Ethereum (ETH) is presently dealing with downward stress, with its value dealing with a possible decline under the $3,000 mark. Other than the broader market consolidation, ETH’s present value fall is pushed by the lower in exercise from its massive buyers.

This evaluation explains why the worth decline could happen and highlights the worth factors ETH holders ought to take note of.

Ethereum Faces Selloff Strain as Whale Netflow Drops

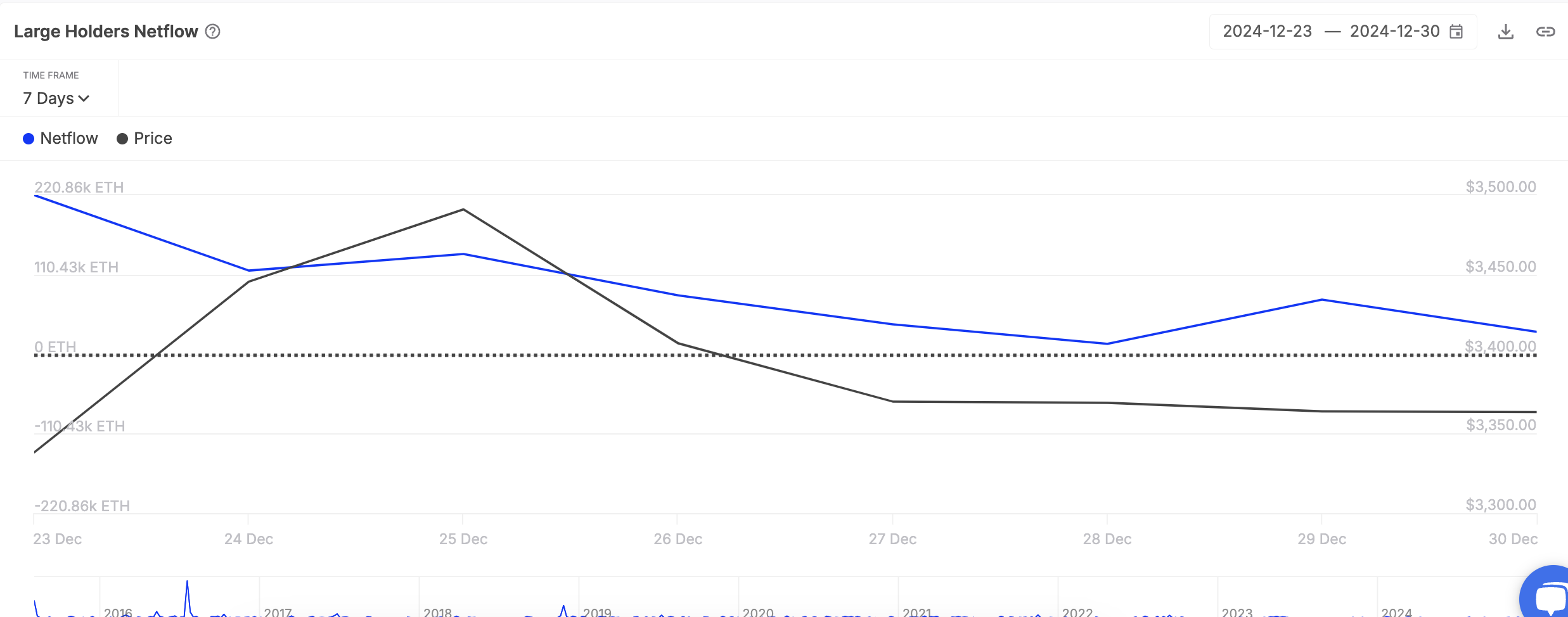

In response to IntoTheBlock, ETH’s massive holders’ netflow has plummeted by 73.19% over the previous seven days. Giant holders are whale addresses that maintain greater than 0.1% of an asset’s circulating provide.

When an asset witnesses a fall in whales’ netflow, it signifies that its large buyers are lowering their positions by promoting off or transferring property. This typically alerts a insecurity within the asset’s short-term prospects, resulting in potential downward value stress as these holders transfer their funds elsewhere.

Ethereum Giant Holders Netflow. Supply: IntoTheBlock

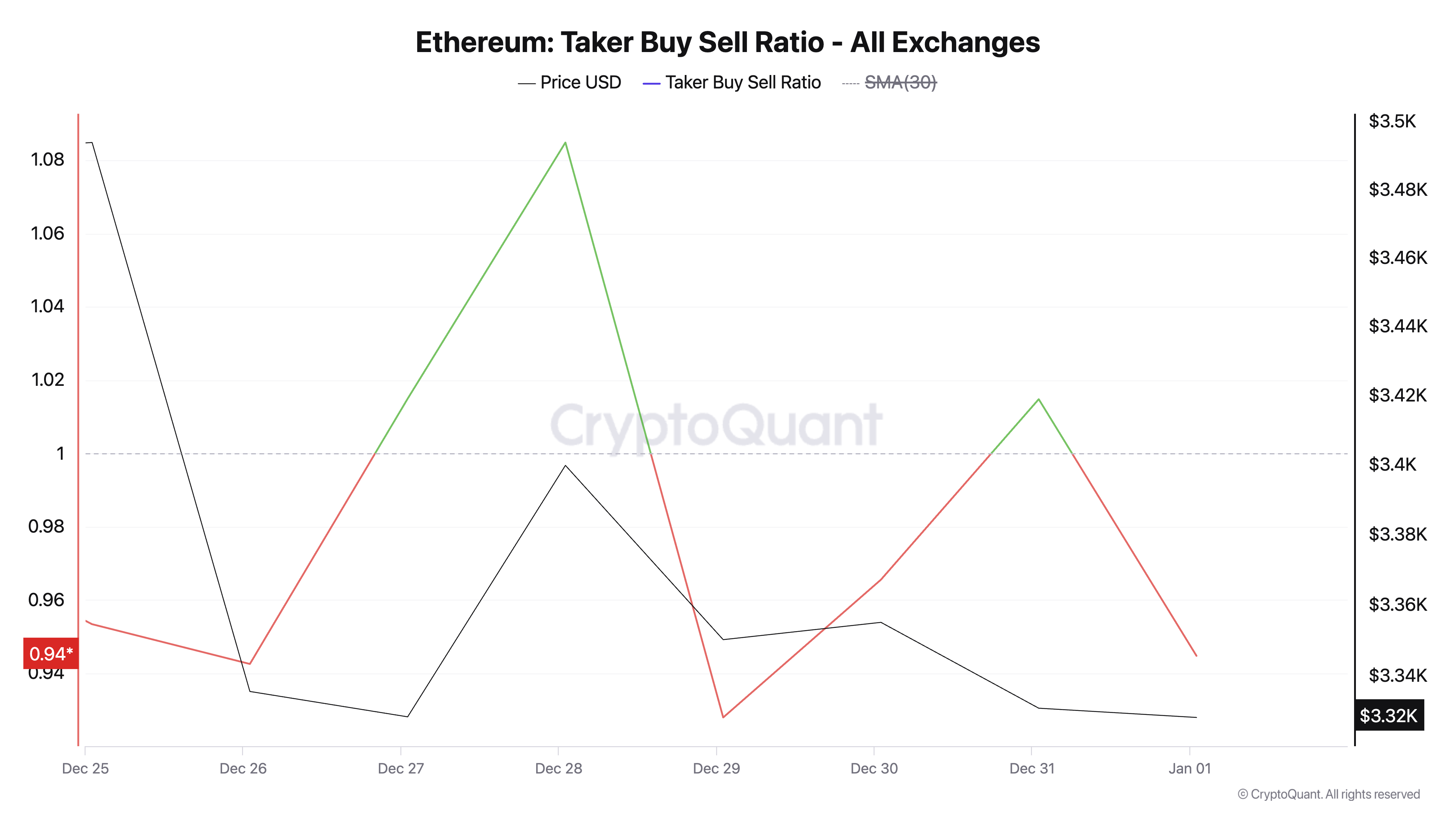

Along with lowered whale accumulation, ETH’s Taker-Purchase-Promote ratio has been predominantly lower than one up to now seven days, indicating selloffs amongst its derivatives merchants. In response to CryptoQuant, this stands at 0.94 at press time.

An asset’s Taker-Purchase-Promote ratio measures the proportion of purchase orders to promote orders executed by market takers. A ratio under one signifies that promote orders outweigh purchase orders, signaling bearish sentiment. This implies promoting stress exceeds shopping for curiosity, typically hinting at potential value declines as extra merchants exit positions than enter them.

Ethereum Taker Purchase Promote Ratio. Supply: CryptoQuant

ETH Worth Prediction: All Lies With the Whales

On the day by day chart, readings from ETH’s Transferring Common Convergence Divergence verify the drop within the demand for the main altcoin. At press time, the coin’s MACD line (blue) rests under its sign line (orange) and nil line.

This indicator helps merchants establish modifications in a development’s energy, path, and length. As with ETH, when the MACD line is under the sign line, it signifies a bearish development. If promoting stress strengthens additional, ETH’s value may fall under assist at $3,070 to commerce at $2,558.

Ethereum Worth Evaluation. Supply: TradingView

Alternatively, if market sentiment improves and ETH whales resume accumulation, they might drive the coin’s value towards $3,415.