Ethereum is on the verge of breaking out of a decisive value vary, introducing heightened volatility and indecision to the market.

A bullish breakout would probably set off a rally towards the $4K resistance, whereas a bearish transfer might set off vital draw back momentum.

Technical Evaluation

By Shayan

The Day by day Chart

ETH’s value motion displays a part of heightened volatility adopted by a interval of sideways consolidation. The cryptocurrency is presently trapped inside a slim vary, outlined by the 100-day shifting common at $3.2K and the essential $3.5K resistance zone.

This value vary is important, because it holds substantial liquidity that might gas a pointy transfer in both course upon a breakout. A break above the $3.5K mark would probably provoke a bullish rally towards the $4K threshold, reinforcing constructive market sentiment. Conversely, a bearish breakdown beneath the 100-day MA might end in a cascade of promote orders, doubtlessly driving the worth down towards the $3K help stage.

The upcoming value motion inside this vary is pivotal for shaping Ethereum’s mid-term pattern, with each patrons and sellers ready for heightened market exercise.

The 4-Hour Chart

On the decrease timeframe, Ethereum’s tight buying and selling vary displays a fierce wrestle between bulls and bears. The value is bounded by the 0.5 Fibonacci retracement stage at $3.2K and the descending wedge’s higher boundary close to $3.3K, leading to unstable sideways motion.

Ethereum patrons are exhibiting willpower, aiming to push the worth above this dynamic resistance. If profitable, this breakout might drive the asset towards the $3.5K threshold, the place additional upside momentum could possibly be examined. Nevertheless, ought to sellers regain management, a breakdown beneath the 0.5 Fibonacci stage would probably result in a bearish cascade, concentrating on decrease help ranges.

Given the market’s present state, a bullish breakout above the descending wedge and a subsequent rally towards the $3.5K resistance is the extra possible state of affairs within the brief time period. This transfer might sign renewed optimism and set the stage for additional positive factors out there.

Onchain Evaluation

By Shayan

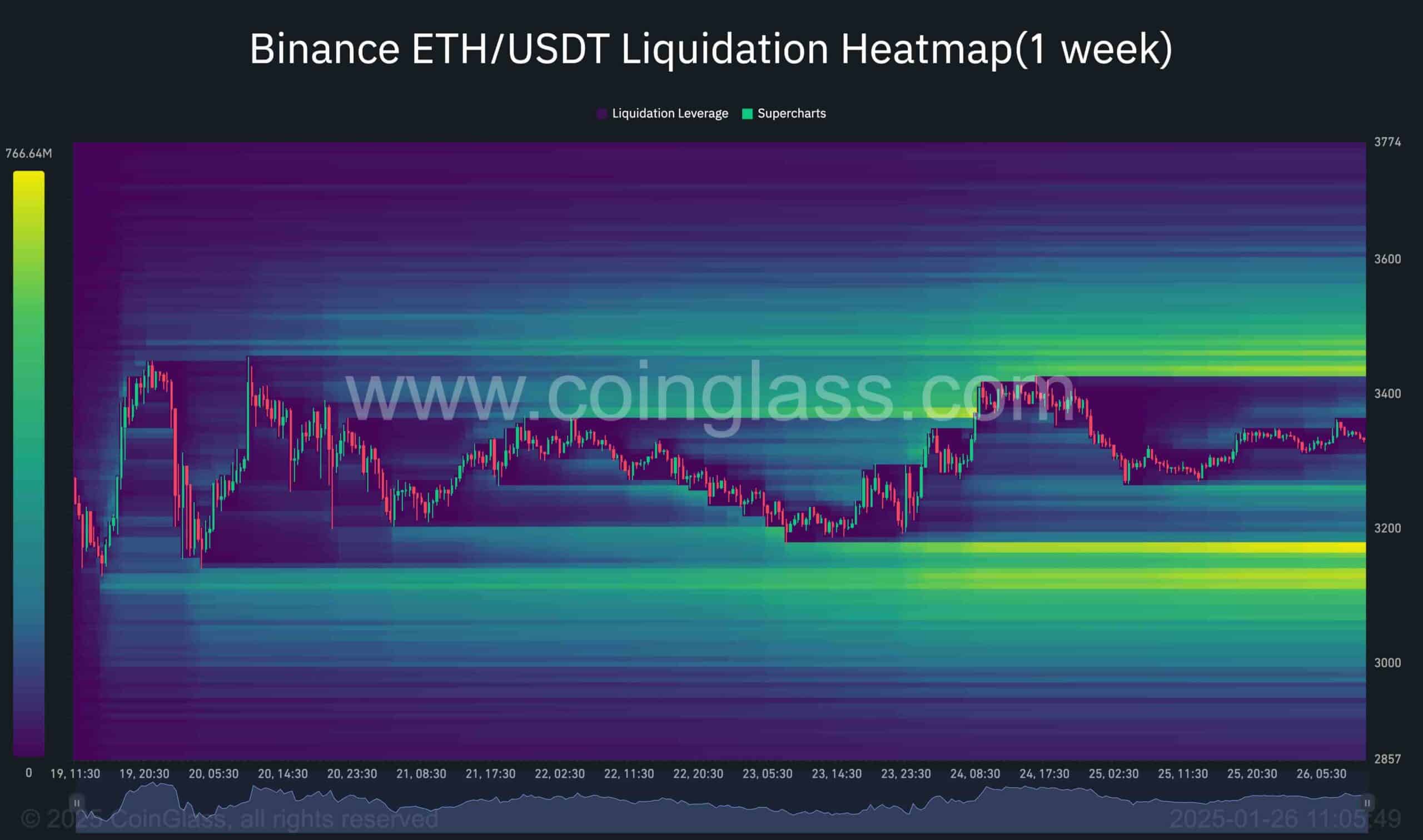

In the course of the latest consolidation stage, two vital liquidity swimming pools have emerged, one beneath the $3.2K mark and the opposite above the $3.5K threshold. These zones signify the liquidation ranges for brief and lengthy positions, respectively, and are extremely engaging targets for bears and bulls. The clustering of liquidity at these ranges underscores the heightened stress between provide and demand forces out there.

This setup makes each the $3.2K help and $3.5K resistance essential ranges to look at because the market seems poised for a decisive transfer. The focus of liquidity at these thresholds will increase the probability of a breakout towards both course within the close to time period.

Given the present market circumstances and the seen bullish momentum, a breakout above the $3.5K mark appears extra possible within the short-to-mid time period. Such a transfer would probably purpose to seize liquidity above this threshold, paving the way in which for a sustained rally towards increased resistance ranges.