Bitcoin posted considered one of its worst Q1 returns in 2025, Ethereum carried out even worse, with over 45% drawdown in its worth. Ethereum’s worth has been in a decline because the Dencun improve in March 2024. Ethereum’s downfall appears pushed by the Layer 2 protocols amassing giant transaction quantity and passing on the fraction of the income to the ETH chain.

Ethereum (ETH) leaned into its position as safety infrastructure and the underlying blockchain for Layer 2 protocols, scaling the crypto ecosystem and shedding its worth all through 2025. Merchants and buyers holding the biggest altcoin ask the query whether or not Ethereum will ever accrue worth or lose relevance in H1 2025.

Desk of Contents

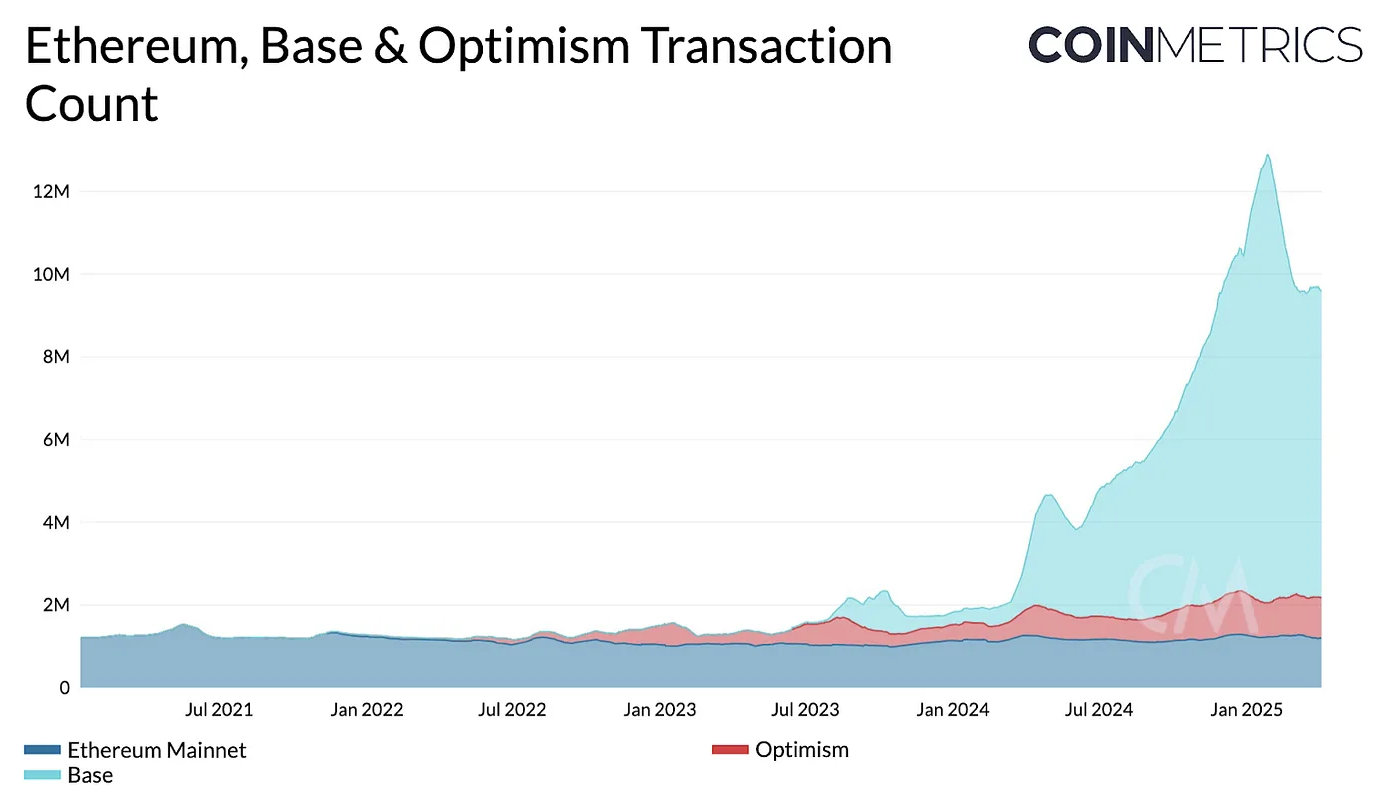

Ethereum powers Layer 2 scaling, mainnet loses traction

Ethereum began out with the objective of turning into the decentralized laptop of the world, and the chain accrued worth because the ICO, rallying to its peak of $4,878 in November 2021. Since then ETH erased 71% of its worth over 4 years.

Probably the most notable shift that’s thought of the catalyst for the decline in Ether worth is its Layer-2 centric scaling mannequin. Ethereum shifted from its main position because the mainnet to the chain that aggregates worth and powers Layer 2 scaling. The transfer fueled by the Dencun improve that slashed transaction prices for Layer 2 chains, reshaped Ethereum’s ecosystem dynamics.

Utilizing Ethereum as a base chain turned considerably cheaper for Layer 2 and Layer 3 initiatives, powering a big DeFi ecosystem. Base by Coinbase has amassed $94 million in revenue and paid a fraction of the fee, $4.9 million to Ethereum.

The profitability of Layer 2 chains has ignited the talk over whether or not Layer 2s are squeezing worth out of Ethereum or nurturing the partnership the place they derive safety and move on income to the ETH blockchain.

Dencun improve decreased ETH worth, transaction income declined

The Dencun improve made Layer 2 settlement low-cost sufficient to decrease the entry barrier for DeFi protocols. Ethereum has crossed $44 billion in complete worth of belongings locked and a decline in charges collected by the community has disrupted the objective of turning the altcoin “deflationary.”

With decrease quantity of charges collected by the chain, whereas Ethereum will not be deflationary, the availability is predicted to develop lower than a % a yr, in response to the Ultrasound Cash tracker. Crypto specialists on X and merchants throughout exchanges have questioned Ethereum’s worth proposition in mild of its modified enterprise mannequin.

Pectra improve, the following key replace to the Ethereum ecosystem may replenish the chain’s worth if it stimulates demand.

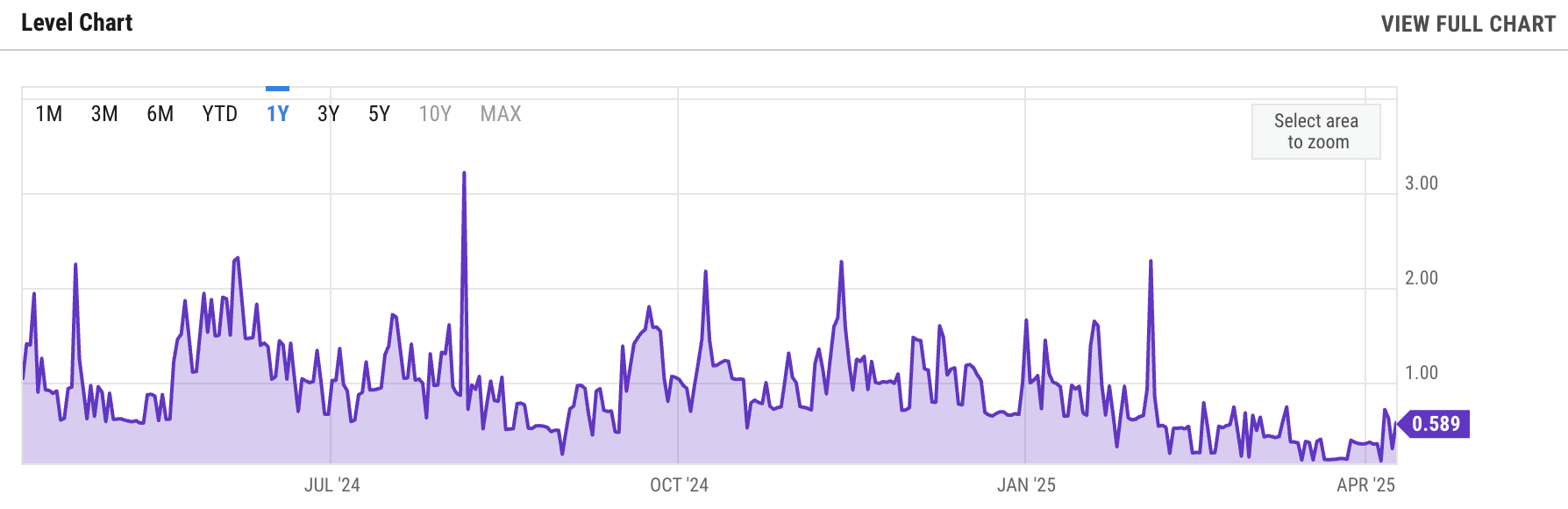

Ethereum’s common transaction payment chart | Supply: Yahoo Finance

You may also like: Bitcoin, Ethereum, XRP, and altcoin costs boosted as U.S. inflation dives

Ethereum’s returns and ETH worth are more and more tied to charges and burn

Ethereum’s holders and merchants checked out metrics like the full worth of belongings locked on the chain and the transaction quantity, relevance and demand, beforehand, to find out ETH worth. Ethereum is now being more and more valued on the charges the chain generates, the token burn and the online income generated.

With the drop in charges and migration of worth and transactions to Layer 2s, a key metric, the transaction rely of Ethereum reveals a steep decline.

Ethereum, Base and Optimism transaction rely | Supply: Coinmetrics

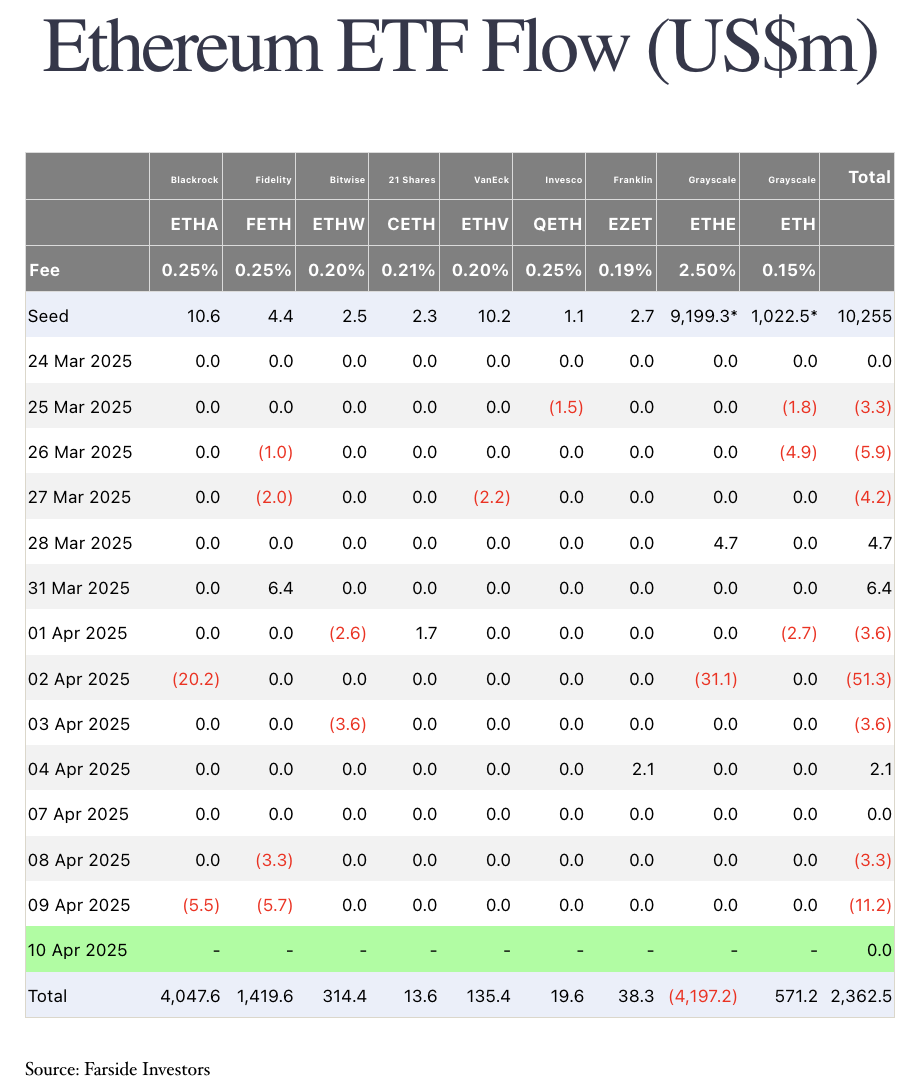

To make issues worse, establishments misplaced curiosity in Ether, probably attributed to the pivot within the chain’s enterprise mannequin and the Ethereum Basis has bought ETH constantly over the previous few months, elevating issues amongst merchants.

U.S.-based Spot Ethereum ETFs did not garner curiosity from institutional buyers and inflows have been muted all through 2025.

Ethereum ETF flows | Supply: Farside Buyers

What to anticipate from the Pectra improve?

The Pectra improve will influence validators and stakers within the Ethereum ecosystem. Pectra will introduce Ethereum Enchancment Protocols that streamline validator administration, cut back congestion on the chain, enhance validator deposit effectivity and provides increased management to stakers over exit of validators.

Whereas the improve is full of developer related technical updates to the blockchain, the adjustments are anticipated to drive increased worth to Ethereum.

The Pectra improve could have a big influence on Ethereum validators and stakers, introducing EIPs that streamline validator administration, cut back community congestion, enhance validator deposit effectivity, and empower stakers with extra management over validator exits.

You may also like: Ethereum worth rally stalls as economist maintains recession odds at 60%

Knowledgeable commentary

Marko Ratkovic, CTO of Graphite Community, an enterprise prepared monitoring device and a Layer 1 blockchain, instructed Crypto.information,

“Pectra is predicted to have a optimistic influence on the expansion of L2 community customers, as two of the brand new EIPs are immediately geared toward this: EIP-7691 will increase the variety of blobs per block, and EIP-7623 raises the price of name knowledge — each of which incentivize the usage of blobs over name knowledge. Since main L2 options depend on blobs, this makes L2s much more environment friendly and engaging.”

Total, Ratkovic says, Pectra is an enormous step ahead.

The manager explains with the instance of EIP-7702:

“Take EIP-7702, for instance — it allows sending transactions without having the native token. This solves a long-standing difficulty that used to require workarounds just like the Gasoline Station Community, however now it’s addressed natively on the protocol degree.

On the similar time, Ethereum’s upgrades stay technical in nature and don’t immediately deal with the broader hole between TradFi and DeFi. Whereas Ethereum focuses on streamlining onboarding, decreasing overhead, and enhancing throughput, institutional gamers are extra involved with authorized readability, consumer verification, and the prevention of illicit flows.”

Chains like Graphite may remedy the challenges that institutional buyers are confronted with, supporting the ecosystem as a complete.

Dr. Sean Dawson, Head of Analysis at Derive.xyz, a decentralized on-chain choices platform, instructed Crypto.information:

“As volatility continues to surge, we’re seeing implied volatility (IV) for ETH soar from 71.5% to 122%, reflecting the market’s uncertainty and fears of additional chaos.

Wanting forward, the probability of ETH falling beneath $1,400 by Could 30 has practically doubled from 18% to 33% as of April 8, signaling elevated bearish sentiment out there.

In brief, we’re in for a bumpy journey, and volatility is more likely to stay excessive as each conventional and digital markets proceed to react to those macroeconomic shocks. Merchants and buyers ought to brace for extra uncertainty within the weeks to return because the market navigates these turbulent waters.”

Disclosure: This text doesn’t symbolize funding recommendation. The content material and supplies featured on this web page are for academic functions solely.