After weeks of uneven worth motion, Ethereum is again in focus as volatility brews throughout the crypto market. Whereas ETH has maintained key ranges not too long ago, the rising divergence between worth motion and futures open curiosity is elevating eyebrows.

With macro uncertainty easing and altcoin narratives slowly rotating again into the highlight, ETH is organising for a possible directional transfer—however it stays to be seen whether or not that’s to the upside or draw back.

Technical Evaluation

By ShayanMarkets

The Each day Chart

Ethereum continues to consolidate slightly below the $2,800 resistance zone after reclaiming the 200-day shifting common yesterday. The value has been hovering inside a slender vary, caught between the important thing resistance space round $2,800 and the $2,500 demand zone.

It has additionally been creating a decent ascending channel sample beneath $2,800, which is often a reversal sample if damaged to the draw back. Nevertheless, a bullish breakout from this sample might invalidate the reversal and add gas to a possible rally larger.

The RSI additionally chart stays secure across the 60 stage, indicating there’s nonetheless room for upward motion earlier than the asset enters overbought territory. However with no convincing break above $2,800, the transfer might nonetheless be categorised as a spread somewhat than a pattern continuation.

If $2,500 offers means, and the channel is damaged to the draw back, a deeper pullback into the $2,100-$2,200 imbalance zone turns into more and more probably, particularly as resting liquidity stays uncollected there.

The 4-Hour Chart

Zooming in on the 4H timeframe, ETH’s worth motion contained in the ascending channel turns into clear. This sample has shaped after an nearly vertical impulse transfer from the $1,800 area, which left behind noticeable imbalances which might be but to be crammed. There may be additionally a Truthful Worth Hole shaped across the $2,600 stage, which is now performing as short-term assist.

This space is essential for the consumers to defend in the event that they wish to protect the present market construction. Up to now, the asset has attacked the upper trendline of the channel a number of occasions, however every retest is coming with lowering bullish momentum.

Furthermore, the RSI is printing decrease highs whereas the value holds regular, suggesting a possible bearish divergence is forming. If confirmed, this might result in a drop again to the decrease boundary of the channel and even a possible breakdown, sending ETH towards the $2,350 liquidity pool and even deeper into the imbalance zone round $2,000. For a bullish breakout, ETH should clear $2,800 with energy and continuation, ideally backed by quantity and liquidation movement to gas the rally.

Sentiment Evaluation

By ShayanMarkets

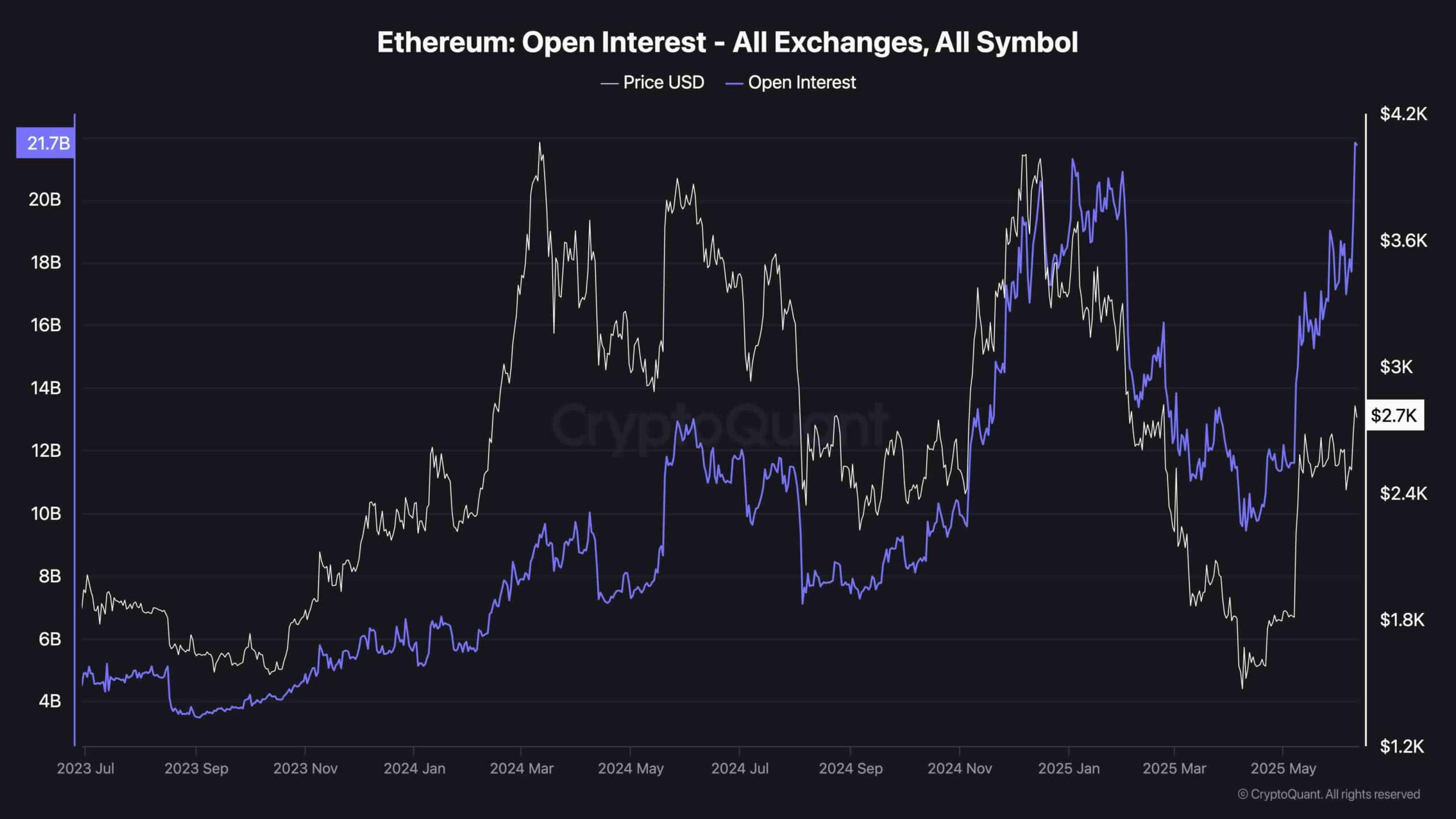

Some of the notable shifts in latest days has been in Ethereum’s open curiosity (OI). As proven within the chart, the metric has hit a brand new excessive of over $21.7B throughout all exchanges, regardless of the ETH worth nonetheless sitting beneath latest highs.

This creates a transparent divergence: OI is climbing aggressively whereas worth stays comparatively muted. This type of divergence usually precedes sharp volatility, both within the type of a liquidation flush or a breakout squeeze. Merely put, the market is closely positioned, however the worth isn’t validating the buildup.

This situation can result in two outcomes. If ETH breaks above key resistance, the heavy open curiosity might gas a fast brief squeeze and continuation rally. On the flip facet, if the value fails to reclaim $2,800 quickly and loses $2,500 assist, a cascade of lengthy liquidations might kick in, probably wiping out latest bullish leverage.

Merchants ought to put together for an enlargement transfer quickly, as compression between rising OI and flat worth isn’t sustainable. It’s a volatility entice ready to spring. Timing it proper might be essential for short-term positioning.