- Ethereum declined over 7% after the Fed introduced a hawkish charge outlook for 2025.

- Ethereum might bounce again to smash key resistance ranges after its Weighted Sentiment plunged to lows final seen in December 2023.

- Ethereum dangers decline to $2,800 if it breaches the $3,550 help degree.

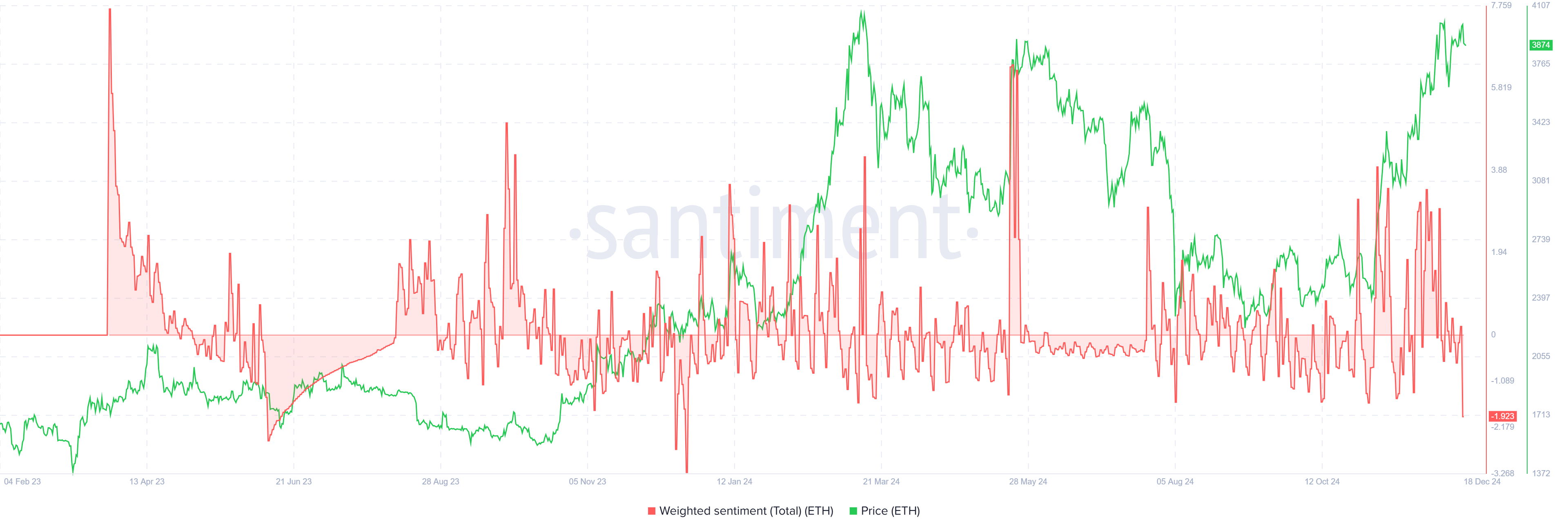

Ethereum is down 6% after the Federal Reserve hinted that it’s going to scale back its charge reduce frequency in 2025. The hawkish information has despatched ETH’s Weighted Sentiment to lows final seen in December 2023.

Ethereum declines following Fed’s hawkish choice

Ethereum dived 6% after the Fed introduced a 25-basis-point charge reduce and revised its charge reduce projections in 2025 from 4 to 2. Based on Coinglass information, the decline sparked $102 million in ETH futures liquidations up to now 24 hours, with liquidated lengthy and brief positions accounting for $90.74 million and $12.16 million, respectively.

Following the hawkish Fed choice, Ethereum’s Weighted Sentiment declined to lows final seen in December 2023.

Weighted Sentiment is obtained by measuring an asset’s social quantity in tandem with its total market sentiment. This metric dips when an asset’s social quantity is excessive however the total market sentiment is destructive.

ETH Weighted Sentiment | Santiment

Whereas the destructive sentiment signifies a possible bearish outlook, costs have typically posted an reverse response each time the Weighted Sentiment sees a dip. Consequently, ETH might see a bounce again to beat key resistance ranges.

Additionally, Ethereum long-term holders (LTH) confirmed resilience all year long, growing their stability to a excessive of 110 million ETH in 2024 — i.e., over 90% of the complete ETH in circulation, per IntoTheBlock’s information. With LTH displaying a bias towards accumulation, Ethereum might get pleasure from a major increase in its worth if the development continues.

Lengthy-term ETH holders confirmed conviction this yr, with a continued improve of their collective stability.

Roughly 110 million $ETH is now held by long-term holders. pic.twitter.com/smh7DZL1of

— IntoTheBlock (@intotheblock) December 18, 2024

In the meantime, Ethereum ETFs maintained their influx development on Tuesday, recording internet inflows of $144.7 million, per Coinglass information. This marks seventeen consecutive days of optimistic flows and a cumulative internet influx of $2.46 billion for the merchandise. Notably, BlackRock’s iShares Ethereum Belief (ETHA) crossed 1 million ETH in its whole internet inflows because it units sight on surpassing Grayscale’s ETHE.

Ethereum Worth Forecast: ETH dangers decline to $2,800 if $3,550 help degree fails

Ethereum noticed a rejection at its yearly excessive resistance of $4,093 for the second time in December. The constant rejection close to $4,093 all year long has established it as a serious resistance degree for the highest altcoin. Following this transfer, ETH declined beneath the help degree close to the higher boundary trendline of a symmetry triangle sample.

ETH/USDT weekly chart

The decline might ship ETH towards the help degree at $3,550. A bounce off this degree might see ETH recuperate the help degree of the triangle’s higher boundary. If such a transfer happens, consumers might proceed asking questions of the $4,093 resistance.

A profitable transfer above $4,093 might see ETH rally to check its all-time excessive resistance at $4,868. Nevertheless, it has to clear one other resistance degree at $4,386 to finish this transfer.

Conversely, a breach of the $3,550 help degree will ship ETH towards the help zone round $2,800 to $3,000.

The Relative Power Index (RSI) and Superior Oscillator (AO) momentum indicators are above their impartial ranges, indicating bullish momentum remains to be dominant out there. The Stochastic Oscillator is within the overbought area, signaling a looming worth correction.

A weekly candlestick shut beneath $2,817 will invalidate the thesis.