Ethereum is dealing with key resistance, with robust bullish momentum, whereas liquidation knowledge highlights ongoing market volatility.

The primary week of 2026 has seen Ethereum (ETH) buying and selling at $3,253.44, down a modest 1.2% within the final 24 hours. With a market cap regular at $392.7 billion and a sturdy 24-hour quantity of $28.85 billion, ETH holds its no. 2 rank firmly.

Ethereum has gained 9.5% over the previous 7 days and 11% within the final 14 days, reflecting robust optimistic momentum.

A CoinGecko chart exhibits a optimistic momentum, significantly from January 6, with a pointy worth improve earlier than stabilizing above $3,240. Given the bullish development, Ethereum’s worth may proceed to rise, significantly if it breaks the fast resistance ranges above $3,300.

Ethereum Value Evaluation

Ethereum is at present testing key Fibonacci retracement ranges because it approaches potential resistance at $3,303, which aligns with the 0.786 Fibonacci stage. The latest worth motion exhibits a robust rally, however ETH is dealing with a problem at this stage, which may act as an overhead resistance.

Ethereum 1 Day Chart

The subsequent important resistance stage is the $3,447 space, marking the highest of the present vary. If Ethereum can shut above $3,303, it might verify a breakout and will goal larger ranges, probably pushing towards the $3,400–$3,600 zone.

On the draw back, ETH has established $3,190 as potential help, marked by the 0.618 Fibonacci retracement stage. If Ethereum experiences a pullback, this space will probably act as a crucial ground, offering shopping for help. A drop under this stage would open the door for additional declines in the direction of $3,100 or $2,980, the following key Fibonacci ranges.

The Superior Oscillator additionally helps this, with inexperienced bars indicating bullish momentum so long as the market stays above these help zones.

Ethereum Liquidation Knowledge

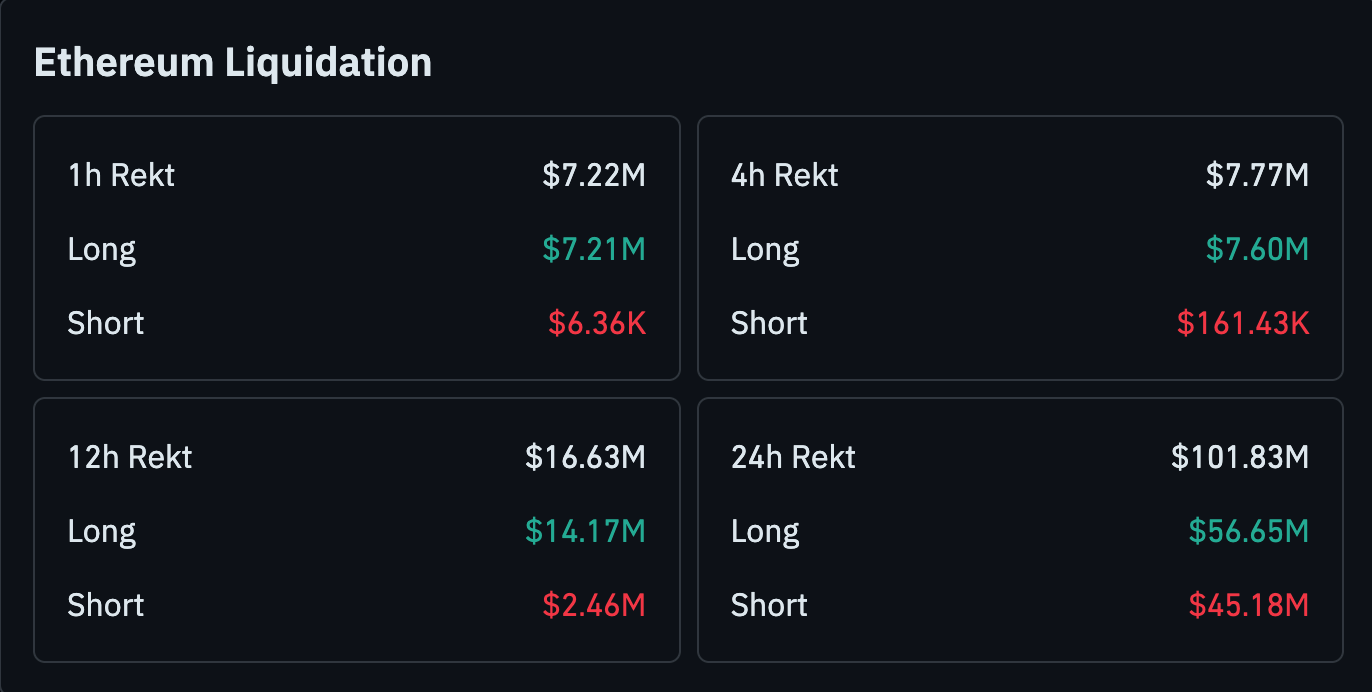

Ethereum’s futures market, albeit punishing the bulls, continues to indicate robust volatility and potential for worth swings. Over the previous 24 hours, $101.83 million in whole liquidations occurred, with $56.65 million coming from lengthy positions and $45.18 million from quick positions.

Ethereum Liquidation

In shorter time frames, lengthy positions constantly lead the liquidations, akin to within the 4-hour and 1-hour home windows, the place $7.60 million and $7.21 million value of lengthy positions had been liquidated, respectively. The numerous strain on lengthy positions suggests a bullish bias in Ethereum’s worth motion, however the excessive liquidation figures are an indication of warning.