Ethereum continues to commerce in a fragile construction because the broader market slides towards defensive positioning. Value sits close to $2,900 after a modest rebound from $2,659, which marks the present cycle low.

The market exhibits hesitation as futures exercise cools, spot flows stay damaging, and institutional accumulators enhance their publicity. Consequently, merchants now monitor whether or not ETH can stabilize earlier than deeper drawdowns problem the following help cluster close to $2,500.

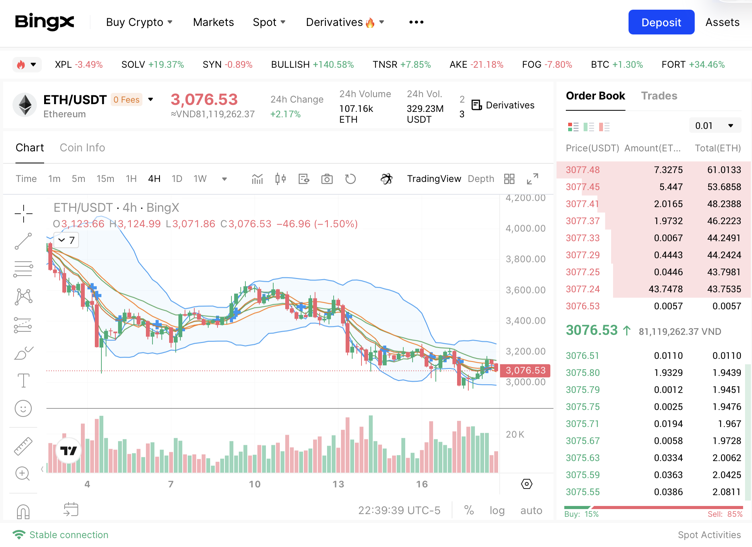

Market Construction Stays Weak Beneath Dynamic Resistance

ETH nonetheless varieties clear decrease highs and decrease lows on the medium-term chart. Value stays beneath the 9-EMA, which alerts weak momentum regardless of the current uptick.

Moreover that, the retest of short-term resistance close to $2,886 continues to restrict any significant restoration makes an attempt. An in depth above this space may open a path towards $3,166, the place structural resistance aligns with the 0.236 Fibonacci zone. Till then, the broader development alerts warning.

ETH Value Dynamics (Supply: TradingView)

Momentum readings add to the uncertainty. The Chande Momentum Oscillator sits close to 32, which exhibits enchancment from current oversold ranges. Nevertheless, it stays beneath the midline, so merchants see neutral-to-bearish circumstances till momentum breaks larger. Therefore, the market lacks robust affirmation of a shift.

Futures and Spot Flows Replicate Defensive Positioning

Ethereum futures open curiosity has eased from its September peak above $40 billion. Present ranges hover close to $35.8 billion. Merchants decreased leverage after the September surge. Nevertheless, open curiosity nonetheless exhibits robust participation, which retains the derivatives market energetic. Furthermore, the sample means that merchants keep engaged at the same time as volatility rises.

Supply: Coinglass

ETH spot flows inform a unique story. Outflows dominate throughout main merchandise, with regular pink prints via September and October. Moreover, Ethereum recorded a $61 million outflow on November 25. These traits spotlight ongoing threat discount from giant holders. Considerably, influx spikes stay temporary and smaller, which reinforces the defensive tone.

Associated: Solana Value Prediction: SOL Makes an attempt Rebound Whereas ETF Growth Indicators Market Curiosity

BitMine Extends Accumulation as Treasury Technique Expands

BitMine Immersion revealed that its crypto and money holdings reached $11.2 billion. The corporate now holds 3.63 million ETH, equal to three% of the whole provide.

Furthermore, BitMine added practically 70,000 ETH prior to now week, which alerts continued accumulation throughout market weak spot. The agency additionally controls $800 million in money and smaller allocations to different belongings.

BitMine goals to achieve a 5% share of the ETH provide. Analysts view this as a significant long-term play as a result of it aligns with expectations of stronger infrastructure demand.

Moreover, the corporate ranks among the many most traded US shares, which will increase its visibility as a crypto-focused treasury agency. Consequently, its technique now influences broader discussions round institutional accumulation throughout the Ethereum ecosystem.

Technical Outlook for Ethereum Value

Key ranges stay clear as Ethereum trades inside a medium-term downtrend.

Upside ranges sit at $2,886, $3,166, and $3,479 as the primary main hurdles. A breakout above these resistance layers may open a transfer towards $3,732 and probably $3,985.

Draw back ranges embrace $2,750 as minor help, adopted by the cycle low at $2,659. Dropping $2,659 exposes a psychological retest of $2,500.

Resistance ceiling sits close to $2,900, the place the 9-EMA at the moment caps each rebound try. Reclaiming this degree is crucial for any medium-term bullish momentum.

The technical construction exhibits ETH sliding inside a broad descending channel, the place compression continues to restrict volatility. A decisive break exterior this channel will dictate the following directional wave.

Will Ethereum Get better?

Ethereum’s near-term outlook will depend on whether or not patrons can defend $2,659 lengthy sufficient to problem the $2,886–$2,900 zone. Momentum stays fragile, however enhancing indicators counsel promoting strain is slowing.

Moreover, structural resistance at $3,166 acts as the primary affirmation degree for a development shift. A powerful reclaim may ship ETH towards $3,479 and $3,732 if inflows strengthen.

Failure to guard $2,659 dangers breaking the cycle ground and exposing ETH to $2,500. Such a transfer would weaken the broader construction and reset sentiment. For now, ETH sits at a decisive zone. The following leg will depend on momentum restoration, spot flows, and whether or not patrons can flip short-term resistance into help.

Associated: Monad (MON) Value Prediction 2025, 2026, 2027, 2028–2030

Disclaimer: The data introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any sort. Coin Version shouldn’t be chargeable for any losses incurred because of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.