- ETH derivatives present weak momentum regardless of sturdy ETF inflows.

- Ethereum’s community exercise and TVL proceed to say no.

- Technical evaluation hints at long-term upside, however merchants keep cautious.

Ethereum (ETH) has seen a robust worth surge in latest weeks, gaining greater than 54% over the previous month and buying and selling at round $3,755 at press time.

Nevertheless, regardless of this rally and powerful spot ETF inflows, derivatives market information paints a really completely different image, casting doubt on whether or not Ethereum can break by way of the psychologically vital $4,000 stage any time quickly.

In essence, the disconnect between bullish institutional inflows and weak derivatives metrics raises a number of questions for market members.

Is Ethereum’s latest rally sustainable, or is it merely a mirrored image of speculative optimism pushed by ETF hype?

Moreover, are buyers shedding confidence in Ethereum’s community fundamentals amid rising competitors from rival blockchains?

Derivatives market tells a cautious story

Whereas Ethereum’s spot market has been energised by inflows into exchange-traded funds, futures information exhibits merchants are hesitant to decide to leveraged bullish positions.

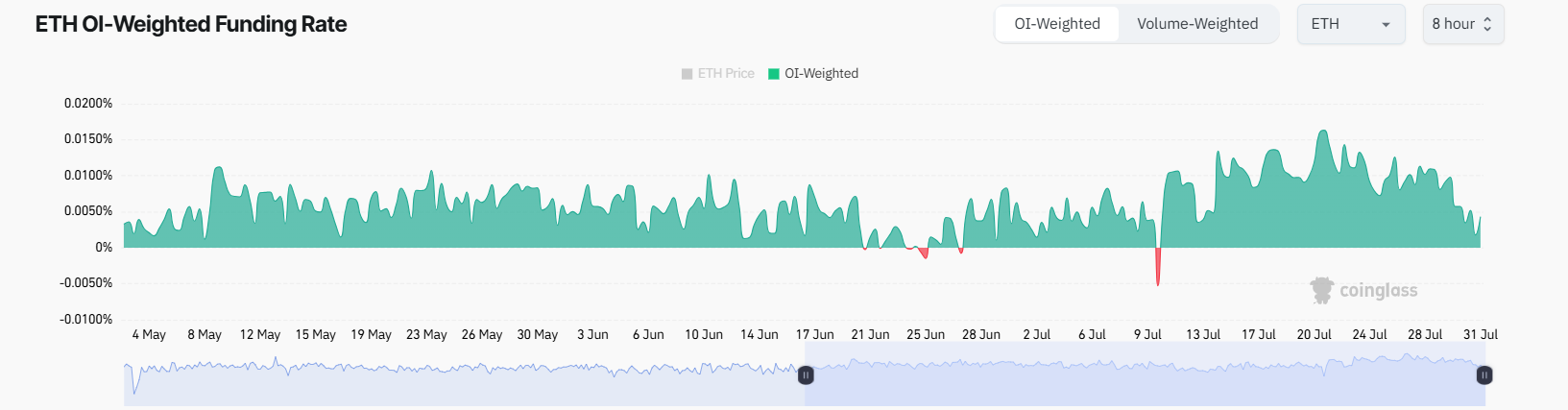

As of Thursday, the annualised funding fee for ETH perpetual futures had fallen again to 9%, down from 19% earlier within the week, with the ETH OI-weighted funding fee dropping to 0.0043% from 0.0163% on July 21.

This means waning demand for lengthy positions, even after a close to 46% acquire in ETH worth since early July.

This behaviour is uncommon. Traditionally, rising costs coincide with stronger futures premiums, but the present pattern signifies hesitation.

The three-month ETH futures premium has additionally softened barely to six%, down from 8% simply days in the past.

Whereas this nonetheless sits inside a impartial vary, it reveals a reluctance amongst whales and market makers to guess aggressively on additional worth appreciation within the close to time period.

Ethereum community weak point frustrates buyers

The cautious tone in derivatives is probably going being fueled by stagnant on-chain exercise.

Ethereum’s whole worth locked (TVL) dropped to a five-month low of 23.4 million ETH, falling 11% in simply 30 days.

That sharp decline comes regardless of ETH’s rising greenback worth and highlights a big discount within the quantity of property being deployed throughout the ecosystem.

In distinction, Solana’s TVL solely fell 4% throughout the identical interval, whereas BNB Chain’s TVL rose 15% in native token phrases.

These shifts present that competing platforms are both sustaining or rising their utility at a time when Ethereum’s exercise seems to be plateauing.

Much more regarding is Ethereum’s decline in dominance amongst decentralised alternate (DEX) volumes.

In line with DefiLlama, Ethereum recorded $81.32 billion in DEX exercise over the previous month.

Solana surpassed that with $82.9 billion, whereas BNB Chain led with a staggering $189.2 billion.

These figures spotlight that Ethereum is not the go-to platform for sure core DeFi actions.

Technical evaluation indicators a blended ETH worth outlook

Regardless of lukewarm spinoff exercise, technical analysts stay divided on Ethereum’s future trajectory.

Standard investor Ivan On Tech has pointed to a symmetrical triangle sample that might result in a breakout towards $7,709, greater than double the present worth.

ETHEREUM BREAKING OUT ON THE MONTHLY!!!!!!!!!!!!

TARGET $7,700

YES

OOOH YES GUYS pic.twitter.com/z0sZvKxOYW— Ivan on Tech 🍳📈💰 (@IvanOnTech) July 20, 2025

In the meantime, one other analyst, Mikycrypto Bull, has recognized a long-term ascending triangle formation relationship again 5 years, which may theoretically launch ETH as excessive as $16,700.

ETHEREUM IS SET FOR A MACRO BREAKOUT

IT WILL SPARK OFF A HUGE ALTSZN IF IT HAPPENS

A VERY CRITICAL MOMENT FOR ETHEREUM pic.twitter.com/IoZX77DvmR

— Mikybull 🐂Crypto (@MikybullCrypto) July 30, 2025

Including to the bullish sentiment is a latest MACD crossover on the month-to-month chart, a sign that has preceded main rallies in earlier cycles.

Nevertheless, whereas long-term technicals trace at explosive potential, short-term forecasts are extra cautious.

ETH should first break by way of $4,100 and maintain above $3,700 to maintain its upward momentum.

Company confidence grows amid market doubts

Institutional and company adoption of Ethereum continues to develop.

Companies reminiscent of SharpLink Gaming and World Liberty Monetary have gathered substantial ETH reserves in latest months.

SharpLink now holds over 438,000 ETH and actively stakes its property to generate passive revenue.

World Liberty Monetary has acquired over 77,000 ETH, with latest purchases close to $3,294 per coin.

These strikes counsel that some establishments are positioning Ethereum as a long-term strategic asset.

Their investments mirror confidence in Ethereum’s evolving function as foundational infrastructure for decentralised functions and finance.