$Ethereum is buying and selling round $3,030, regaining the important thing $3,000 psychological degree after a decisive rebound from assist. Renewed ETF inflows, rising whale accumulation, and bettering technical momentum all contributed to the bounce. With ETH now consolidating slightly below main resistance, merchants are watching whether or not it may possibly set off a breakout towards larger ranges.

Beneath is the complete breakdown of why $ETH is up — and the place the value might go subsequent based mostly on the chart.

Why Ethereum Worth Is Up

1. ETF Demand Returns (Bullish Influence)

Overview

After dealing with $1.4B in web outflows via November, Ethereum ETFs flipped optimistic with $368M in inflows in the course of the last week. This shift aligned with decreased geopolitical stress and ETH’s extended underperformance in comparison with Bitcoin.

What This Means

Establishments seem like rotating again into ETH, treating it as a catch-up play. ETF inflows lower promote stress and act as affirmation that the $3,000 assist space is basically backed by institutional demand.

Watch For

Whether or not inflows proceed into early December

If ETH ETF demand outpaces BTC for the primary time in weeks

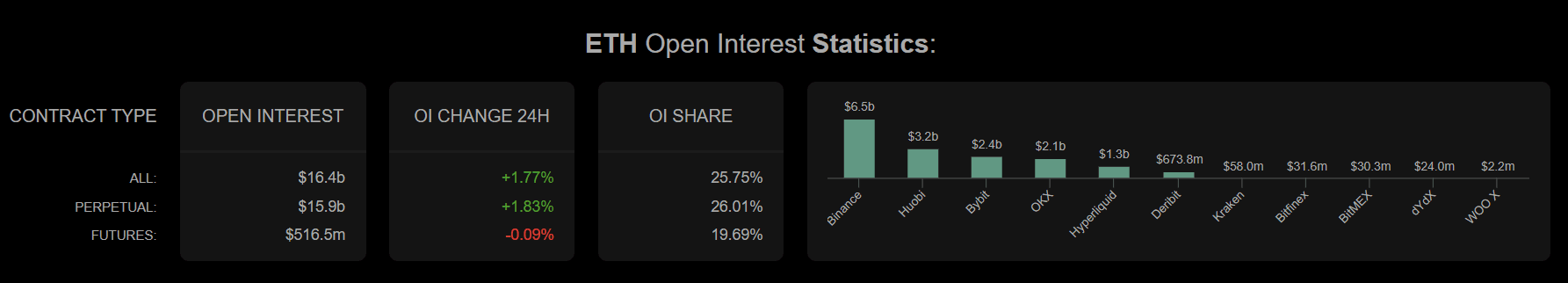

2. Whale & Derivatives Exercise (Blended Influence)

Overview

On-chain knowledge reveals whales added 14,618 ETH (~$185M) in late November. On the identical time, ETH derivatives open curiosity rose $700M, with longs dominating shorts 2:1 close to $2,960.

What This Means

Giant gamers are aggressively defending the $2,960–$3,000 zone. Nevertheless, rising leverage — 3.97M open contracts — introduces liquidation dangers if ETH fails to interrupt above $3,100 resistance.

Watch For

Lengthy liquidations if ETH rejects at $3,100–$3,200

Leverage resets that might set off both volatility spike

3. Technical Momentum (Bullish Quick-Time period)

Overview

ETH has reclaimed the 20-day EMA ($2,968) and printed a bullish MACD crossover with a robust histogram at +37.73. The zone between $2,960 and $3,000 now acts as confirmed assist.

What This Means

If ETH maintains a day by day shut above $3,000, merchants anticipate continuation towards key Fibonacci ranges, particularly the 38.2% retracement at $3,270. Nevertheless, the 200-day MA at $3,520 stays a significant resistance barrier.

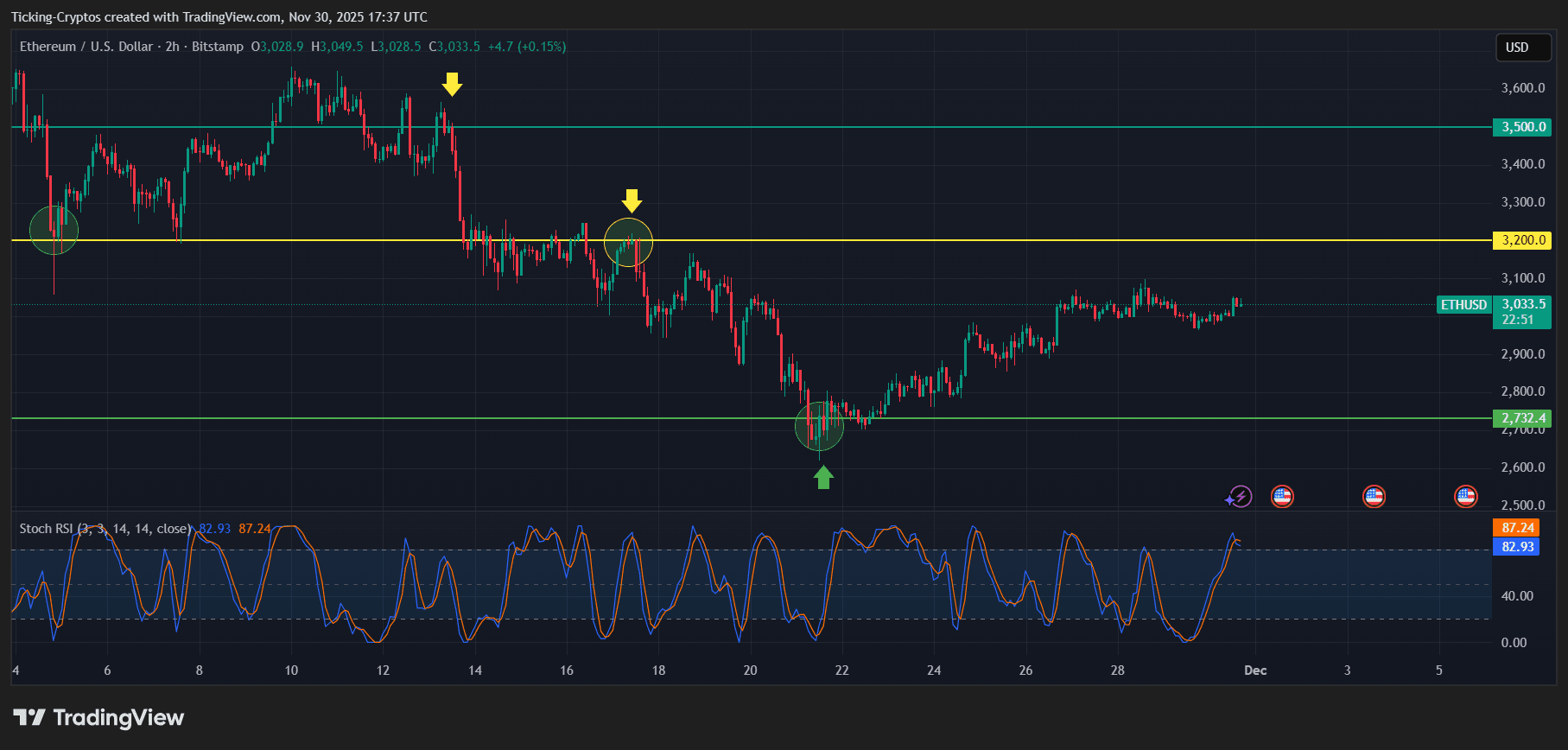

Ethereum Chart Evaluation: What Simply Occurred

Trying on the connected chart, we discover a transparent sample.

ETH/USD 2-hour chart – TradingView

1. ETH Rejected Repeatedly at $3,200 (Yellow Line)

The chart reveals a number of rejections at $3,200, marked by yellow arrows and circles. This zone has acted as mid-range resistance for a number of weeks.

2. Robust Bounce From $2,732 Assist (Inexperienced Line)

ETH bottomed completely on the $2,732 structural assist, the place a inexperienced arrow confirms a high-volume reclaim. Every historic contact at this degree triggered robust reversals.

3. Present Sideways Consolidation Round $3,030

ETH is now stabilizing in a slender band just below resistance — which frequently precedes a breakout try.

4. Stoch RSI Reveals Overbought Momentum

The Stoch RSI at the moment reads:

- 82.93 (blue)

- 87.24 (orange)

ETH is short-term overbought, which means a quick cooldown could happen earlier than continuation.

Ethereum Worth Prediction: The place will Ethereum Attain Subsequent?

Based mostly on the present chart construction, momentum indicators, and market fundamentals:

Bullish State of affairs (Almost definitely if ETH holds above $3,000)

ETH pushes larger from present consolidation.

Upside Targets

- $3,200 (first main breakout zone)

- $3,270 (38.2% Fibonacci degree)

- $3,500 (robust resistance)

- $3,520 (200-day MA — key trend-flip degree)

If ETH closes above $3,500–$3,520, the following macro goal opens towards $3,800+.

Bearish State of affairs (If ETH fails to carry $3,000)

A rejection at $3,200 might ship ETH right into a corrective transfer.

Draw back Targets

- $2,960

- $2,850

- $2,732 (crucial assist zone)

A breakdown beneath $2,732 would shift the pattern right into a mid-term bearish part.