Ethereum (ETH), the world’s second-largest cryptocurrency by market cap, is poised for large upside momentum as an knowledgeable hints at a purchase sign for the altcoin. On February 11, 2025, a distinguished crypto knowledgeable made a publish on X (beforehand Twitter), stating that ETH seems bullish. They additional famous that the TD Sequential indicator flashes a purchase sign on each each day and weekly time frames.

Primarily based on current worth motion and historic patterns, if ETH holds above the breakout space, there’s a sturdy risk it may soar by 10% to achieve the $3,000 degree within the close to future.

This shift in sentiment and up to date breakout occurred after the general cryptocurrency market started experiencing upside momentum, attracting vital consideration from merchants and buyers.

Ether Bullish On-Chain Metrics

In accordance with the on-chain analytics agency Coinglass, ETH open curiosity (OI) has jumped by 6.50%, indicating rising participation and the formation of latest positions, which helps a bullish outlook. Nonetheless, Coinglass knowledge additionally reveals that intraday merchants are presently betting strongly on lengthy positions.

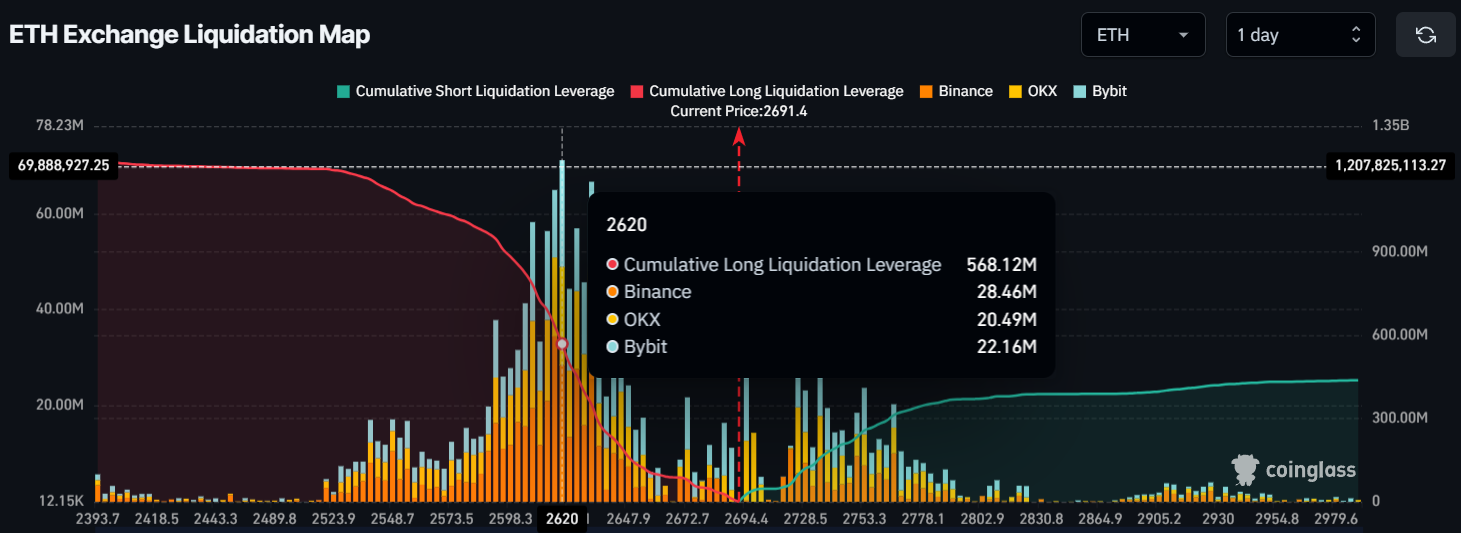

At press time, the main liquidation ranges are close to $2,620 on the decrease facet and $2,725 on the higher facet, with merchants being over-leveraged at these ranges.

If market sentiment stays unchanged and the worth rises to the $2,725 degree, almost $100 million value of brief positions might be liquidated. Conversely, if sentiment shifts and the worth drops to the $2,620 degree, almost $570 million value of lengthy positions might be liquidated.

This liquidation knowledge reveals that merchants are strongly betting on the lengthy facet, presently holding greater than 5 instances the worth in lengthy positions in comparison with brief positions.

Ethereum (ETH) Present Outlook

With rising curiosity and bullish worth motion, Ether is presently buying and selling close to the $2,685 degree, having surged over 4% previously 24 hours. Nonetheless, throughout the identical interval, its buying and selling quantity has elevated by 5%, indicating a modest rise in participation from merchants and buyers in comparison with the day before today.