Ethereum has just lately proven a notable shift in short-term momentum, attracting renewed consideration because it approaches a technically essential space. Whereas the broader construction stays corrective, latest value behaviour means that patrons have gotten extra lively close to key technical ranges.

Ethereum Worth Evaluation: The Day by day Chart

On the day by day timeframe, ETH has skilled a transparent upside surge from the $2.7K demand zone, pushing the value towards a considerable resistance zone. This resistance is outlined by the confluence of the 100-day shifting common of $3.4K and the highlighted yellow provide space. Traditionally, this area has acted as a powerful barrier, and the present method into this zone will increase the chance of a response or consolidation.

Regardless of the latest bullish impulse, the asset continues to be buying and selling inside a broader descending channel, indicating {that a} transfer above this resistance is required to shift the higher-timeframe bias. Till then, this space ought to be handled as a crucial choice zone the place momentum might sluggish, or sellers might re-emerge.

ETH/USDT 4-Hour Chart

On the 4-hour chart, the construction offers a clearer view of the latest restoration. The value discovered strong assist on the decrease boundary of the wedge at $2.7K, confirming robust demand at that degree. From there, Ethereum rallied steadily towards the higher boundary of the wedge $3.3K and has now barely damaged above it.

This breakout displays bettering short-term momentum, but it surely doesn’t but affirm a full pattern reversal. The blue resistance field above, bounded by the $3.3K-$3,450 thresholds, stays the first impediment for continuation, as the value has beforehand reacted sharply from this zone. A clear acceptance above this space can be wanted to verify sustained bullish continuation, whereas rejection might result in one other pullback towards wedge assist or the mid-range ranges.

Sentiment Evaluation

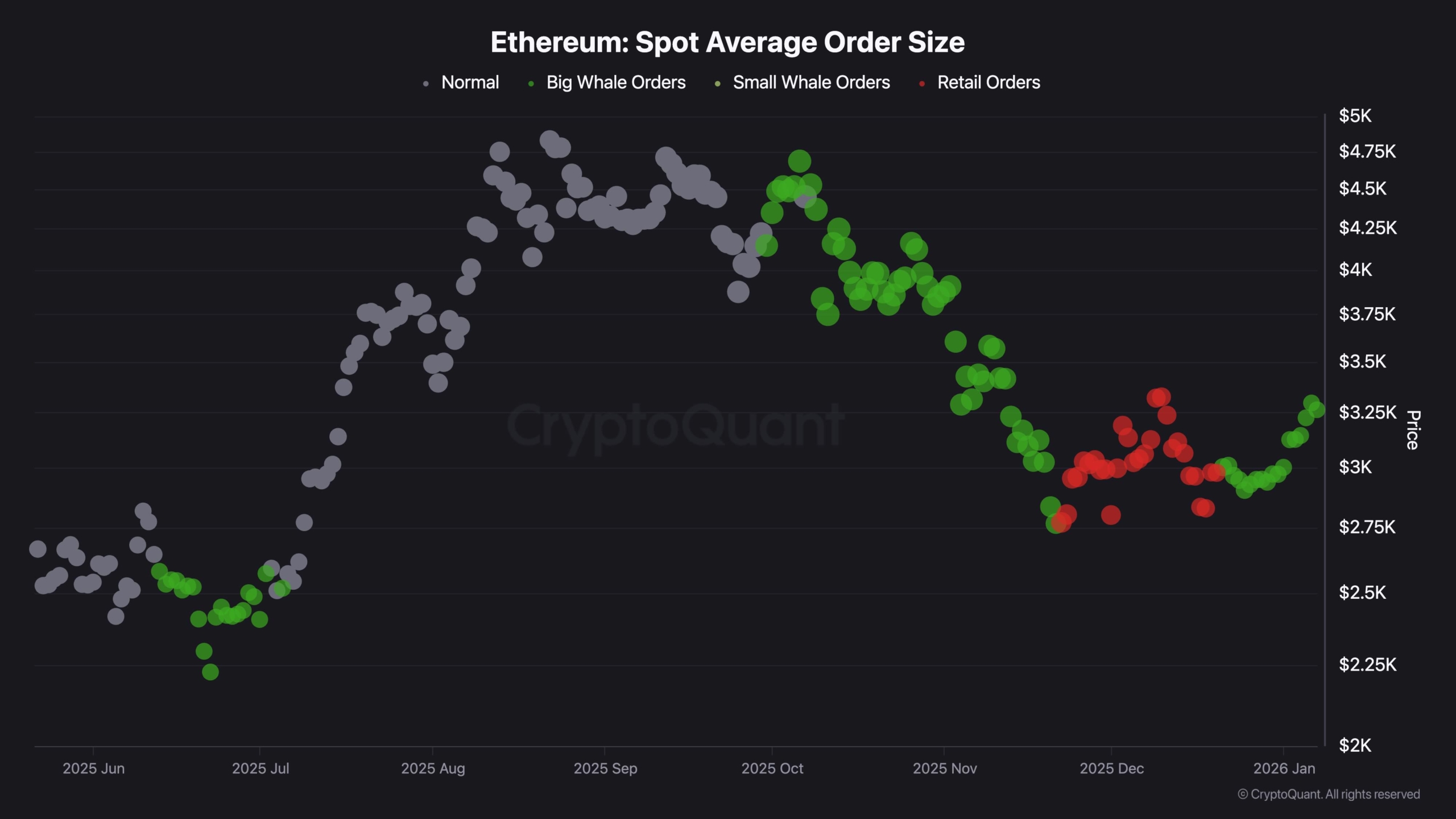

From an on-chain perspective, the Ethereum Spot Common Order Dimension chart exhibits an essential behavioural shift. The latest look and clustering of inexperienced spots point out elevated participation from whale-sized spot patrons through the present value restoration. This means that bigger contributors have gotten lively once more after a interval dominated by retail-sized orders.

Such behaviour usually aligns with accumulation phases reasonably than distribution, particularly when it happens close to structural assist zones. Whereas this doesn’t assure speedy upside continuation, it provides weight to the concept draw back danger could also be more and more absorbed by stronger palms.

General, Ethereum is presently positioned at a technically delicate space the place short-term momentum has improved, however higher-timeframe resistance nonetheless dominates. Worth response across the $3.4K–$3.5K area might be essential in figuring out whether or not the latest restoration evolves right into a broader pattern shift or stays a corrective bounce inside the present construction.