Since early August, Ethereum has sustained its lead in spot buying and selling quantity over Bitcoin, and the development continues.

Abstract

- Spot Ethereum buying and selling quantity has persistently outpaced BTC

- The development means that merchants are rotating into altcoins

- Fed’s anticipated charge cuts gas bullish altcoin outlook

Bitcoin has lengthy been the undisputed chief in market liquidity. Nevertheless, as BTC trades close to its document highs, buyers are slowly rotating into altcoins, and Ethereum is the first beneficiary. As of September 11, Ethereum is main in spot buying and selling quantity, a development that has continued since early August. Notably, that is the primary time Ethereum has flipped BTC on this metric in seven years.

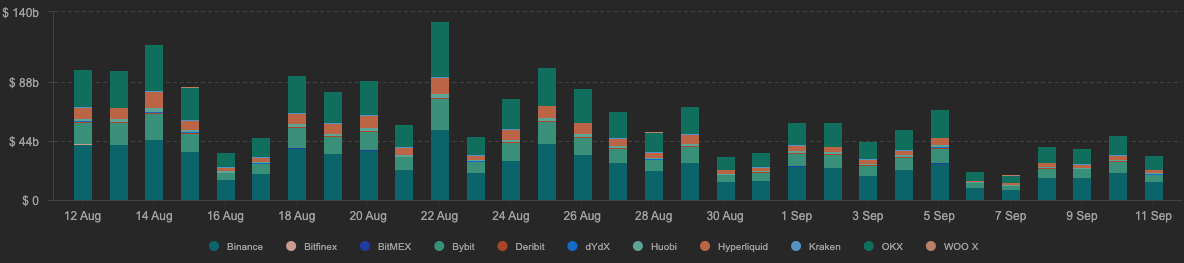

Ethereum each day spot buying and selling quantity | Supply: Coinalyze

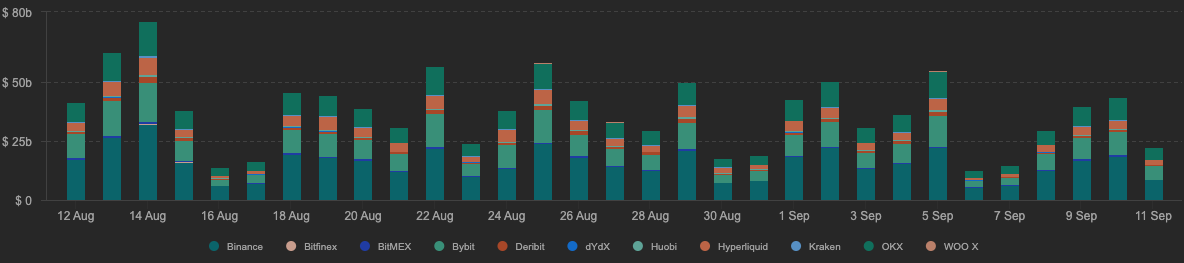

Bitcoin each day spot buying and selling quantity | Supply: Coinalyze

From early August to September 9, Ethereum’s (ETH) buying and selling quantity was at 32.9%, based on CryptoRank. On the identical time, that determine for Bitcoin (BTC) was 32.6%. What’s extra, this development continued, and Ethereum’s spot buying and selling quantity reached $48 billion on September 10, in comparison with $43 billion for BTC.

You may also like: Bitcoin worth prediction: $10K swing on chart sample imminent?

ETFs present Ethereum and Bitcoin diverging

Ethereum’s rise in spot quantity coincided with a divergence of Ethereum and Bitcoin spot ETF flows. Notably, based on VanEck, Ethereum ETFs pulled $4 billion in inflows in August, whereas Bitcoin ETFs skilled outflows.

The probably motive for this divergence is rising danger urge for food amongst buyers. Bitcoin is close to its all-time excessive ranges, whereas buyers anticipate that the Federal Reserve will decrease rates of interest. On this surroundings, buyers are keen to take riskier bets that probably supply larger returns.

For that reason, Ethereum merchants are testing the $4,400 to $4,500 resistance zone whereas buying and selling above $4,200. Presently, these are vital ranges for the coin. Passing this zone could lead on the coin to $5,000, whereas a collapse beneath help could lead on it beneath $4,000.

Learn extra: Bitcoin worth breaks $114,000 as $757M in ETF inflows observe indicators of cooling U.S. inflation