The cryptocurrency market has seen a surge in institutional curiosity in current months, with BlackRock making notable strikes in the direction of Ethereum. This transfer has sparked a bullish outlook for Ethereum (eth) value.

On June 5, BlackRock bought $34.7 million price of Ethereum (ETH), marking a big shift in institutional funding patterns.

With ETH value at the moment buying and selling at round $2,572, this transfer has sparked discussions on the potential for a bullish outlook for the asset.

As Ethereum’s value continues to consolidate, eyes are actually on whether or not BlackRock’s resolution might sign a bigger shift towards ETH adoption.

BlackRock’s $34.7M Ethereum Buy Sparks Institutional Confidence

BlackRock has made a big transfer within the cryptocurrency market by buying $34.7 million price of Ethereum (ETH) by its iShares Ethereum Belief.

On June 5, the agency added 27,846 ETH, price $73.21 million, bringing its complete holdings in Ethereum to roughly 1.49 million ETH, valued at $3.93 billion.

This marks the twelfth consecutive day of inflows into Ethereum by BlackRock, underscoring the agency’s sturdy perception within the digital asset.

These constant purchases spotlight the rising institutional curiosity in Ethereum. The $34.7M price of ETH acquired by BlackRock alerts that giant traders are positioning themselves for Ethereum’s potential long-term progress.

At the moment priced at $2,572, Ethereum’s market trajectory will likely be influenced by broader developments, together with the rising institutional funding within the crypto.

Supply: X

Together with BlackRock, different distinguished establishments like Constancy are additionally rising their publicity to Ethereum by exchange-traded funds (ETFs).

This wave of institutional funding is contributing to Ethereum’s rising traction, which might sign a shift in sentiment towards a extra bullish outlook for the asset.

Ethereum’s Sturdy Market Efficiency Amid Rising Institutional Assist

The worth of Ethereum has skilled a big enhance over the previous few weeks. From simply above $1,900 in Might, ETH surged to the present degree of $2,572.

Whereas this value level represents a stable upward pattern, analysts are carefully watching how Ethereum reacts to key technical ranges.

Ethereum’s market efficiency, mixed with these institutional inflows, means that ETH could possibly be organising for additional features, particularly if it breaks by the essential resistance ranges.

Some analysts, equivalent to Lark Davis, have identified that Ethereum has been outperforming Bitcoin (BTC) in Q2 2025.

Moreover, current upgrades to the Ethereum protocol, just like the Pectra improve, have improved scalability and decreased inflation charges, making ETH an more and more enticing asset for institutional traders.

Whereas the general sentiment stays bullish, there are nonetheless blended market alerts. In response to Polymarket, there may be solely a 27% probability that Ethereum will attain a brand new all-time excessive by 2025, indicating some uncertainty available in the market.

Nevertheless, the rising institutional curiosity and the rising inflows from ETFs like BlackRock’s iShares Ethereum Belief present a constructive outlook for Ethereum.

Ought to the worth proceed to carry above key assist ranges, there could also be room for additional value will increase within the close to time period.

Ethereum’s Worth Motion and Potential Breakout Situations

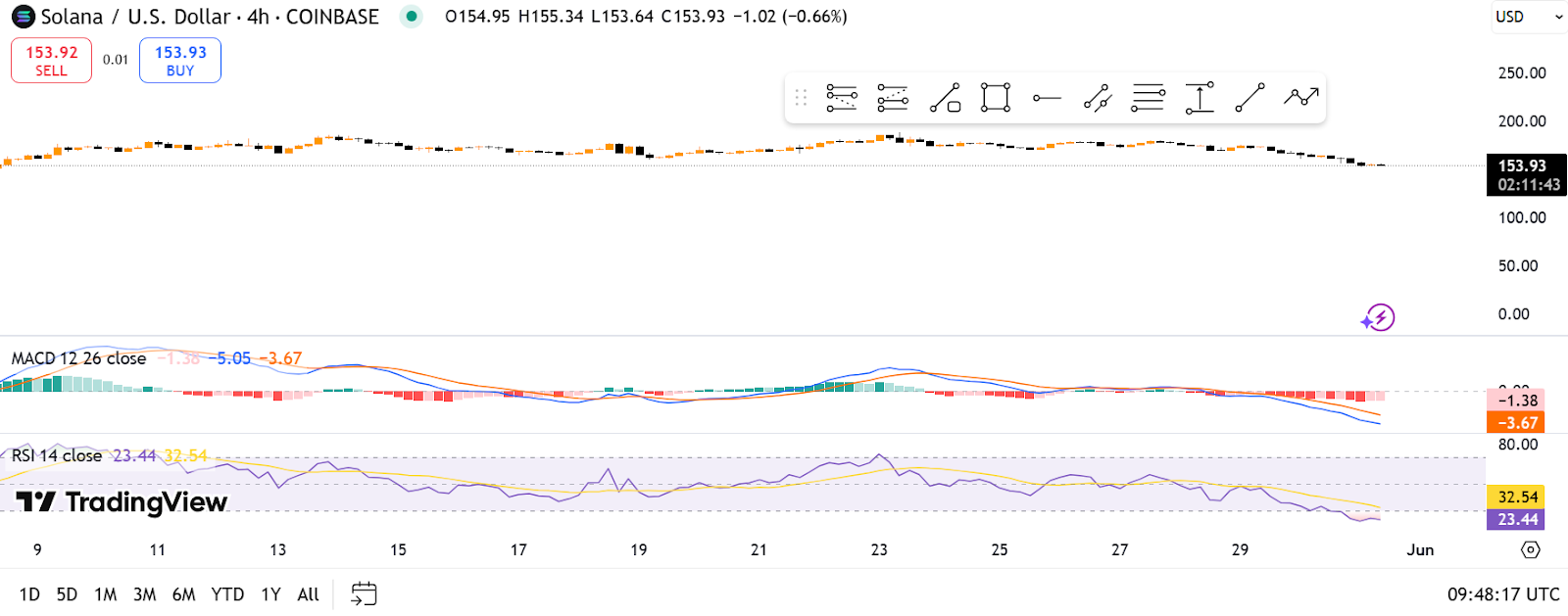

TradingView is exhibiting that Ethereum is at the moment buying and selling at $2,455.9, after a minor decline of 0.03% within the final 4-hour interval.

Current actions within the value had been from $2,455 to $2,468, exhibiting Ethereum is consolidating inside a small value vary.

This implies the market is uncertain after an upward motion, leaving the state of affairs unsure and presumably favoring stability within the vary.

The MACD sign means that the market pattern could quickly flip bearish, because the MACD line is mendacity beneath the Sign line.

The histogram presents crimson strains, which confirms that there’s downward stress within the markets.

The hole between the strains on the chart suggests low vitality, so it isn’t sure if the bearish pattern will final or if the market could reverse.

Supply: TradingView

In response to the Stochastic Oscillator, the blue line is at 24.01 and the orange line is at 18.83, each suggesting an oversold situation.

So, though this might recommend a bearish reversal could also be within the offing, there isn’t any clear crossover but.

With this, the Ethereum value can both have a short-term bounce or proceed to consolidate earlier than catching some decisive momentum in any course.