Ethereum continues to commerce inside a slender vary after rebounding strongly from late-December lows. Value motion across the $3,100 degree displays consolidation quite than exhaustion. Market knowledge reveals ETH holding above key shifting averages, suggesting stability between patrons and sellers.

Quick-Time period Construction Holds Above Important Assist

On the 4-hour chart, ETH stays capped under the $3,300 swing excessive. Nonetheless, greater lows from the $2,700 area proceed to assist the broader restoration construction. Consequently, the market nonetheless respects the prior upside impulse.

Rapid resistance sits between $3,130 and $3,150, the place short-term averages converge. A sustained transfer above this band may expose the $3,290 to $3,300 zone. That space aligns with a key Fibonacci retracement and prior provide. Above that, $3,450 marks the higher boundary of the previous vary.

ETH Value Dynamics(Supply: TradingView)

Assist stays effectively outlined. The $3,080 to $3,100 zone acts as the present worth space. Moreover, the $3,000 to $2,995 area gives robust structural backing.

Associated: Story Value Prediction: IP Extends Rally After Key Breakout Alerts…

Failure there would shift focus towards $2,890. A break under $2,716 would invalidate the restoration narrative. Transferring averages between the 100 and 200 durations now cluster round value. Therefore, ETH trades in equilibrium quite than development enlargement.

Derivatives and Spot Flows Sign Pressure

Futures knowledge provides one other layer to the setup. Ethereum open curiosity continues to broaden regardless of sideways value motion. Open curiosity stays close to cycle highs round $40 billion. This habits suggests merchants rotate leverage quite than exit positions.

Traditionally, such situations improve the probability of sharp directional strikes. Furthermore, elevated leverage typically amplifies liquidation-driven volatility as soon as value escapes its vary.

Supply: Coinglass

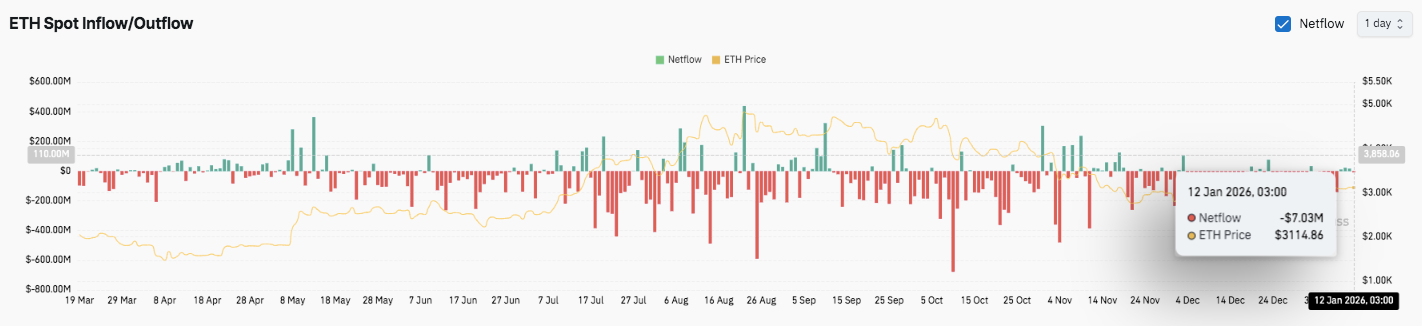

Spot movement knowledge paints a cautious image. Internet outflows dominate most classes, indicating persistent sell-side strain. Nonetheless, latest flows seem smaller and extra balanced close to $3,100. This stabilization hints at short-term equilibrium. Consequently, upside momentum stays capped till sustained inflows return.

Staking Exercise Quietly Reduces Circulating Provide

Lengthy-term positioning provides a structural dimension. Tom Lee’s Bitmine not too long ago elevated Ethereum staking by over 86,000 ETH. Complete staked holdings now exceed a million ETH. Every deposit removes provide from lively circulation.

Tom Lee(@fundstrat)’s #Bitmine staked one other 86,400 $ETH($266.3M) 5 hours in the past.

In complete, #Bitmine has now staked 1,080,512 $ETH($3.33B).https://t.co/P684j5YQaG pic.twitter.com/TpEf32m6AF

— Lookonchain (@lookonchain) January 11, 2026

Moreover, staking rewards encourage long-duration holding quite than short-term buying and selling. In consequence, ETH absorbs provide quietly with out rapid value response. That imbalance typically precedes volatility as soon as demand strengthens.

Associated: Monero Value Prediction: Privateness Coin Explodes To $573 As Peter Brandt Chart…

Technical Outlook for Ethereum Value

Key ranges stay clearly outlined as Ethereum trades inside a tightening vary close to $3,100.

Upside ranges embrace $3,130–$3,150 as the primary resistance zone, adopted by $3,290–$3,300 close to the 0.786 Fibonacci retracement. A confirmed breakout above this space may prolong positive aspects towards $3,450, which marks the prior vary excessive.

On the draw back, rapid assist sits between $3,080 and $3,100. Under that, $3,000–$2,995 stays a vital demand zone aligned with the 0.382 retracement, whereas $2,890 acts as deeper structural assist. The broader restoration turns into invalid if value revisits $2,716.

The technical construction suggests Ethereum is compressing above its medium and long-term shifting averages, signaling stability quite than weak point. This consolidation part typically precedes volatility enlargement.

Will Ethereum Transfer Increased?

Ethereum’s near-term course is determined by whether or not patrons can defend the $3,000 area and reclaim $3,150 with conviction. A profitable push greater may open a path towards $3,300 and past.

Nonetheless, failure to carry $3,000 would shift focus towards $2,890 and weaken the restoration construction. For now, Ethereum stays in a pivotal zone, with vary decision prone to dictate the following main transfer.

Associated: Canton Value Prediction 2026: DTCC Treasury Tokenization and $6T Asset Processing Goal $0.25-$0.50

Disclaimer: The knowledge offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any variety. Coin Version shouldn’t be chargeable for any losses incurred because of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.