Ethereum’s current value motion displays a market transitioning from impulsive promoting into a possible short-term stabilisation section. After a pointy decline towards the $1,750 demand zone, $ETH has reacted with a reasonable rebound, but is predicted to proceed fluctuating within the quick time period.

Ethereum Worth Evaluation: The Day by day Chart

On the every day chart, $ETH continues to commerce inside its descending channel, with decrease highs and decrease lows nonetheless intact. The current impulsive drop pushed the value sharply into the $1.8K demand space, the place consumers reacted and triggered a rebound towards the $2.1K area.

Nevertheless, the asset stays beneath the 0.5 Fibonacci degree at $2.4K and nicely below the 0.618 degree at $2.5K, confirming that the present transfer is corrective reasonably than a confirmed pattern reversal.

The $2.7K vary, aligned with the 0.702–0.786 retracement ranges, stands as a serious provide zone and could be the important thing resistance space if a stronger restoration unfolds. So long as $ETH stays beneath $2.5K, the broader construction favours sellers, whereas the $1.7K degree stays the vital help to carry.

$ETH/USDT 4-Hour Chart

On the 4-hour chart, the value motion has shaped a short-term contracting construction after the sharp bounce from $1.7K. The market is presently fluctuating between the ascending short-term help trendline and the descending native resistance trendline, compressing close to the $2.1K space. A profitable break above $2.1K may open the trail towards $2.5K, which is the following key resistance.

Conversely, shedding the $2K intraday help would seemingly expose the $1.8K zone once more. For now, $ETH seems to be in a short-term consolidation section between $1.8K and $2.1K following the current volatility spike.

Sentiment Evaluation

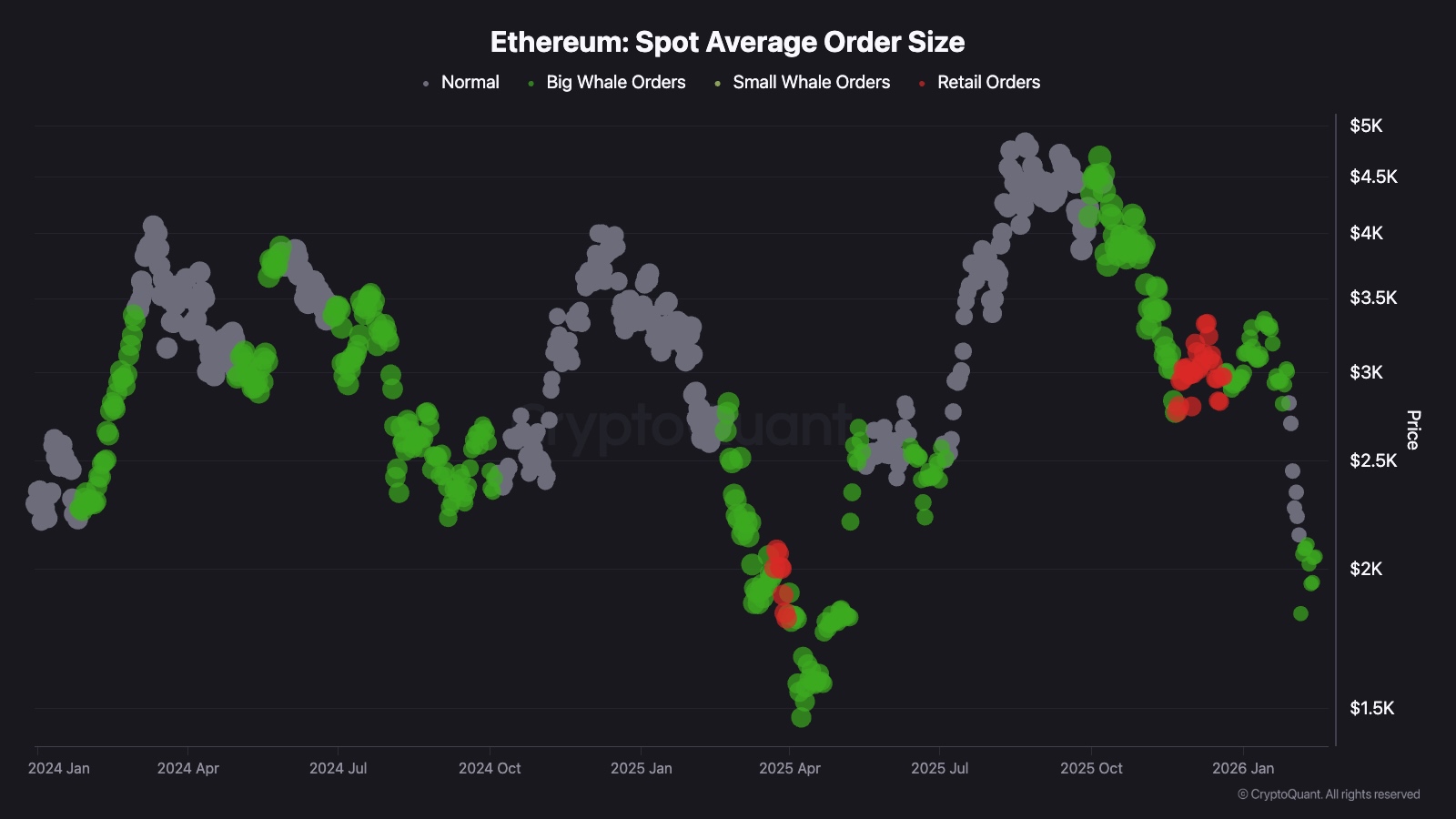

The Ethereum Spot Common Order Measurement chart exhibits a notable improve in inexperienced dots in the course of the current decline towards the $1.8K area. These inexperienced clusters point out giant whale-sized spot orders getting into the market as costs traded at low ranges. This behaviour suggests potential accumulation by larger gamers in the course of the panic-driven sell-off.

Whereas this doesn’t instantly sign a pattern reversal, the focus of whale exercise close to $1.8K strengthens this zone as a structurally necessary demand space. If accumulation continues and value stabilises above $2K, the chance of a broader restoration towards larger resistance ranges will step by step improve.