ETH continues to see liquidity rotation, as good whales and establishments are making a return. As ETH consolidated over $3,125, whales repositioned with expectations of additional enchancment.

ETH consolidated above $3,000, with latest whale exercise displaying extra bullish sentiment. ETH traded at $3,104.96, after briefly rising nearer to $3,200. The ETH concern and greed index is at 51 factors, signaling neutrality.

The token is now in search of course, with a possible increase from each spot-buying whales and lengthy positions on by-product markets. ETH predictions embrace a breakout to the next vary, because the community stays essential to DeFi and tokenization. ETH stays at 0.034 BTC, because the main coin remains to be buying and selling sideways.

Bitmine provides extra ETH

Bitmine is without doubt one of the common sources of assist for ETH. The corporate purchased one other 138,452 ETH, principally acquired between December 1 and December 7.

The corporate now holds 3.73M ETH, up 9.8% prior to now month. Bitmine might proceed shopping for till constructing a 5M ETH treasury.

Different treasury firms haven’t added extra ETH, and stay a restricted supply of demand. Regardless of this, the ETH stability in accumulation wallets stays at an all-time peak above 27M tokens.

Establishments additionally added to the stability, although transferring ETH at a slower tempo in comparison with Bitmine. On-chain knowledge exhibits that the Amber Group withdrew 6,000 ETH for self-custody, originating from a Binance sizzling pockets by way of an middleman tackle.

Metalpha withdrew 3,000 ETH from the Gnosis Protected Proxy pockets and deposited the tokens to Aave.

ETH bounced from $2,800 prior to now weeks, displaying indicators of whale intervention. Whales returned to purchase the dip in that vary, which coincided with the typical acquisition worth for giant holders.

ETH whales present confidence in by-product buying and selling

ETH open curiosity rose to over $17.4B, signaling elevated confidence in an ongoing ETH rally. On Hyperliquid, almost 59% of whales are taking lengthy positions, with the very best one having a notional worth of $162.41M. The main dealer, also referred to as the ‘Anti-CZ’ whale, has demonstrated success in earlier trades.

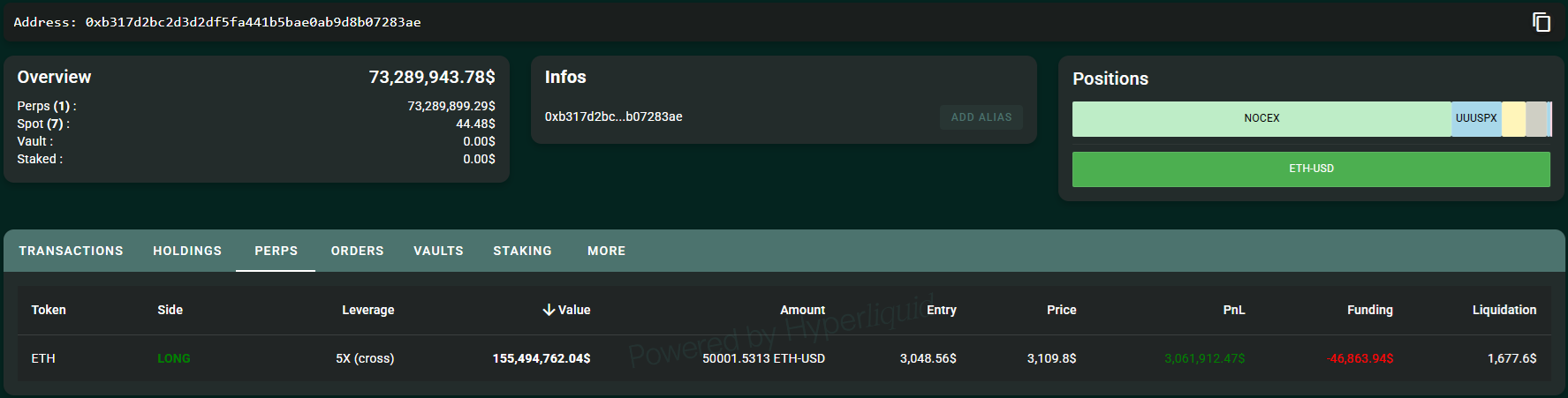

On-chain knowledge reveals among the most outstanding whales have taken up lengthy positions. The 1011 whale that shorted BTC is now bullish on ETH. The whale opened the second-biggest lengthy place on Hyperliquid, at $155.12M, holding even after paying unfavorable funding charges.

The 1011 whale took an extended place in ETH, reaching over $3M in unrealized positive aspects. | Supply: Hyperliquid

The whale achieved over $3M in unrealized positive aspects after ETH prolonged its restoration. To carry this place, the whale has added over $70M in USDC liquidity prior to now day. The whale already locked in $305K in income from a smaller lengthy place on ETH.

The energetic whales have a repute for good cash decisions, and at the least within the quick time period, they’ve managed to build up positive aspects on their positions. They’re, nonetheless, additionally prepared to take income, moderately than get liquidated.