Ethereum’s on-chain exercise is heating up, and worth motion tends to comply with this rising engagement. Rising energetic addresses point out that current customers are interacting with the community extra continuously, whereas the surge in new addresses displays a gradual inflow of contemporary contributors.

These metrics counsel that ETH progress is being pushed by real utility, quite than pure hypothesis. If these day by day transactions persist, ETH could possibly be getting into a brand new section the place fundamentals and market sentiments start to align, because the ETH engine runs hotter than ever.

Is Ethereum Positioning For Market Management?

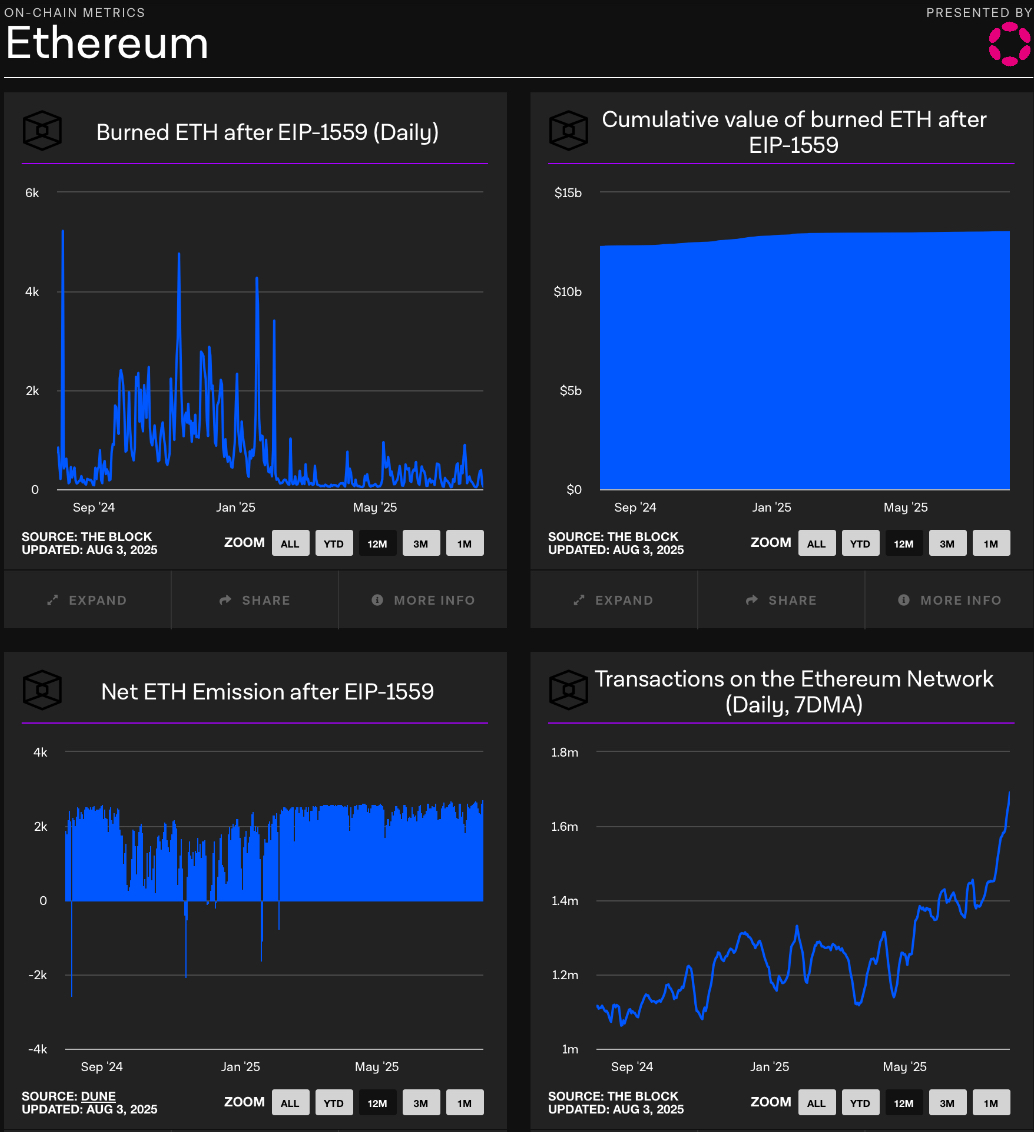

Ethereum on-chain exercise is quietly however decisively gaining momentum. In response to Cas Abbe’s put up on X, ETH’s day by day transactions have now climbed to their highest ranges in additional than a yr, which is an indication that community utilization isn’t just holding regular, but additionally accelerating.

Information shared by the knowledgeable reveals that the variety of day by day transactions stands at about 1.7 million. This surge in exercise means that ETH’s fundamentals are strengthening, even when worth motion hasn’t absolutely mirrored it but.

Presently, extra customers are participating with the ETH community, as each energetic addresses and new addresses development sharply upward. That is greater than short-term buying and selling noise; it’s an indication of actual adoption and sustained community utilization.

Whereas day by day transactions have spiked, the EIP-1559 improve has continued to behave as a quiet and highly effective drive in Ethereum’s economics by completely eradicating ETH from circulation over time, resulting in a tightening provide. Regardless of latest market volatility, Cas Abbe highlighted that the web ETH emissions stay close to impartial, which signifies that the ETH provide dynamics have gotten more and more tight.

This mixture of rising community utilization and restricted web provide is a strong market sign. It reveals that ETH momentum isn’t being pushed by short-term hype, however by real, sustained demand for block house and the service constructed on its community, and long-term fundamentals.

Might Strategic Accumulation Mark The Begin Of A New Bull Section?

Ethereum continues to expertise notable progress in a number of key areas. Latest studies revealed that ETH’s strategic reserve has exploded in dimension over the previous few months, signaling a dramatic shift in market positioning.

An analyst often known as Crypto Patel acknowledged on X that again in April, the ETH strategic reserve stood at round $200 million. In the meantime, at this time, the reserve has surged to an astonishing $10 billion, which displays a 50% enhance in simply 4 months.

The sharp progress within the ETH strategic reserve is greater than only a massive quantity; it’s a transparent sign of sturdy accumulation and deep long-term confidence within the ETH community’s future. It additionally suggests staking progress and large-scale capital repositioning forward of ETH’s subsequent potential catalysts.

Featured picture from iStock, chart from Tradingview.com