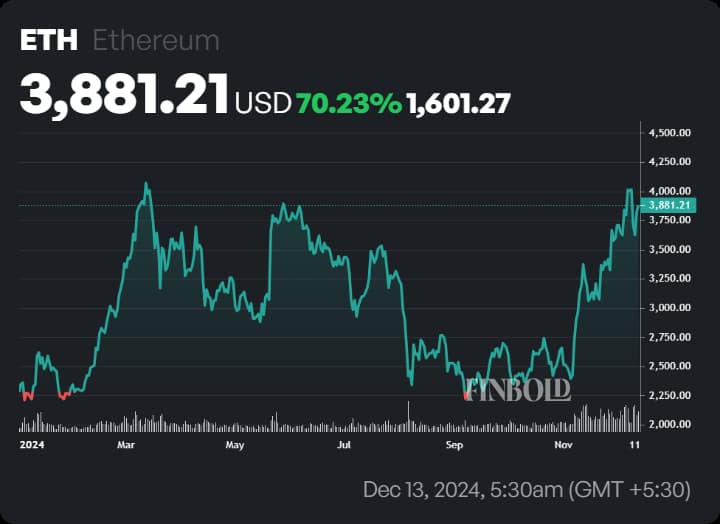

Ethereum (ETH) has lately crossed the $4,000 mark for the primary time since March and is at the moment buying and selling at $3,881.21.

With a year-to-date achieve of over 70%, Ethereum has strengthened its place as a key participant within the cryptocurrency market.

Pushed by document ETF inflows, community upgrades, and rising institutional curiosity, Ethereum’s current rise has sparked contemporary discussions about its future. As 2024 nears its finish, buyers are carefully watching to see the place the world’s second-largest cryptocurrency heads subsequent.

ETF inflows sign strong institutional confidence

One of many main catalysts for Ethereum’s current momentum has been the renewed investor urge for food for U.S.-listed spot Ethereum exchange-traded funds.

BlackRock’s (NYSE: BLK), iShares Ethereum ETF (ETHA), and Constancy’s FETH ETF have led the surge, with each funds collectively buying $500 million value of Ether earlier this week, in keeping with Arkham Intelligence.

For example, ETHA has recorded inflows for ten consecutive days, bringing its whole to $3.2 billion since its inception, in keeping with Farside Buyers.

As of December 12, Ethereum-based ETFs have collectively attracted over $2 billion in inflows since their launch in July, regardless of $3.52 billion in outflows from the Grayscale Ethereum Belief (ETHE) throughout the identical interval.

This highlights the rising institutional confidence in Ethereum, reinforcing its place as a number one digital asset and a well-liked funding automobile.

On-chain exercise helps the bullish narrative

Ethereum’s on-chain metrics replicate strong development, notably on Layer 1 (L1), the place day by day transactions now common 6.5 to 7.5 million, up from 5 million in 2023, in keeping with CryptoQuant.

This enhance has pushed increased community charges, leading to extra Ethereum being burned underneath its fee-burning mechanism.

Binance Analysis attributes this surge to Ethereum’s rollup-centric roadmap, which shifts computational execution to Layer 2 (L2) options whereas retaining Layer 1’s function in information availability and safety.

A significant catalyst was the March 2024 Dencun improve, which launched “blobs” to scale back Layer 1 charges and permit L2s to course of increased transaction volumes. This improve has considerably improved community effectivity and boosted exercise.

Nevertheless, the decrease Layer 1 charges have impacted Ethereum’s burn fee, pushing the community towards an inflationary state.

Whereas this shift has tempered enthusiasm amongst some buyers, consultants view it as a short lived impact of scaling upgrades that expanded blockspace provide quicker than demand.

Regardless of these challenges, Ethereum’s issuance fee stays under 1%, a lot decrease than rival blockchains, suggesting deflationary developments may resume as demand recovers.

Ethereum outshines Bitcoin in post-election rally

Following the U.S. elections, Ethereum has persistently outperformed Bitcoin (BTC), with the ETH/BTC ratio climbing above 0.4.

This development displays a rising choice for Ethereum as merchants favor ETH in choices markets. Bybit’s December 5 Volatility Overview additional highlights this shift, noting a stronger bullish sentiment in ETH choices pricing in comparison with Bitcoin.

Including to this momentum, a pockets linked to Trump-backed World Liberty Monetary has been accumulating $ETH, alongside a couple of different crypto belongings, with purchases exceeding $5 million.

This exercise has pushed the pockets’s whole crypto holdings to over $72 million, additional underscoring the rising institutional confidence in Ethereum as a key digital asset.

ChatGPT’s Ethereum worth outlook for December 31, 2024

Based mostly on a confluence of things, together with sturdy ETF inflows, heightened on-chain exercise, and strong institutional demand, ChatGPT initiatives that Ethereum may attain $5,000 by December 31, 2024.

CryptoQuant analysts echo this optimism, suggesting Ethereum may rally to $5,200 if present developments persist, pushed by strong demand and provide dynamics.

These forecasts strengthen the inspiration for Ethereum’s development, notably as community upgrades and institutional curiosity proceed to drive momentum out there.

Featured picture by way of Shutterstock