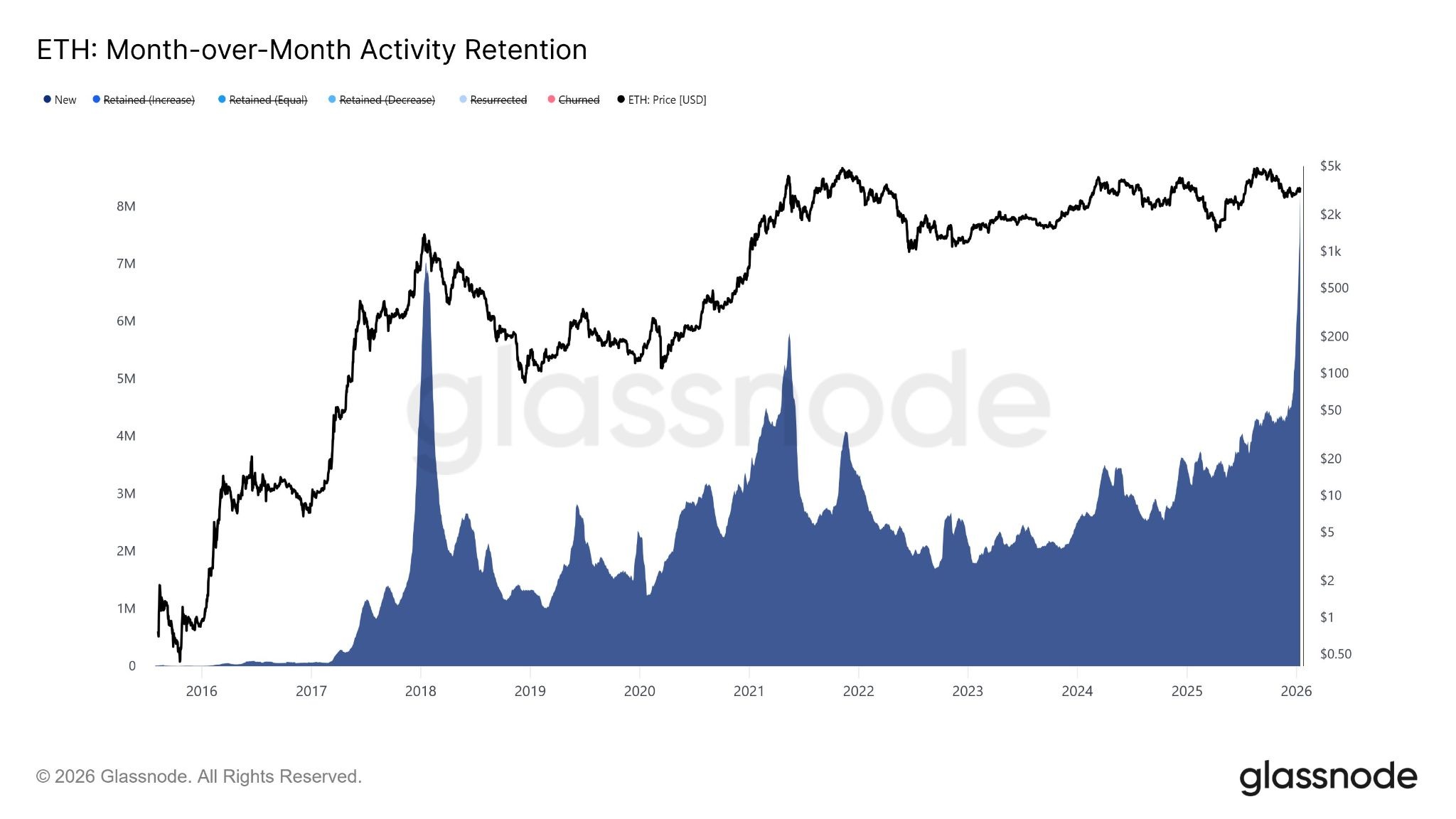

Ethereum community exercise has proven a pointy improve in new customers, with “exercise retention” virtually doubling over the previous month, based on crypto on-chain analytics platform Glassnode.

Month-over-month “exercise retention” reveals a pointy spike within the new cohort, “indicating a surge in first-time interacting addresses over the previous 30 days,” Glassnode reported on Thursday.

It added that this displays a notable inflow of recent wallets partaking with the Ethereum community, “quite than exercise being pushed solely by present contributors.”

New exercise retention, or new community addresses, has spiked from simply over 4 million to round 8 million addresses this month.

Exercise retention measures what number of customers proceed to be lively over time, basically displaying whether or not customers stick round and proceed utilizing the community, quite than displaying up as soon as and disappearing.

Ethereum exercise retention spikes to all-time excessive. Supply: Glassnode

Day by day transactions on Ethereum hit highs

Over the past yr, the variety of lively addresses on the Ethereum community has greater than doubled from round 410,000 accounts recorded this time final yr to over 1 million on Jan. 15, based on Etherscan.

In the meantime, the variety of day by day transactions on Ethereum spiked to an all-time excessive of two.8 million on Thursday, marking a rise of 125% because the similar time final yr.

Associated: Efforts to bulletproof Ethereum are paying off in person metrics

Macroeconomics outlet Milk Highway reported on Thursday that this was because of an explosion of stablecoin utilization on Ethereum whereas charges are collapsing.

“That’s the results of Ethereum pushing execution to L2s whereas preserving settlement safe on L1. That’s what scalable monetary infrastructure really appears to be like like,” it acknowledged.

Stablecoin utilization on Ethereum is at an all-time excessive amid record-low charges. Supply: Token Terminal

“Rather a lot to be optimistic about” with Ethereum

Confidence and sentiment round Ethereum are enhancing. “There’s lots to be optimistic about when Ethereum,” Justin d’Anethan, head of analysis at Arctic Digital, advised Cointelegraph.

“Close to time period, indicators which have been pushed into oversold territory have turned up and appear to trace at a lot larger costs, fueled by renewed capital inflows into ETFs, stablecoins, and native crypto protocols,” he added.

Ethereum’s community exercise has surged as day by day transactions climb previous 2 million whereas staking has reached practically 36 million ETH, noticed Nick Ruck, director of LVRG Analysis.

“These sturdy on-chain fundamentals, mixed with sustained ETF inflows and rising ecosystem optimism, place ETH for a possible breakout above present resistance ranges within the close to time period as liquidity tightens amid heightened institutional participation with current scaling upgrades boosting pace and decreasing gasoline charges,” he added.

All of this heightened community exercise and sentiment must be bullish for the blockchain’s token. “There’s a number of compression going down with ETH, and that’s more likely to escape within the coming week,” mentioned MN Fund founder Michaël van de Poppe on Thursday.

Ether (ETH) costs tapped a two-month excessive of $3,400 on Wednesday, however had retreated barely to commerce round $3,300 throughout early buying and selling on Friday morning.

Journal: Trump guidelines out SBF pardon, Bitcoin in ‘boring sideways’: Hodler’s Digest