Ethereum has displayed bearish indicators after breaking under its 100-day transferring common, underscoring elevated promoting exercise.

Nevertheless, the 200-day MA, appearing because the consumers’ final protection, nonetheless holds, providing hope for a possible rebound.

Technical Evaluation

By Shayan

The Each day Chart

ETH just lately broke under the numerous 100-day MA at $3.1K, signaling the sellers’ rising dominance. This breakdown factors to a possible take a look at of the $3K help area, a vital juncture aligned with the 200-day MA.

At present, Ethereum is discovering non permanent help at this stage, with a modest bullish reversal hinting at demand from consumers. The 200-day MA serves as the first defensive position for bulls, and its means to carry will decide the short-term trajectory. A breakdown under this stage may set off a mid-term bearish development, focusing on the $2.5K help zone.

The 4-Hour Chart

On the 4-hour timeframe, ETH noticed consolidation close to the 0.5 Fibonacci retracement stage ($3.2K) earlier than sellers overwhelmed the market, breaking under this vital help. This triggered a wave of lengthy liquidations, driving the value towards the 0.618 Fibonacci retracement stage at $3K.

This area is pivotal, because it represents the final main help zone for consumers. A sustained breach under this stage may result in a cascade of liquidations, driving the value towards the $2.5K goal. Nevertheless, Ethereum seems to be consolidating round this juncture, with a possible battle between consumers and sellers unfolding.

Onchain Evaluation

By Shayan

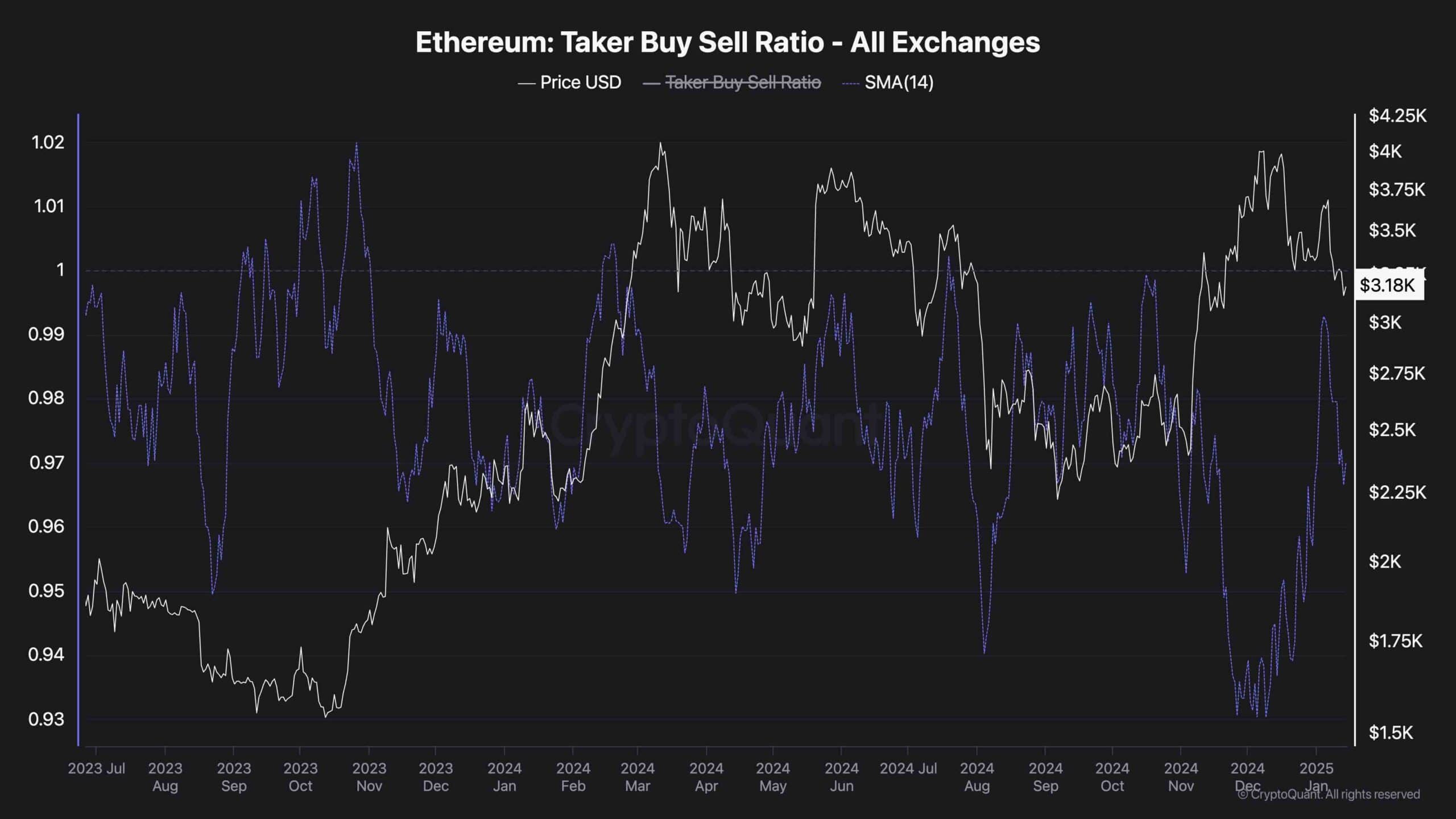

Ethereum is testing the vital $3K help area, with sellers exerting stress to reclaim management. Insights from the Taker Purchase Promote Ratio present a glimpse into market sentiment and potential route.

Upon reaching the $3K help area, the Taker Purchase Promote Ratio initially surged, reflecting elevated shopping for energy and a defensive stance by consumers. Nevertheless, this development was short-lived as a subsequent sell-off coincided with a bearish reversal within the metric. Since then, the ratio has steadily declined, signaling a rising dominance of sellers available in the market.

If this development persists, the probability of a breakdown under the $3K threshold will increase. Such a situation would probably result in heightened promoting exercise, pushing ETH towards the $2.5K help stage. Conversely, a reversal within the ratio may point out renewed purchaser curiosity, stabilizing the value at this vital juncture.