Ethereum despatched blended indicators after U.S. spot ETFs posted a $96.6 million web outflow led by BlackRock promoting. On the identical time, open curiosity rose and Binance knowledge confirmed heavy bids ready between $2,700 and $2,800.

Ethereum ETFs File $96.6M Day by day Outflow as BlackRock Leads Promoting

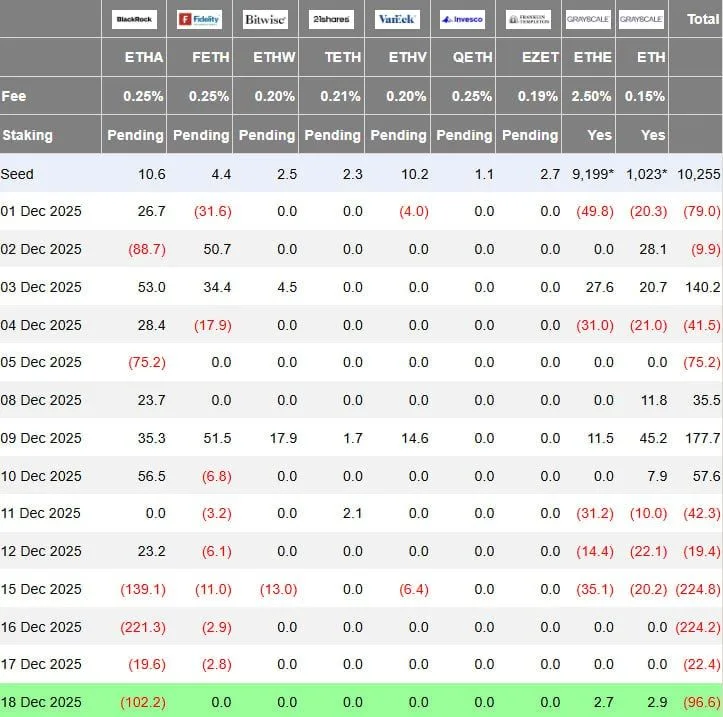

U.S. spot Ethereum trade traded funds recorded a web outflow of $96.6 million within the newest buying and selling session, based on day by day movement knowledge shared by market analysts. The figures present broad weak spot throughout the ETF advanced, with redemptions outweighing new allocations for the day.

Ethereum ETF Day by day Outflows Desk. Supply: Ted Pillows on X

BlackRock accounted for the biggest single transfer. The asset supervisor offered roughly $102.2 million value of Ethereum from its ETF product, making it the primary driver behind the general web outflow. Different issuers posted restricted exercise, which didn’t offset the dimensions of BlackRock’s promoting.

The information displays a continuation of uneven investor demand for Ethereum ETFs in December. Whereas some classes earlier within the month noticed modest inflows, current days have leaned adverse, pointing to cautious positioning amongst institutional individuals as flows stay delicate to broader market situations and quick time period worth motion.

Open curiosity climbs whereas ETH worth lags

In the meantime, Ethereum derivatives knowledge exhibits a transparent divergence between positioning and worth. Aggregated open curiosity continued to rise on main perpetual futures venues, whereas ETH worth didn’t reclaim its prior native excessive close to the $3,000 space, based on TradingView and Hyblock Capital knowledge.

Ethereum Worth and Open Curiosity Divergence. Supply: Hyblock Capital, Maartunn on X

The chart exhibits Ethereum buying and selling round $2,950 whereas open curiosity expanded to roughly $11.79 billion. That represents a notable enhance over current classes, signaling recent leverage getting into the market whilst spot worth momentum stays capped under resistance. Traditionally, rising open curiosity with out observe by way of in worth usually displays crowded positioning quite than confirmed development continuation.

This setup suggests the market is constructing strain. When open curiosity rises however worth stays vary certain or weak, the imbalance can resolve by way of elevated volatility. Merchants usually watch such situations carefully, as both a continuation transfer or a compelled unwind might observe as soon as worth breaks decisively above resistance or slips again towards decrease help zones.

Ethereum Order Guide Reveals Heavy Bid Help Close to $2,700–$2,800

Binance order guide knowledge exhibits greater than $150 million in purchase orders stacked between the $2,700 and $2,800 vary for Ethereum, based on a chart shared by market analyst Ted Pillows. The bids sit under the present buying and selling zone close to $2,950, forming a dense liquidity pocket that would act as close to time period draw back help.

Ethereum Binance Order Guide Bid Wall $2,700 to $2,800. Supply: Ted Pillows

The heatmap highlights sustained curiosity at these ranges quite than remoted orders. A number of bid layers seem unfold throughout the zone, suggesting coordinated demand as a substitute of quick time period scalping exercise. Such clustering usually displays institutional positioning or bigger gamers inserting restrict orders effectively forward of potential pullbacks.

Worth motion over current classes exhibits Ethereum rebounding after dipping towards the excessive $2,800s, whereas the bid wall stays intact. If worth retraces once more, the stacked orders may sluggish or take in promoting strain. On the identical time, failure to carry that zone would probably pressure a fast liquidity shift, as concentrated bids are inclined to outline key determination areas for the market.