ETH is attempting to construct a short-term restoration, however the chart nonetheless displays a market trapped below heavy macro resistance.

The worth is making an attempt to push by a clear trendline that has capped each rally since early October.

Momentum is enhancing, however consumers nonetheless want a decisive break above the $3,500 space to shift the construction. Till then, each transfer larger stays weak to rejection.

By Shayan

The Each day Chart

On the every day chart, ETH continues to respect the descending trendline whereas nonetheless buying and selling nicely under the 100-day and 200-day transferring averages, situated across the $3,600 mark. This retains the broader bias bearish, though the value is slowly recovering from the capitulation low round 2.7k.

The important area stays $3,400-$3,500, the place a key Truthful Worth Hole and bearish order block sit. If ETH can break and shut above that degree, it might sign a transfer towards the $4,000 zone.

Assist ranges stay cleaner. The $2,900 short-term degree held a number of occasions, and under that, $2,500 and $2,200 areas are the robust demand zones. So long as ETH stays above $2,900, consumers have a base to work with, however they nonetheless want a brand new larger excessive to substantiate pattern reversal.

The 4-Hour Chart

The 4-hour chart exhibits ETH pushing into the descending trendline once more after defending the $2,900 zone. This vary is clearly performing as short-term help, however consumers haven’t proven sufficient energy to reclaim the $3,200 current excessive. The RSI can be mid-range, displaying no exhaustion, but additionally no robust momentum.

A rejection right here sends ETH again towards $2,900 for one more check. A clear breakout above $3,200, adopted by a retest, can be the primary actual signal of bullish continuation. With out that, ETH merely stays caught below trendline compression, and the chance of one other liquidity seize to the draw back stays open.

On-Chain Evaluation

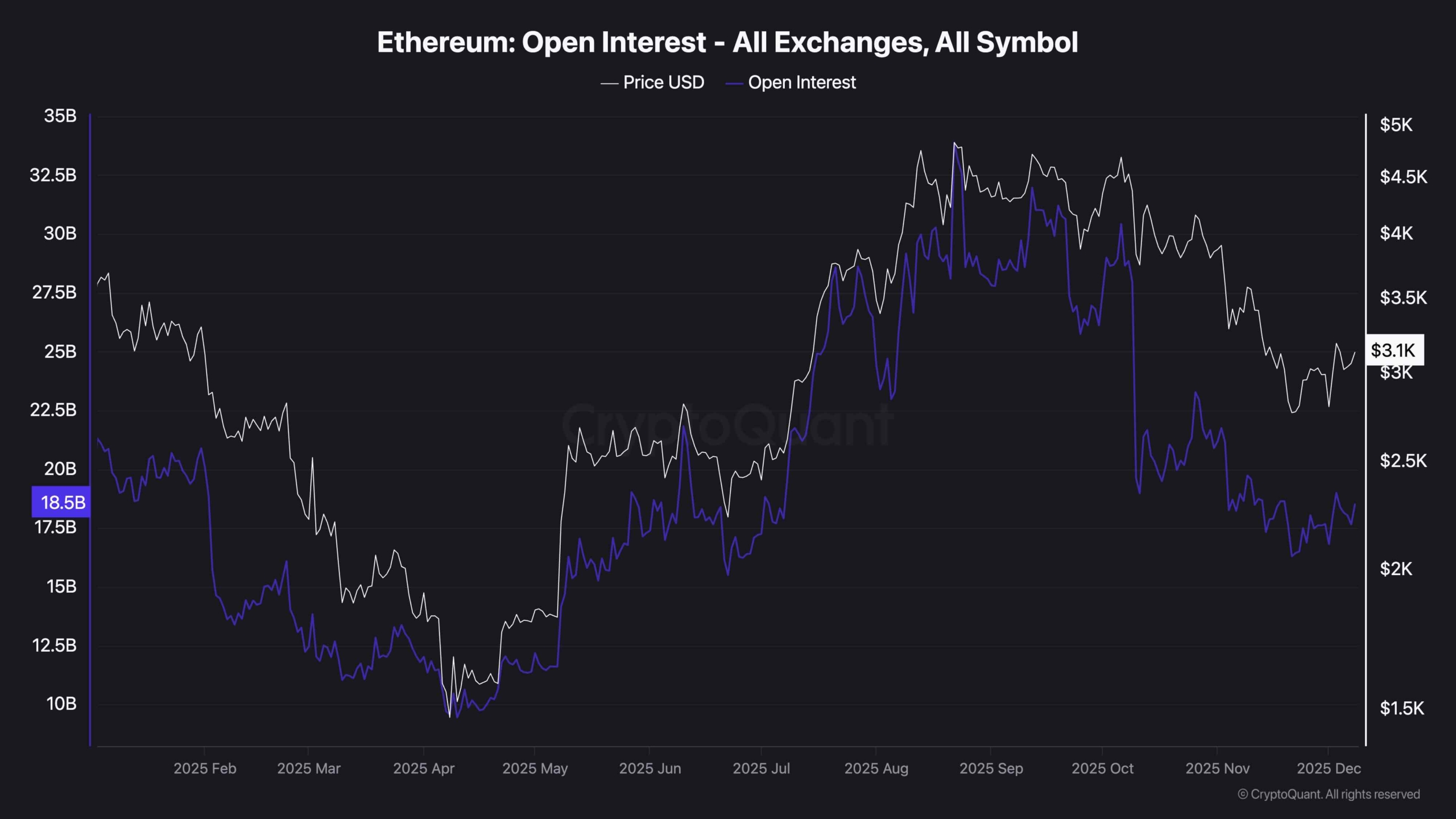

Open Curiosity

Open Curiosity has been declining since September, whereas the value has additionally pulled again from the highs, indicating clear risk-off habits. Crucial half is that OI has not expanded throughout this current bounce. That normally indicators a scarcity of aggressive lengthy positioning. Merchants are cautious, not chasing the transfer, and nonetheless unwinding positions from the sooner rally.

This type of sentiment can really gasoline a stronger breakout later, as a result of rallies that start on low leverage are usually more healthy. However for now, it exhibits that the market doesn’t totally belief the upside. A fast spike in OI throughout a trendline breakout would verify actual participation returning. Till then, ETH stays in a neutral-to-cautious sentiment part.