Ethereum is at the moment making an attempt to stabilize after the latest sell-off that pushed costs beneath key ranges. Whereas the bullish pattern construction hasn’t been absolutely damaged on greater timeframes, each worth motion and on-chain metrics are displaying blended indicators that merchants ought to carefully monitor.

Technical Evaluation

By Shayan

The Each day Chart

On the day by day chart, ETH has misplaced the midline of its ascending channel, breaking beneath the dotted trendline that had supported the value since August. The asset is now testing the $4,000 key stage, which aligns carefully with the decrease boundary of the channel and the 100-day shifting common positioned across the $3,800 stage.

The RSI has additionally dipped close to the oversold area however has rebounded barely and is now hovering round 40, hinting at a attainable native backside if patrons step in with quantity. Nevertheless, if the asset breaks beneath the $4,000 stage, a deeper drop towards the $3.5K vary could possibly be anticipated, which might formally put the market in a downtrend scenario.

The 4-Hour Chart

On the 4-hour chart, ETH exhibits indicators of a short-term rebound after reaching the purple demand zone round $3,850. The value bounced fairly sharply from this zone and is now consolidating slightly below $4K. This transfer kinds a possible short-term backside, particularly since RSI has exited oversold territory and is now trending up.

That mentioned, the construction stays bearish so long as ETH stays beneath $4,200 stage. If patrons can reclaim that stage, momentum might shift again in favor of a bullish transfer. In any other case, a drop towards the $3,500 space can be very possible within the coming weeks.

Onchain Evaluation

Alternate Provide Ratio

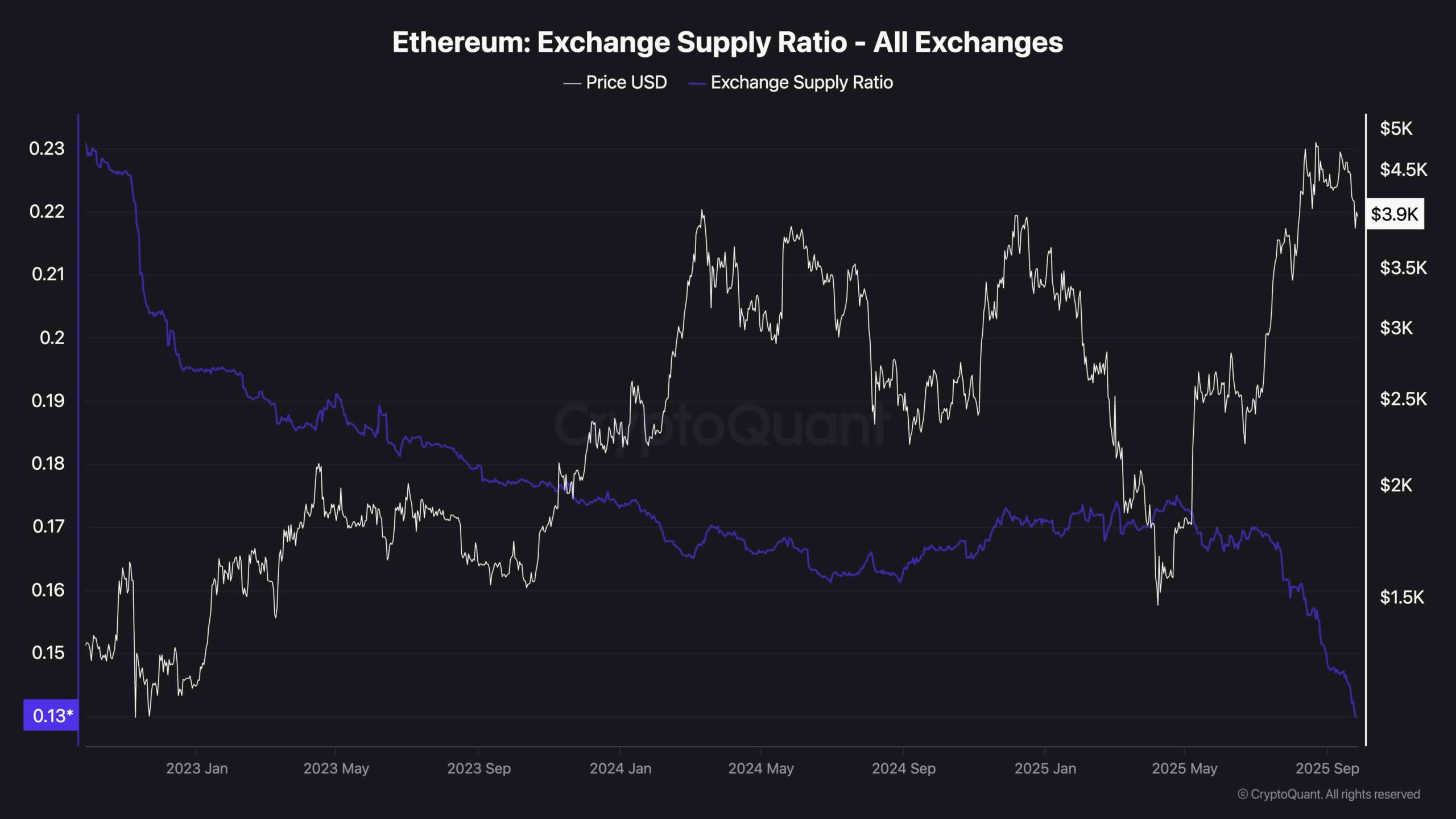

On the on-chain knowledge entrance, Ethereum’s Alternate Provide Ratio continues to pattern downward, now sitting at its lowest level in years, close to 0.13. This exhibits {that a} declining portion of the overall ETH provide is held on centralized exchanges, suggesting a robust long-term accumulation pattern. Traditionally, this has been a bullish sign, because it means fewer tokens are available for promoting.

Nevertheless, this accumulation pattern contrasts with the latest worth motion. Whereas fewer ETH are sitting on exchanges, the value nonetheless dropped sharply, presumably on account of short-term leverage wipeouts or broader market sentiment. In any case, this metric helps the concept long-term holders stay assured, and until we see a sudden reversal in change inflows, the macro bullish construction stays intact.