Ethereum’s spot worth hovered at $3,087 per coin on Saturday, whereas derivatives merchants quietly stacked threat throughout futures and choices markets. The info exhibits leverage constructing whilst worth motion stays uneven, a setup that has a behavior of punishing crowded positions.

Ethereum Futures and Choices Sign Dealer Pressure Close to $3,100

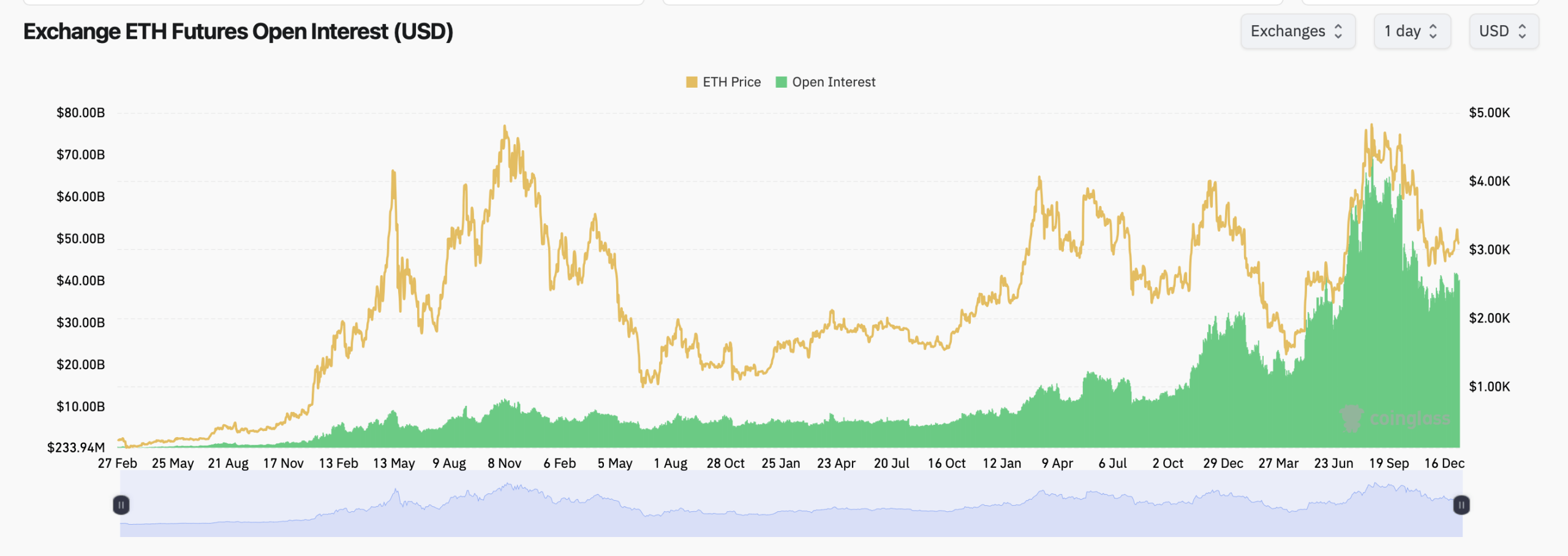

Ethereum futures open curiosity climbed to 13.01 million ETH, representing roughly $40.22 billion in notional worth throughout main exchanges. Regardless of minor pullbacks prior to now hour and four-hour home windows, open curiosity posted a 0.69% improve over 24 hours, signaling that merchants are including publicity reasonably than stepping away.

Binance stays the heavyweight in ethereum futures, controlling 22.62% of complete open curiosity, or about $9.10 billion. CME follows with $5.86 billion, a notable determine that highlights continued institutional participation. Gate, Bybit, OKX, and Bitget spherical out the highest tier, every carrying multi-billion-dollar positions that collectively hold leverage elevated.

Ethereum futures open curiosity by way of Coinglass on Jan. 10, 2026.

Brief-term market motion appears to be like uneven. Most exchanges recorded small one-hour and four-hour declines in open curiosity, suggesting tactical de-risking. Nonetheless, the broader 24-hour image tells a distinct story, with Gate posting a 4.34% bounce and OKX rising 2.47%, indicating selective accumulation reasonably than panic exits.

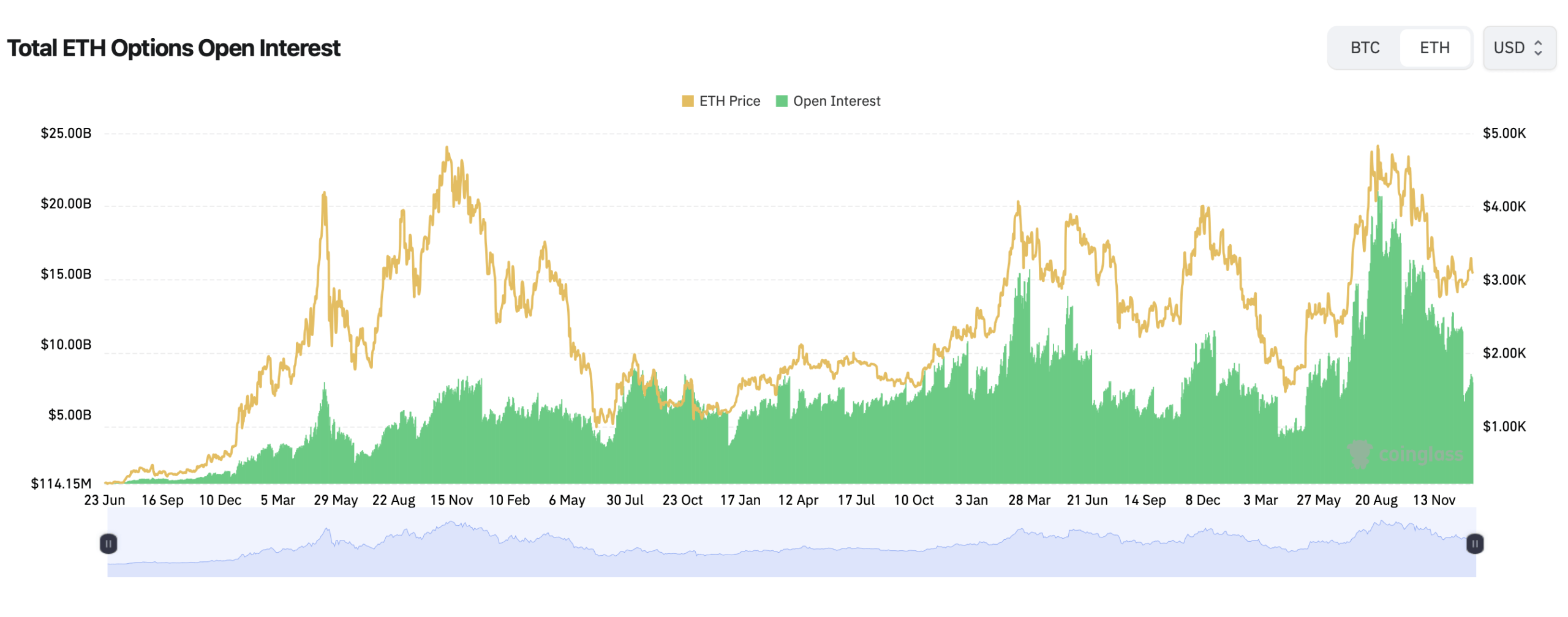

Choices markets lean decisively towards optimism. Complete ethereum choices open curiosity exhibits calls accounting for 60.40%, in contrast with 39.60% in places, translating to roughly 1.29 million ETH in calls versus 843,794 ETH in places. Quantity over the previous 24 hours echoes that bias, with calls making up 52.83% of traded contracts.

Ethereum choices open curiosity by way of Coinglass on Jan. 10, 2026.

Probably the most crowded choices strikes sit far above spot. On Deribit, the biggest open curiosity contracts embody ETH-$6,500 calls expiring March 27 and $5,500 calls expiring March 27 and June 26, suggesting merchants are betting on prolonged upside later within the 12 months reasonably than rapid fireworks.

But the max ache information provides a twist. On Deribit, ethereum’s max ache stage clusters close to $3,100, uncomfortably near the present spot worth. Binance and OKX present related profiles, with max ache curves dipping towards the $3,000–$3,100 vary, a zone that traditionally acts like a magnet as expiration approaches.

Additionally learn: ‘Working Bitcoin’: BTC Holds $90K on seventeenth Anniversary of Hal Finney’s Iconic Tweet

That rigidity creates an ungainly standoff. Futures merchants are including leverage, choices merchants are loading calls, and max ache quietly lurks under the most well-liked bullish strikes. It’s the type of setup the place persistence, not bravado, normally wins.

Traditionally, durations the place futures open curiosity rises sooner than spot worth are inclined to precede sharper strikes. Course is rarely assured, however crowded positioning reduces the margin for error. When everybody leans the identical means, the market has a behavior of testing resolve.

For now, ethereum derivatives markets replicate conviction with out affirmation. Leverage is constructing, optimism is seen, and threat stays finely balanced close to a psychologically charged worth stage. Whether or not merchants get rewarded or rinsed will depend upon who blinks first.

FAQ ❓

- What’s ethereum futures open curiosity proper now?

Ethereum futures open curiosity stands at roughly $40.22 billion throughout main exchanges. - Are ethereum choices merchants extra bullish or bearish?

Choices information exhibits a bullish tilt, with calls making up about 60% of open curiosity. - The place is ethereum’s max ache stage?

Max ache clusters close to the $3,000–$3,100 vary on Binance, OKX, and Deribit. - Which trade dominates ethereum futures buying and selling?

Binance leads with greater than 22% of complete ethereum futures open curiosity.