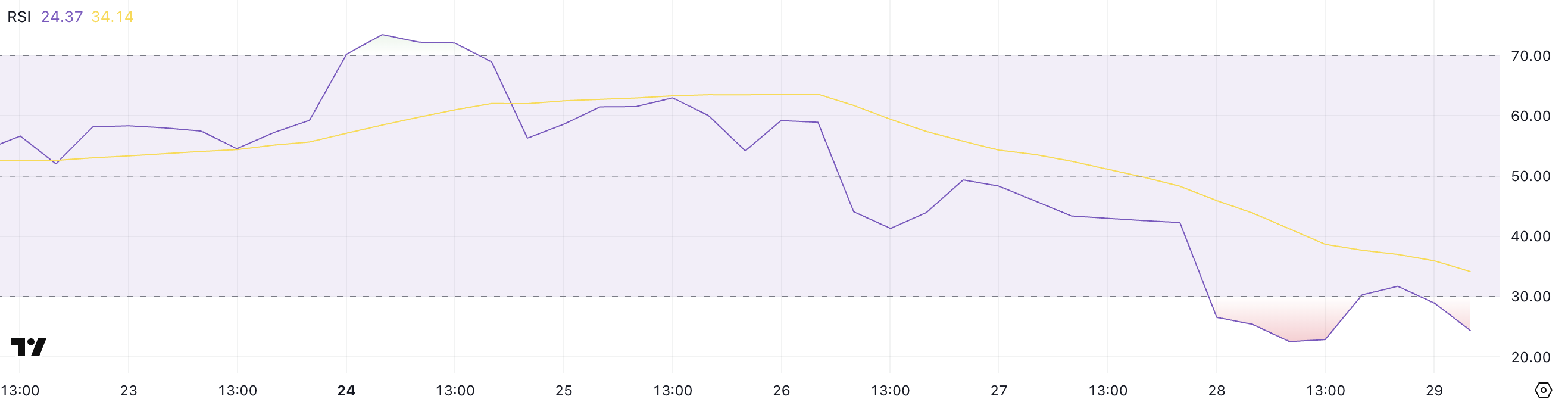

Ethereum’s latest worth drop has pushed its Relative Power Index (RSI) again into oversold territory, at the moment sitting at 24.37. Simply three days in the past, the RSI was at 58.92, indicating how rapidly sentiment has shifted.

The RSI is a momentum indicator that measures the velocity and alter of worth actions, with readings under 30 usually signaling that an asset is oversold.

ETH RSI. Supply: TradingView.

Whereas this implies that Ethereum could also be due for a short-term bounce or aid rally, historic information exhibits that RSI can stay oversold for prolonged durations—and even drop additional—if bearish momentum stays robust.

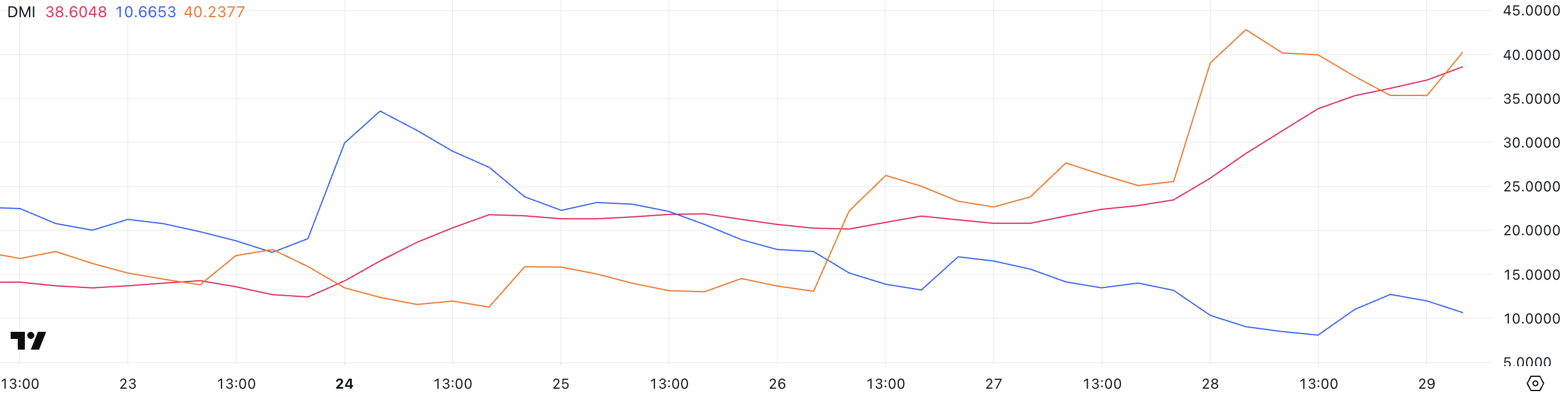

Ethereum’s Directional Motion Index (DMI), which alerts a robust downtrend, provides to the bearish outlook. The Common Directional Index (ADX), which measures the power of a pattern, surged to 38.6 from 23.47 only a day in the past, indicating rising momentum behind the present transfer.

ETH DMI. Supply: TradingView.

In the meantime, the +DI (constructive directional indicator) has fallen to 10.6, whereas the -DI (damaging directional indicator) has spiked to 40.23, exhibiting that sellers are firmly in management.

This mixture—rising ADX, excessive -DI, and falling +DI—usually suggests an intensifying bearish pattern, which means Ethereum’s worth might stay underneath stress within the close to time period regardless of already being technically oversold.

Will Ethereum Fall Beneath $1,800 Quickly?

If Ethereum’s downtrend continues, the subsequent key stage to look at is the assist at $1,823. A break under this stage might rapidly push the value down towards $1,759—a transfer that will set off the liquidation of two main whale vaults on Maker, that are already hovering close to their thresholds.

These potential liquidations might amplify promote stress, making it even more durable for Ethereum worth to stabilize within the quick time period. Given the present bearish momentum and weak technical indicators, this state of affairs stays an actual threat if bulls fail to step in.

ETH Worth Evaluation. Supply: TradingView.

Nevertheless, if sentiment shifts and the pattern reverses, Ethereum might regain floor and check the resistance stage at $1,938.

Breaking above that would open the trail towards $2,104, a stage that has beforehand acted as each resistance and assist. Ought to shopping for momentum strengthen additional, ETH would possibly proceed climbing towards $2,320 and doubtlessly even $2,546.