Ethereum has lastly damaged a four-week streak of steady ETF outflows. The week ending February 18 recorded inflows, marking the primary signal of returning institutional demand. On the similar time, whale wallets have began accumulating once more. But long-term holders proceed promoting into each Ethereum worth bounce.

This creates a direct battle that would determine whether or not Ethereum’s worth restoration continues or stalls.

ETF Outflow Streak Ends as Whale Accumulation Begins

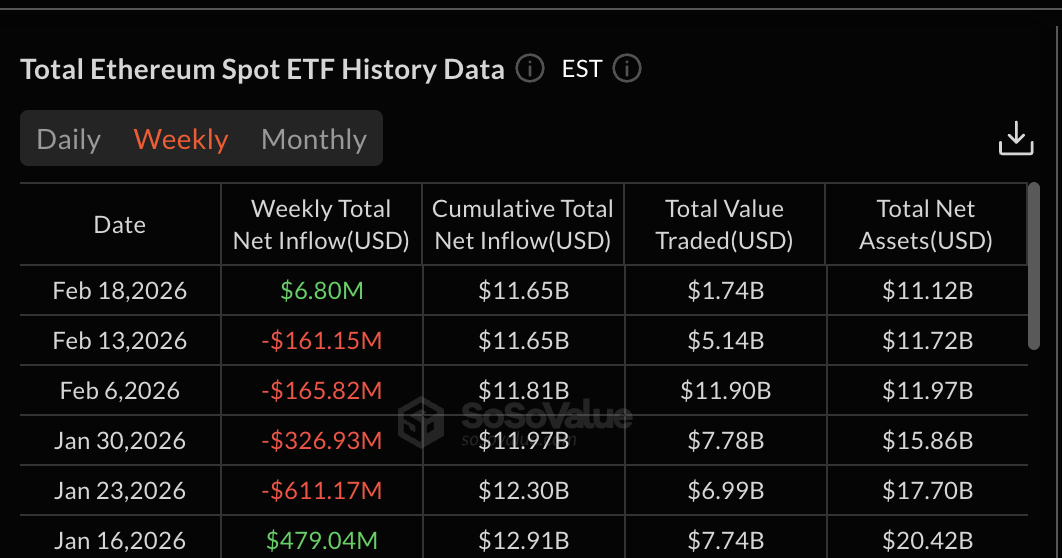

Ethereum spent 4 straight weeks beneath constant institutional promoting stress. Spot Ethereum ETFs recorded web outflows within the weeks ending January 23, January 30, February 6, and February 13. This sustained promoting mirrored weak institutional confidence and coincided with Ethereum’s broader worth decline.

That pattern has now modified. The week ending February 18 noticed a web influx of $6.80 million. This shift suggests institutional promoting stress has paused, a minimum of quickly. When ETF flows flip optimistic after prolonged outflows, it typically indicators early levels of stabilization. Nonetheless, the influx figures are nonetheless weak and never at par with the outflow energy, but.

Ethereum ETFs: SoSo Worth

Need extra token insights like this? Join Editor Harsh Notariya’s Every day Crypto E-newsletter right here.

On the similar time, whale accumulation has returned. Knowledge exhibits wallets holding giant quantities of Ethereum elevated their holdings from 113.50 million $ETH on February 15 to 113.63 million $ETH at the moment. This represents a rise of 130,000 $ETH. On the present worth, this equals roughly $253 million value of Ethereum accrued in just some days.

Ethereum Whales: Santiment

Whale accumulation throughout weak spot is necessary as a result of giant buyers typically place early earlier than broader recoveries start. Nonetheless, this rising optimism faces resistance from one other group of buyers.

Ethereum Worth Flashes Bullish Divergence, However Lengthy-Time period Holders Proceed Promoting

Ethereum’s 8-hour chart exhibits a key momentum sign that has traditionally preceded worth bounces.

Between February 2 and February 18, Ethereum’s worth shaped a decrease low. This implies the worth dropped beneath its earlier assist stage. However throughout the identical interval, the Relative Power Index (RSI) shaped a better low. The RSI measures shopping for and promoting energy and this sample is named bullish divergence.

This sign has already confirmed efficient twice earlier this month. The primary bullish divergence shaped between February 2 and February 11. Ethereum’s worth then rallied 11%. The second divergence appeared between February 2 and February 15. This led to a different 6% restoration.

Bullish Divergence Noticed: TradingView

Each these $ETH bounces occurred whereas ETF outflows have been nonetheless ongoing, exhibiting that consumers have been already trying to regain management. Now, ETF inflows have returned, and whales are accumulating. This will increase the likelihood that one other bounce try may occur.

Nonetheless, long-term holders are shifting in the other way. The Hodler Web Place Change measures whether or not long-term holders are accumulating or promoting. A damaging worth means long-term holders are distributing their holdings.

On February 17, long-term holders offered 34,841 $ETH over the rolling 30-day interval. By February 18, that quantity elevated to 38,877 $ETH. This represents a pointy improve in promoting stress in simply sooner or later, at the same time as bullish divergence indicators appeared.

Holders Hold Promoting: Glassnode

This exhibits long-term holders are utilizing worth energy to exit positions. The identical habits was seen throughout earlier February rallies. Each earlier bounces did not maintain upward momentum as a result of long-term holder promoting capped the restoration.

This creates a transparent battle. Whale accumulation and ETF inflows assist restoration, whereas long-term holder promoting limits upside potential, hinting at a transparent danger. This battle is now mirrored instantly in Ethereum’s worth construction.

Triangle Sample Reveals Crucial Ranges

Ethereum is at the moment buying and selling inside a symmetrical triangle sample on the 8-hour chart. This sample kinds when the worth strikes between converging assist and resistance strains.

A symmetrical triangle represents steadiness between consumers and sellers. In Ethereum’s case, consumers embody whales and institutional buyers returning via ETF inflows. Sellers embody long-term holders distributing their positions.

This steadiness explains why Ethereum stays caught in consolidation.

The primary key resistance stage sits close to $2,030. This stage stopped the earlier restoration try. A profitable transfer above this stage would sign strengthening momentum and likewise affirm the triangle breakout. The following main resistance stands at $2,100, one other bounce blocker. Breaking this stage would affirm a stronger restoration and will open the trail larger.

Ethereum Worth Evaluation: TradingView

Nonetheless, draw back dangers stay. Instant reclaim stage sits at $1,960. Failure to carry this stage may push Ethereum all the way down to $1,890. A deeper decline may prolong towards $1,740 if promoting stress accelerates.

The submit Ethereum ETFs Break 4-Week Outflow Streak — Can $ETH Worth Lastly Get better? appeared first on BeInCrypto.