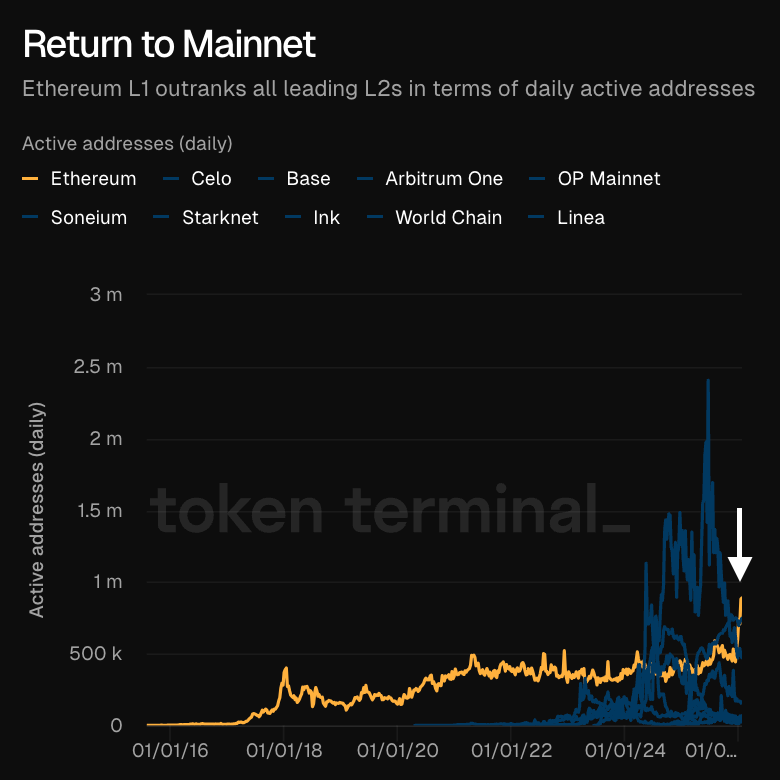

Ethereum, the good contract blockchain, now handles extra every day exercise than its cheaper facet chains, known as Layer -2 networks. However this comeback has a catch – not all of that Ethereum exercise seems to replicate real person demand.

The variety of every day energetic addresses on Ethereum climbed towards the 1 million mark earlier this month, briefly peaking above 1.3 million on Jan. 16 earlier than settling nearer to 950,000, in accordance with knowledge supply Token Terminal.

That places Ethereum forward of fashionable scaling networks comparable to Arbitrum, Base and OP Mainnet, reversing a lot of the narrative that customers had completely migrated off L1.

Lively addresses are the distinctive blockchain wallets that make transactions, like sending, receiving cryptocurrencies, or interacting with good contracts, in a given time interval, for instance every day. Analysts observe the metric to review the actual community utilization past the token worth hype.

Layer 2 scaling networks are like facet roads or categorical lanes constructed on prime of the primary blockchain freeway, Ethereum. These sidechains deal with tons of transaction site visitors shortly and cheaply off the primary chain, after which talk the ultimate tally again to the primary chain for safety.

The rebound in Ethereum exercise follows December’s Fusaka improve, which sharply decreased transaction charges and made it cheaper to transact straight on Ethereum once more. Decrease prices have helped revive on-chain exercise, notably for stablecoins, which stay the dominant use case for day-to-day transfers.

At face worth, the numbers counsel a “return to mainnet” second. However analysts warning that uncooked deal with counts will be deceptive, particularly when charges fall far sufficient to make spam economical.

Deal with poisoning muddies the image

Think about spam calls flooding your telephone. your name log appears to be like busy, however most are junk, not actual conversations. One thing comparable has been occurring on Ethereum, as a good portion of January’s deal with progress is tied to deal with poisoning assaults slightly than natural adoption.

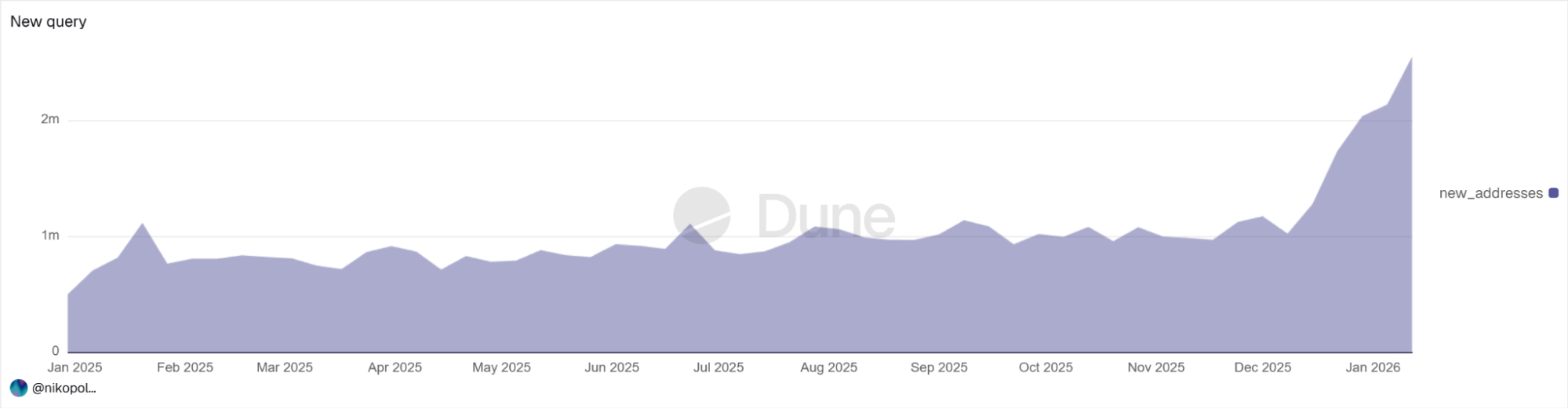

Safety researcher Andrey Sergeenkov stated in a publish earlier this week that the spike aligns carefully with an increase in dusting exercise, the place attackers ship tiny stablecoin transfers to hundreds of thousands of wallets.

Deal with poisoning works by exploiting human habits. Attackers generate pockets addresses that carefully resemble a sufferer’s actual deal with, typically matching the primary and final characters.

They then ship small “mud” transfers, normally beneath $1, so the pretend deal with seems within the sufferer’s transaction historical past. When the sufferer later copies an deal with from that historical past as a substitute of a trusted supply, funds are mistakenly despatched to the attacker.

Sergeenkov’s evaluation discovered that the variety of new Ethereum addresses jumped to roughly 2.7 million in the course of the peak week of Jan. 12, about 170% above regular ranges. Round two-thirds of these addresses acquired mud as their first stablecoin transaction, a powerful sign of poisoning exercise slightly than actual onboarding.

The assault has already resulted in additional than $740,000 in confirmed losses, with a lot of the stolen funds coming from a small variety of victims. Decrease charges following Fusaka seem to have made these campaigns viable, permitting attackers to spray transactions at scale with restricted upfront value.

The takeaway will not be that Ethereum utilization is pretend, however that headline metrics want context.

Decrease charges have clearly introduced exercise again to mainnet, particularly for stablecoins. On the identical time, low cost transactions additionally allow abuse, inflating deal with counts and transaction volumes.