Ethereum’s value drop to $2700 exposes deeper points as community exercise stays weak for almost two years.

DeFi and NFT utilization keep muted regardless of decrease charges, dragging Ethereum’s general community earnings downward.

10x Analysis warns ETH valuation now is determined by actual blockchain utilization, not hypothesis alone.

Ethereum is as soon as once more below strain, as ETH dropped to $2,700, an 8% within the final 24 hours. However, it’s not simply the value chart that’s worrying merchants. In response to 10x Analysis, Ethereum’s largest drawback is its personal community exercise, which has stayed weak for almost two years.

With fewer customers, decrease charges, and quiet DeFi exercise, the Ethereum community is just not incomes the best way it used to.

And now, this weak demand is now elevating questions on how ETH must be valued going ahead.

ETH Exercise Has Fallen, Even With Decrease Charges

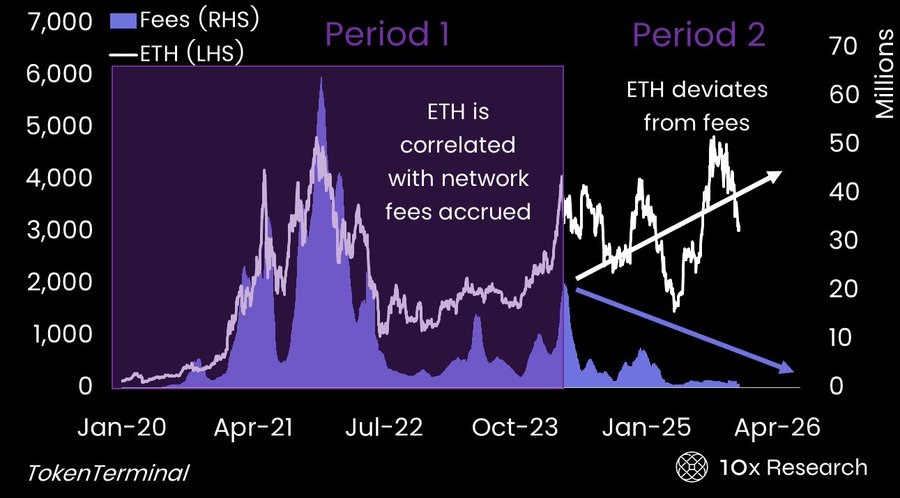

ETH has all the time been strongly linked to community demand. In 2020–2021, folks rushed into DeFi, NFTs, staking, and crypto gaming, which pushed ETH charges very excessive. These excessive charges helped ETH keep sturdy even when the market was weak.

However since mid-2024, issues have gone in the wrong way.

Despite the fact that charges at the moment are cheaper and lots of customers have moved to Layer-2 networks like Arbitrum, Optimism, and Base, exercise on Ethereum’s most important community has not picked up.

DeFi utilization remains to be weak, NFT buying and selling is a fraction of what it was once, and general payment era has dropped sharply.

It’s now been nearly two years of weak community demand, and that weak spot is clearly exhibiting in ETH’s value as we speak.

Web Inflation Is Rising Once more

Ethereum was anticipated to grow to be “deflationary,” burning extra ETH than it creates. However within the final three years,

- 4.2 million ETH issued within the final 3 years

- Solely 3.5 million ETH had been burned

Which means Ethereum has grow to be internet inflationary, primarily as a result of the burning shouldn’t be sufficient to cancel new provide.

Can Ethereum Value Get well?

In response to 10x Analysis, value restoration is determined by actual utilization, not simply hype. Two issues may pull ETH again up:

Nonetheless, 10x Analysis notes two doable paths ahead that would push ETH value up.

- First the regulatory readability in the USA, unlocking institutional DeFi participation

- Secondly, a brand new wave of Web3 exercise, which may carry again increased charges and stronger utilization.

Till then, the market could proceed to deal with Ethereum like a speculative asset moderately than a productive community.