Ethereum is holding a agency footing close to $3,317 as merchants watch whether or not the rally can stretch greater on the 4-hour chart. Current value motion exhibits ETH regaining momentum after clearing a key resistance band round $3,300–$3,320.

This transfer has helped verify a short-term bullish continuation setup, with greater highs and better lows forming throughout the most recent swings. Apart from the breakout, Ethereum has additionally stayed above its main shifting averages, which merchants usually deal with as a sign that patrons nonetheless management the pattern.

ETH Breakout Holds Above Key Technical Zones

Ethereum pushed above the $3,300 space and stored the extent as assist throughout current pullbacks. Therefore, the $3,305–$3,315 vary now acts as the primary protection line for bulls. The EMA cluster additionally sits beneath value and continues to carry as dynamic assist. Moreover, the Supertrend indicator stays bullish, which helps the case for follow-through good points.

Shallow pullbacks have additionally stood out in the course of the newest part. Consequently, this conduct factors to regular dip demand and restricted profit-taking strain. If ETH holds above $3,300, merchants could preserve focusing on the following upside band.

ETH Worth Dynamics (Supply: Buying and selling View)

ETH now faces quick resistance between $3,350 and $3,380, the place sellers beforehand defended current highs. Furthermore, a clear push above this zone may open the trail towards $3,405–$3,450. That space matches a serious prior vary excessive and features up with extension targets on many short-term charts.

Associated: Bitcoin Worth Prediction: ETF Inflows Conflict With Spot Outflows As Worth Stalls…

Nonetheless, value should still stall if patrons fail to soak up provide close to the highest of the present vary. Merchants will probably monitor momentum carefully round $3,380 since it may possibly determine the following directional transfer.

Derivatives and Spot Flows Sign Warning

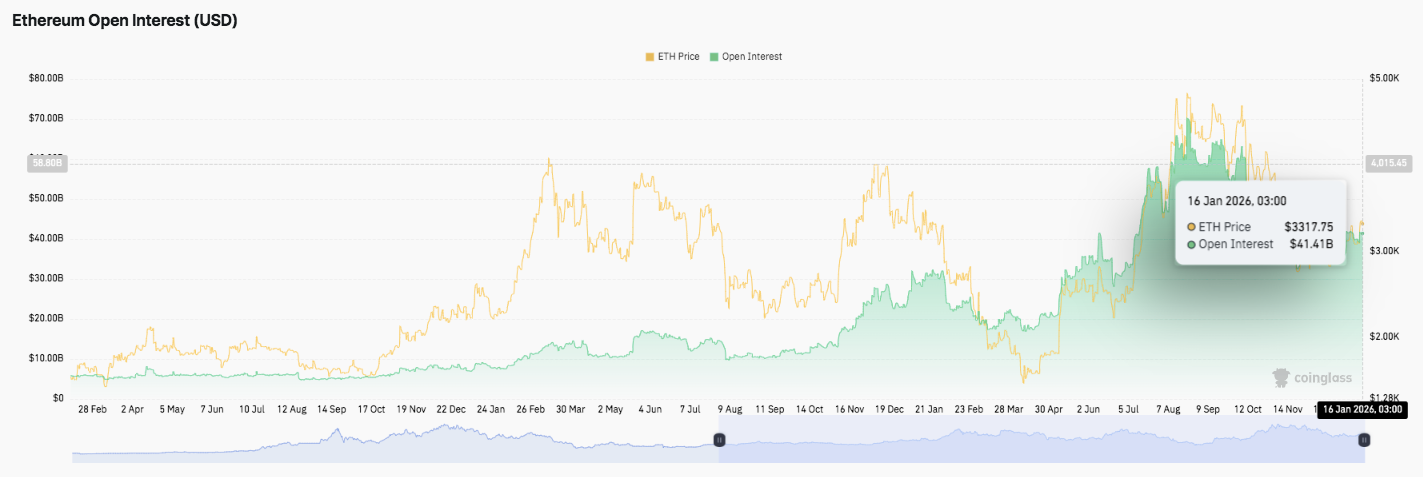

Supply: Coinglass

Ethereum’s open curiosity pattern continues rising, which suggests stronger derivatives participation. Considerably, open curiosity sits close to $41.41 billion whereas value trades round $3,317. This degree exhibits leverage stays elevated even after a small cooldown. Therefore, sudden volatility can nonetheless seem if merchants unwind positions shortly.

Spot influx and outflow information additionally exhibits a softer tone. Netflows stayed principally detrimental for months, and the most recent studying exhibits a light web outflow close to $34 million. Moreover, outflows have slowed in comparison with earlier spikes, which hints at lowered promoting depth.

Associated: Shiba Inu Worth Prediction: Burn Fee Collapses 87% As Solely 550K SHIB…

Technical Outlook for Ethereum Worth

Key ranges stay well-defined for Ethereum as value stabilizes above current breakout assist.

Upside ranges to look at embody $3,350–$3,380 as the primary resistance band. A clear break may open room towards $3,405 and $3,450, aligned with prior vary highs and Fibonacci extensions.

On the draw back, quick assist sits at $3,305–$3,315, the place earlier resistance flipped into demand. Beneath that, $3,190–$3,200 stands as a important confluence zone, combining EMA assist and the 0.618 Fibonacci degree. A deeper assist base rests close to $3,040–$3,080.

The technical image suggests Ethereum is consolidating inside a bullish continuation construction after reclaiming key shifting averages. This compression part usually precedes volatility enlargement.

Will Ethereum go up?

The near-term bias depends upon patrons defending the $3,300 space whereas constructing momentum towards the $3,380 resistance. Stronger inflows and sustained leverage may gas a transfer towards $3,450.

Nonetheless, failure to carry $3,190 dangers weakening construction and exposing ETH to a deeper pullback towards the $3,080 zone. For now, Ethereum trades in a decisive vary the place affirmation will form the following leg.

Associated: Web Laptop Prediction 2026: Mission70 Cuts Inflation 70% and AI Integration Goal $8-$12

Disclaimer: The data introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any sort. Coin Version shouldn’t be chargeable for any losses incurred because of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.