Ethereum continues to undergo from extraordinarily low market exercise, with its worth exhibiting minimal volatility – a regarding bearish sign.

This stagnant conduct will increase the probability of sellers pushing the cryptocurrency under the essential $1.5K help stage within the coming weeks.

By Shayan

The Each day Chart

Ethereum continues to hover above the essential $1.5K help area, a long-standing psychological and structural stage that has held since January 2023. Nevertheless, the market presently reveals extraordinarily low exercise, with the worth consolidating in a muted, sideways method. This lack of volatility and momentum suggests a state of uncertainty, with neither patrons nor sellers displaying dominance.

Such situations typically precede vital strikes, because the market builds up power awaiting new provide or demand. From a technical standpoint, bearish sentiment dominates the present worth motion. Ought to renewed promoting strain emerge, a decisive break under the $1.5K mark might set off a cascade towards the $1.1K stage.

Nonetheless, a short-term corrective retracement towards the $1.8K resistance zone stays a chance earlier than sellers mount one other try and breach the $1.5K help. The approaching days are essential, as worth motion round this stage will doubtless dictate the route of Ethereum’s subsequent main pattern.

The 4-Hour Chart

On the 4-hour timeframe, Ethereum’s tight-range consolidation is clearly seen. The worth is presently trapped between the $1.5K help and the higher boundary of the descending channel at $1.6K, reflecting a market in equilibrium. This steadiness suggests hesitation from each patrons and sellers.

A breakout from this slim vary can be pivotal. If Ethereum manages to breach the $1.6K higher boundary, a short-term rebound towards $1.8K might materialize.

Conversely, a breakdown under the $1.5K stage will doubtless spark a major downward transfer, probably driving the worth towards $1.1K within the mid-term.

By Shayan

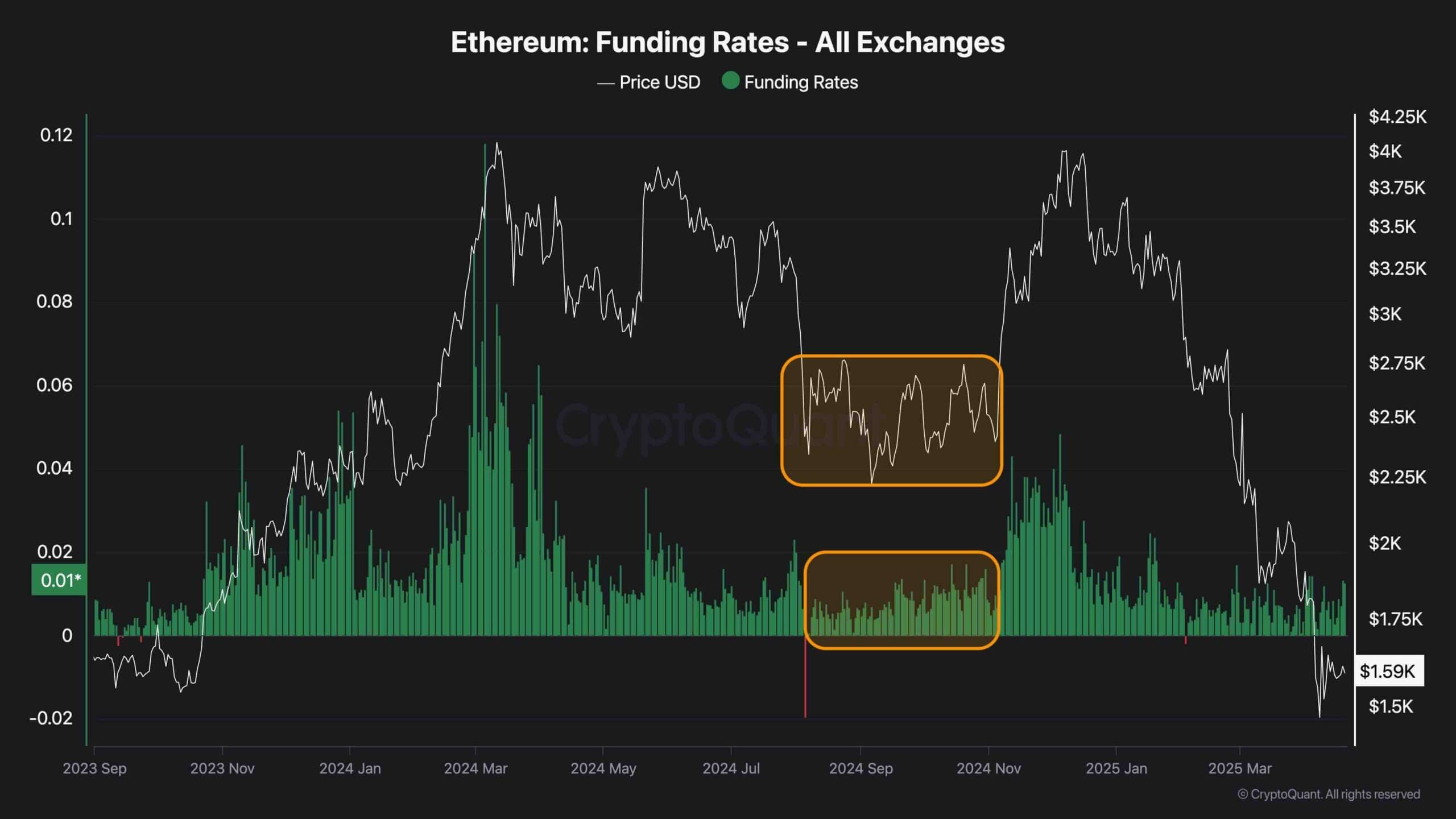

The funding charges metric serves as an important indicator of sentiment within the futures markets. Analysing its latest behaviour presents key insights into Ethereum’s potential subsequent strikes. Notably, each the worth and the funding charges have been mirroring the patterns noticed throughout the September to November 2024 interval, a section marked by extended consolidation and deep corrections that finally preceded a robust bullish rally.

Such market situations typically mirror sensible cash accumulation, as knowledgeable buyers reap the benefits of panic-driven promoting and widespread distribution amongst retail members. At present, funding charges have dropped to near-zero values and are consolidating, suggesting that the market might as soon as once more be coming into an accumulation section.

Nevertheless, it is very important word that inside such phases, additional draw back stays doable. The worth might dip decrease earlier than a significant rebound happens, providing much more engaging ranges for accumulation by long-term buyers.